APRIL 2024

The 3 Body Problem in International Education - IBIS Capital CEO, Charles McIntyre on the dynamics of international education as forces collide.

The Underfunding of Women’s Health - IBIS Capital Analyst, Sophia Nasser examines women's health disparities and the road to gender equality.

A global snapshot of the EdTech, HealthTech & Impact Investing markets.

Notable M&A & Fundraising activities across EdTech & HealthTech industries

Global trends across the tech-led impact ecosystem. In this issue:

Education Industry Analysis – Q1 2024

Healthcare Industry Analysis - Q1 2024

The 3 Body Problem in International Education

By Charles McIntyre, CEO at IBIS Capital

Having just come to the end of the Netflix series based on Liu Cixin’s fantastic sci-fi novel, I had to ask myself what is this age-old problem originating from Newtonian mechanics, known as the 3 Body Problem? Well, as it turns out, when “you have three bodies or more that are all exerting a force on each other at the same time, that system breaks down”.

It feels as though we have a similar problem in higher education at the moment. We have a growing demand from international students to access university places in an underfunded market ultimately overseen by politicians who want to reduce immigration statistics, and so don’t want them to come in.

The total number of international students looking for tertiary education abroad is expected to reach 8 million by 2030; by comparison, back in 2020 there were only 2 million1. At the same time, the UK is reviewing the Graduate route visa and presenting student numbers as excessive migration. Canada has announced a temporary student number cap to tackle ‘sustainability’. Australia is stumped and considering what its education minister has coined ‘spiky ideas‘.

To bring the third force into orbit, we have a situation here in the UK where English universities are estimated to lose £2,500 on every home undergraduate student2. The alarm bells are ringing on the financial stability of higher education.

It seems strange to me to have a product that people want, and are prepared to pay handsomely for, yet we don’t want to take advantage of this valuable export, worth $262 billion globally in 20233. This education export also has many other benefits, perhaps not so easily measurable, for example, over 50% of world leaders went to the US or UK4 as part of their education. Considering the economic benefits, both direct and indirect, together with less tangible benefits of soft-power, we should make an effort to solve the 3 body problem. The good news is there are stable solutions to the problem, we just need to find our one.

Sources: 1, 3Frost & Sullivan; 2The Russel Group; 4Higher Education Policy Institute

International Student Agencies

ApplyBoard | Keystone | IDP | SI-UK | Leverage Edu | AECC | EduCo

The Underfunding of Women’s Health

By Sophia Nasser, Investment Banking Analyst at IBIS Capital

In our pursuit of longer, healthier lives, humans have explored everything from magical elixirs to cryonics, seeking the secret of longevity. Women are arguably one step closer to this as studies indicate that women tend to live longer than men on average. They do, however, also spend 25% more of their lives in a state of debilitating health1. It's saddening to acknowledge that despite the progress we've made as a society, gender biases persist and are especially evident within healthcare.

The obvious differences in health outcomes between genders, such as maternal mortality rates being the highest in 20 years, underscore the pressing need for progress in women's health2. Unfortunately, this area has been long neglected, largely due to a lack of interest from decision makers and subsequent lack of funding.

In recent years, there has been a shift towards addressing this issue. The emergence of 'FemTech', a term coined by Ida Tin in 2016 to describe technology tailored to women's health, sparked hope for increased attention and funding for this sector3. Despite setbacks caused by the pandemic, there are encouraging signs of progress. For instance, the recent UK government U-turn on new angel investing legislation, which threatened to hinder funding for women's health initiatives, offers a glimmer of hope.

However, it's essential to recognise that advancing women's health cannot and should not be solely the responsibility of women themselves. Aside from the obvious point of gender equality, addressing the gender health gap carries substantial economic benefits. Closing this gap could potentially boost the global economy by a staggering $1 trillion annually by 20404.

Moving forward, it's key that we educate and enact top-down changes to motivate individuals and society in closing the gender bias gap in healthcare and other parts of society where it persists. The goal is a future where everyone has equal access to healthcare and can enjoy longer, healthier lives.

Sources: 1World Economic Forum, 2023; 2University of Oxford, 2024 ; 3Lexology, 2019 ; 4Forbes, 2024

FemTech

HERA Biotech | Natural Cycles | Luna | MirZyme | Daye | Vira Health

📱 Spotify Tests Video-Based Learning Courses in the UK - Spotify have partnered with educational tech companies including BBC Maestro, PLAYvirtuoso, Skillshare, and Thinkific to bring video content directly to Spotify users. (Spotify)

🥽 ‘EdTech’ offers no escape from reality - Experiments in virtual teaching could turn a digital divide into an educational one. VR may yet develop into a creative supplement to traditional learning but it is never going to replace it. (The Financial Times)

🤖 Generative AI and the Future of Work - For business leaders, globally, the challenge is two-fold: understanding the possibilities and risks Generative AI brings and preparing for the inevitable organisational change that is headed their way. (Deloitte)

👴🏼 Smarter Aging: The Importance of Health Tech Planning - In today’s tech-savvy world, weaving Health Tech Planning into the fabric of care for older adults is essential. (MedCity News)

🌟 WHO unveils a digital health promoter harnessing generative AI for public health - The World Health Organization (WHO) announces the launch of S.A.R.A.H., a digital health promoter prototype with enhanced empathetic response powered by generative artificial intelligence (AI). (WHO)

👭 McKinsey: ‘Women’s Healthcare Neglected for Decades' - Lucy Pérez, an Affiliated Leader of the McKinsey Health Institute, on why science and common misconceptions affect the quality of women's healthcare. (Healthcare Digital)

🤔 If Not AI, Then What? Exploring Investor Interests In 2024 - AI's presence is undeniable, and experts suggest that 2024 could mark the beginning of a second wave of AI startups. However, investors are casting their nets wider. Beyond AI, which sectors are catching their attention? (Forbes)

💻 It’s a good time to invest in early-stage EdTech, investors say - Edtech is nowhere near as popular as it was when schools were closed during the pandemic. Still, it would be shortsighted to overlook this category amid the present downturn, especially now that AI is disrupting nearly every industry out there. (TechCrunch)

🩺 Survival of the fittest for HealthTech - With the pandemic boom over, consumer medical start-ups now face fickle customers and a crowded market place. (The Financial Times)

Education

Source: Capital IQ

Health

Source: HealthTech Alpha

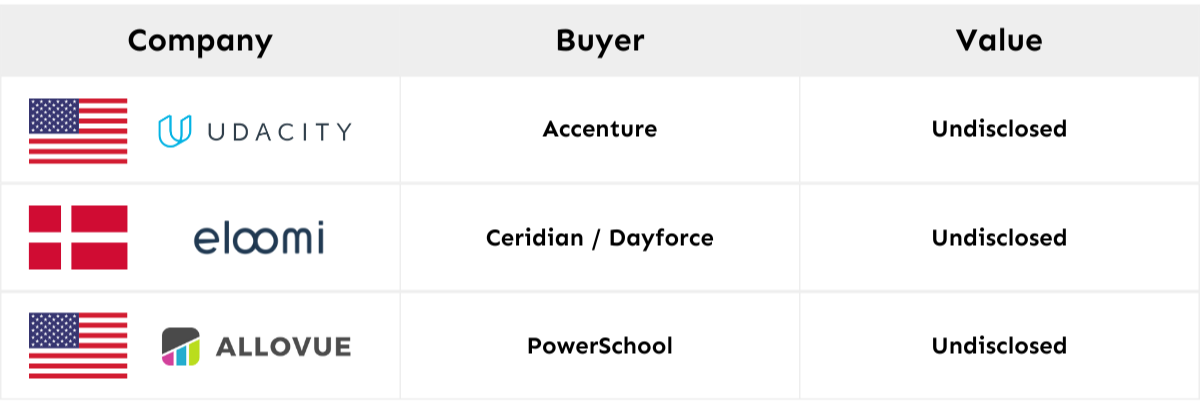

Education

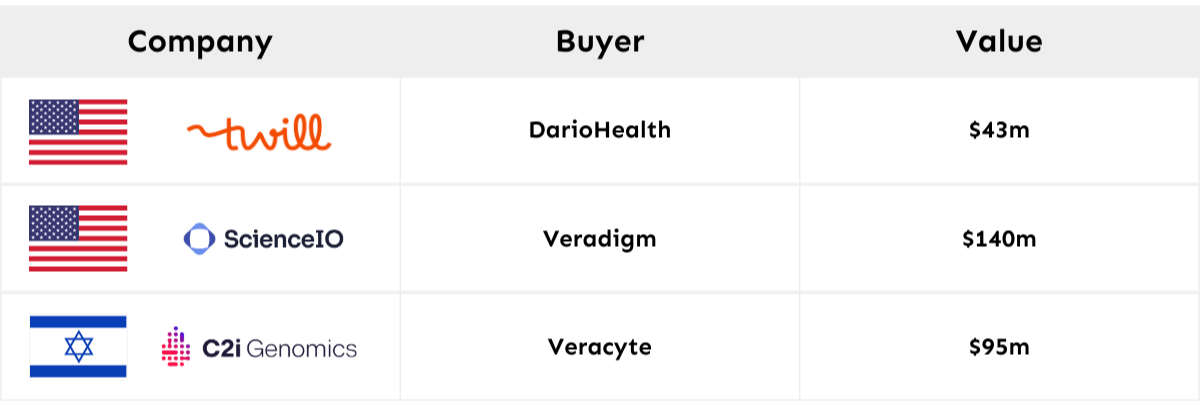

Health

In Q1 2024, global education deal-making reached its lowest volume in terms of both fundraising and M&A transactions, compared to previous quarters from 2020 onwards. Disclosed M&A deal value increased by $905m, compared to the same quarter in the previous year, representing an increase of 109%, however disclosed fundraising deal value decreased by $1,824m, compared to the same quarter in the previous year, representing a decrease of 43%.

.png)

.png)

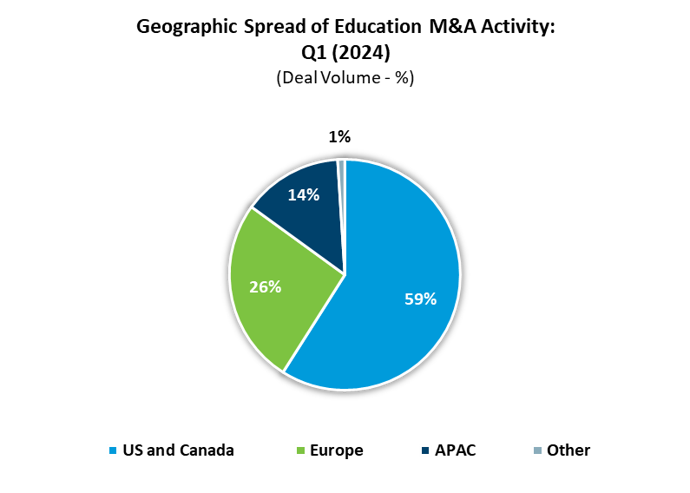

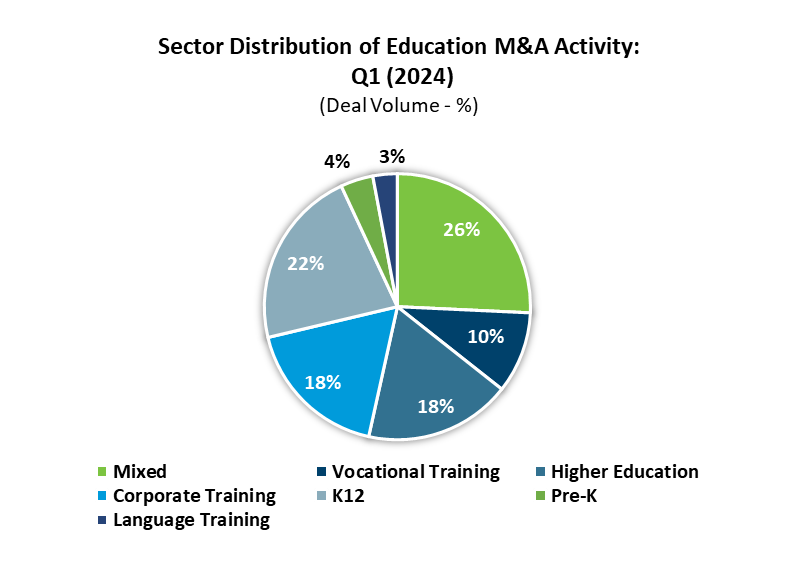

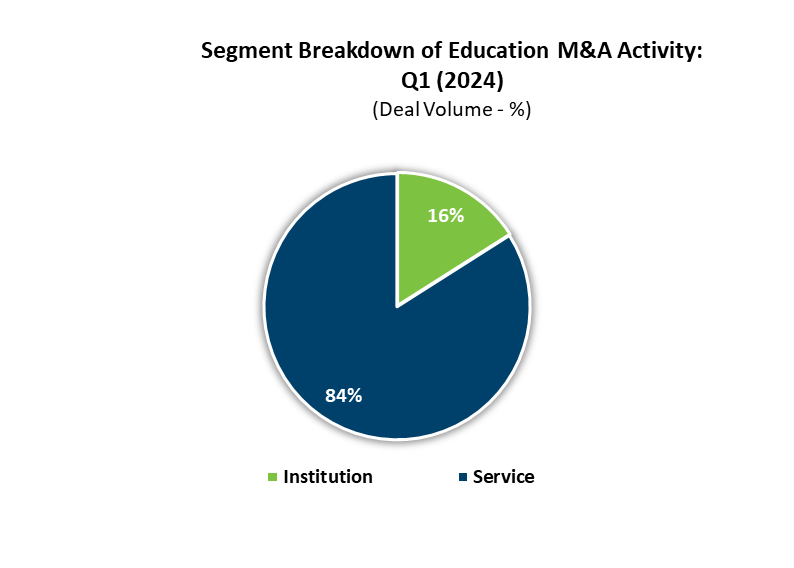

Consistent with previous years, the United States and Canada were the dominant geographies in terms of M&A deals in the first quarter of 2024, accounting for 59% of total transactions, followed by Europe, where 26% of transactions occurred. Strategic buyers dominated the space in Q1 2024, making up 88% of transactions. Significant transactions included Accenture’s acquisition of Udacity, a digital online education company that specialises in tech skills. The acquisition will accelerate and strengthen Accenture LearnVantage’s capabilities to deliver comprehensive technology learning and training services to Accenture’s clients. Although M&A deal volume has decreased this quarter in comparison to previous years, deals such as the Udacity acquisition are a positive sign and provide optimism for the future. In terms of sector distribution of Education M&A this quarter was split fairly evenly with Pre-K receiving the most funding at 26% and K12 receiving 22%.

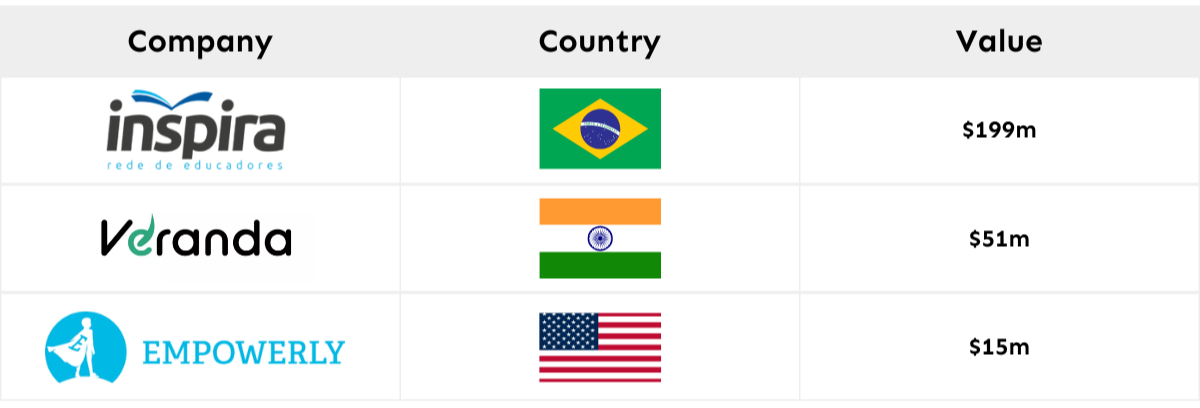

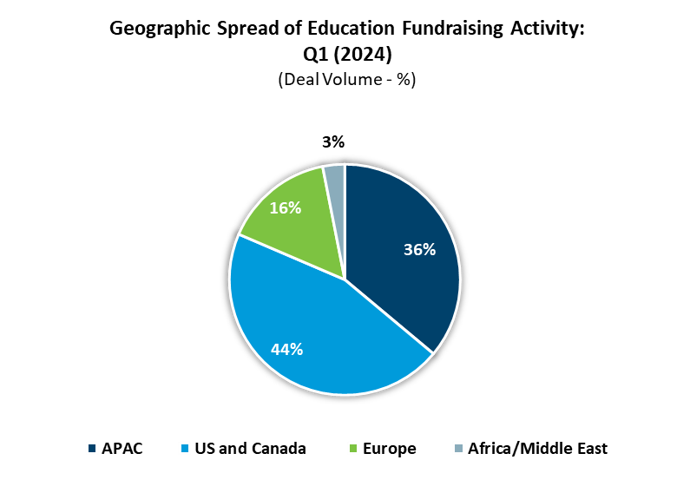

In terms of capital raises, investors continue to exercise caution with 45% less fundraising deal volume in Q1 2024, compared to previous quarters from 2020 onwards. Geographic spread of education fundraising activity was similar to M&A with 44% of deals coming from the US and Canada. One particularly notable deal in the quarter was Advent and CPP Investments co-investment in Inspira Rede de Educadores, which is one of the largest Brazilian networks for basic education. The capitalisation aims to strengthen the company and accelerate its organic and inorganic expansion, particularly through acquisitions across Brazil.

Although this quarter may not have been as exciting as in previous years, there are encouraging indications for the future and enthusiasm surrounding the prospective advancements in technology's applications within the realm of education.

Notes

1.Source: Capital IQ

2.Includes deals announced but not yet closed

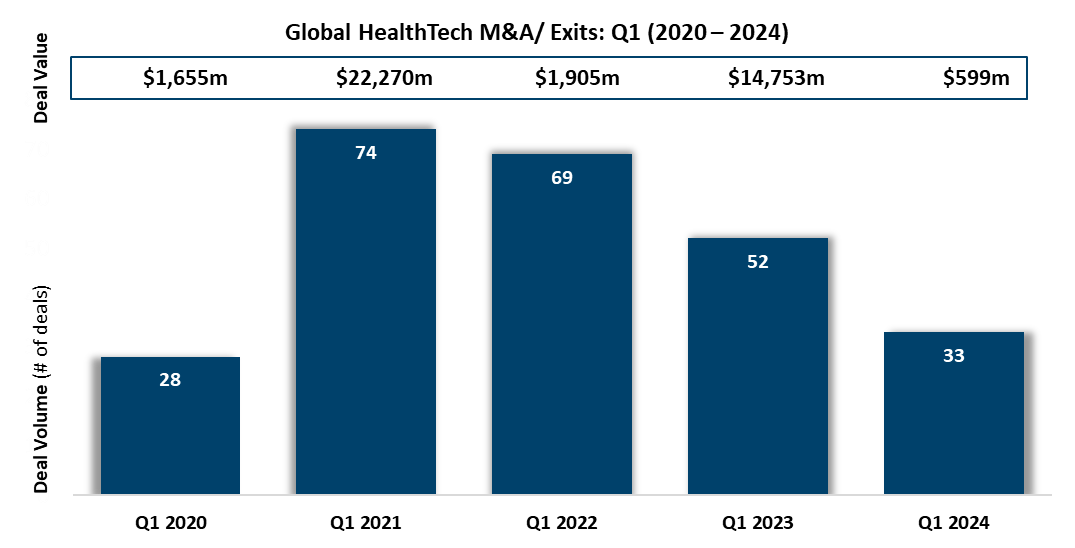

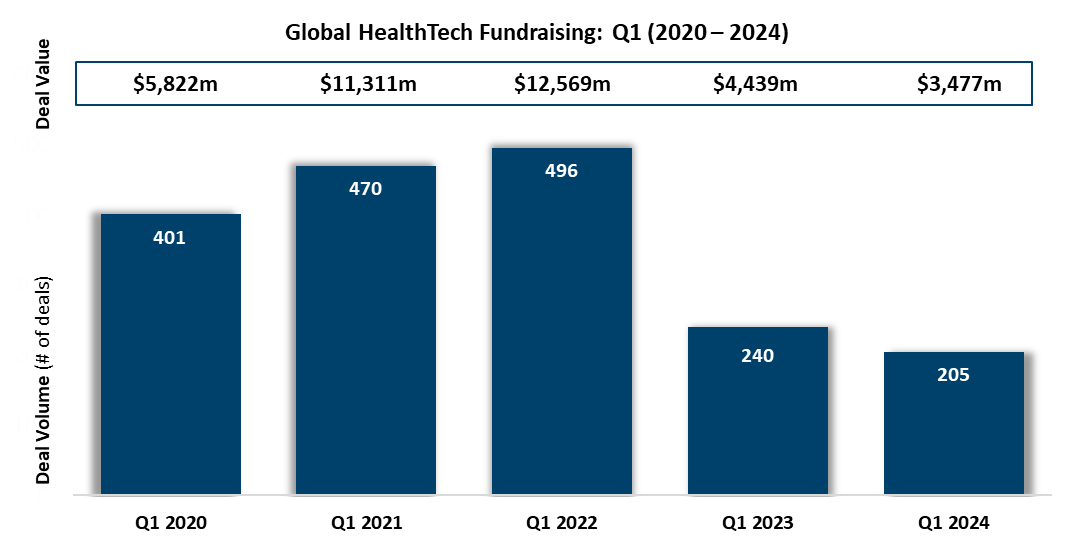

With both M&A and fundraising deal volume as well as value down, compared to previous quarters from 2020 onwards, the start of 2024 has continued to remain cautious within HealthTech. Global HealthTech M&A deal volume declined from 52 in Q1 2023 to 33 in Q1 2024, representing a 37% decrease. In line with this declining M&A trend, fundraising during Q1 2024 also declined, albeit at a much lower pace from 240 in Q1 2023 to 205 in Q1 2024, representing a 15% decrease.

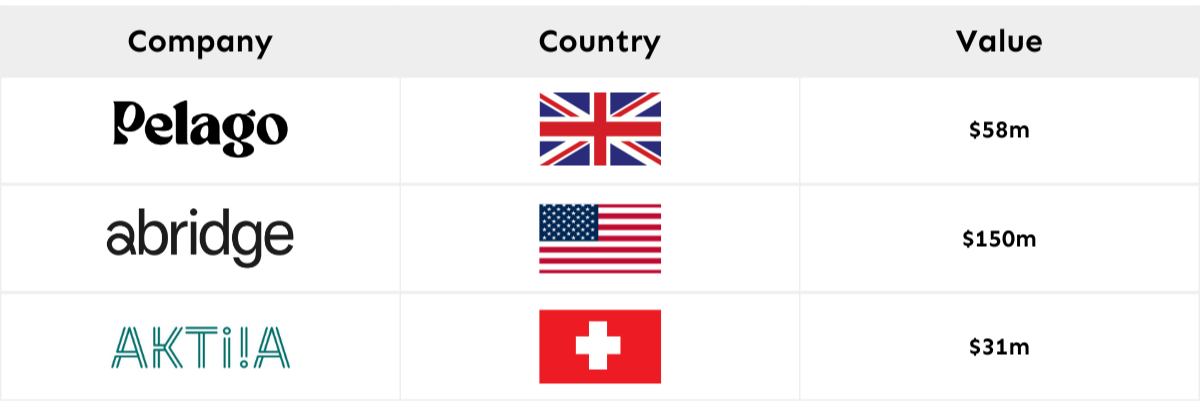

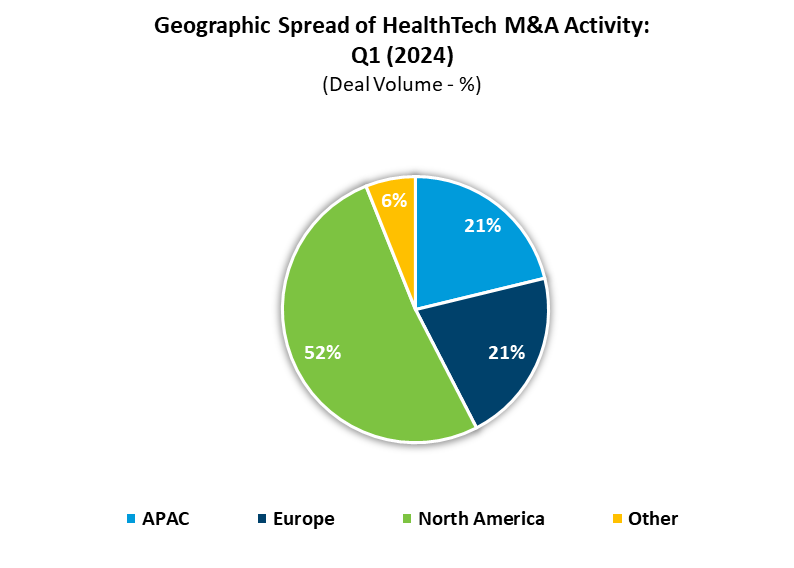

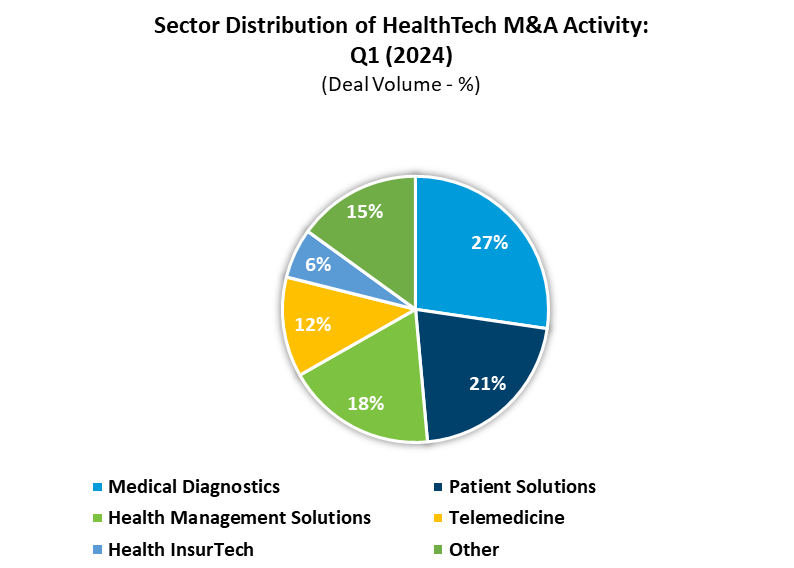

Just over half of all M&A transactions in Q1 2024 came from North America, followed by Europe and APAC, which represented 21% of transactions each. In terms of sector distribution of M&A activity, 27% of deals were within Medical Diagnostics, followed by 21% from Patient Solutions. A notable deal within medical diagnostics was Veracyte’s $95m acquisition of C2i Genomics, which offers post-surgery monitoring of cancer recurrence and progression by analysing subtle changes in the pattern of the tumor's DNA. Another sector which received increased deal activity, especially following a difficult 2023 largely driven by the bankruptcy of Pear Therapeutics and the struggle companies in the sector faced to find a sustainable business model, was Digital Therapeutics. NASDAQ-listed DarioHealth acquired Twill, a software-enabled platform designed to improve mental and physical health, for $43m. Other acquisitions within Digtial Therapeutics included Aptar Digital’s acquisition of Healiant and TruDoc’s acquisition of Wellthy Therapeutics. With many smaller digital therapeutic players across the globe, this is a sector that will potentially see more activity during 2024 as M&A consolidation occurs.

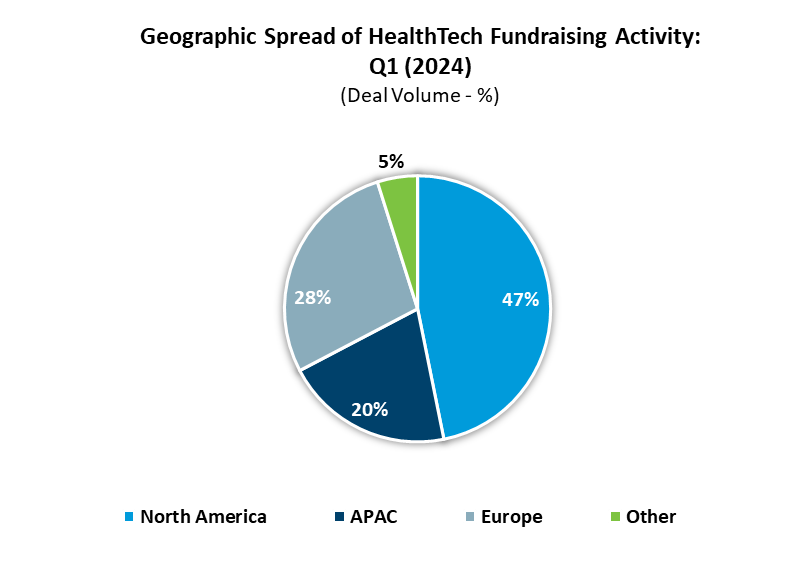

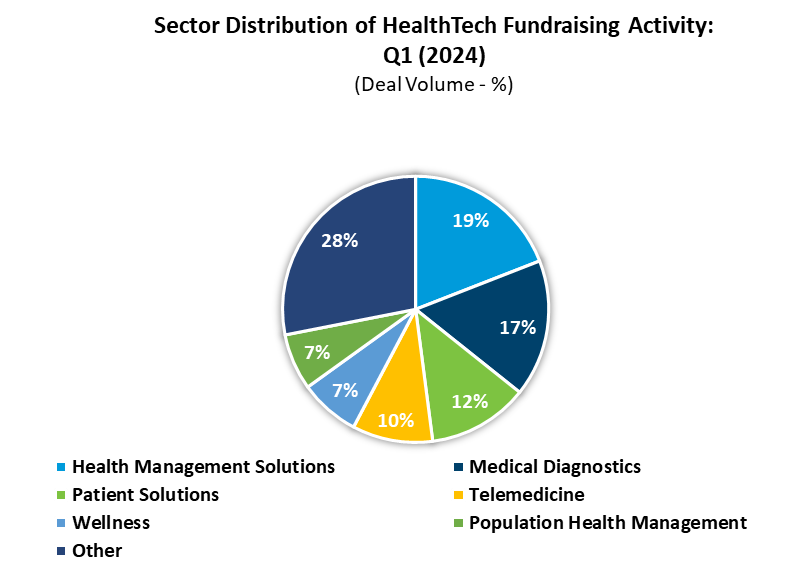

In comparison to M&A activity, fundraising activity remained quite flat during Q1 2024 compared to Q1 2023. Unsurprisingly 47% of deals were in North America, followed by Europe and APAC, with 28% and 20%, respectively. Similar to M&A, the largest sector that activity came from was Medical Diagnostics with 28%, followed by 19% from Health Management Solutions and 12% coming from population health management. Reported deal value across Q1 2024 was supported by multiple $100m+ deals from the United States. A significant deal to note was Freenome’s $254m series E funding round led by Roche. Another significant transaction from the US was Zephyr AI’s $111m series A with Revolution and Lilly as key investors, signifying the continued interest in AI solutions with healthcare applications. Both these transactions signify the interest from big pharma to continue investing in digital health companies as they bolster and accelerate their technological capabilities.

Notes

1. HealthTech Alpha

2. Includes deals announced but not yet closed