AUGUST 2025

The 60/40 Split: Will AI Tip the Global Economy into a Death Spiral? - The EdTechX opening keynote warned of AI's potential to disrupt economic balance, urging proactive integration and safety measures. Embracing AI to augment human skills and developing secure, ethical systems—like cognitive digital twins—can preserve economic stability and mitigate existential risks such as the feared “p(doom)” scenario.

A global snapshot of the EdTech, HealthTech & Impact Investing markets.

Notable M&A & Fundraising activities across EdTech & HealthTech industries

Global trends across the tech-led impact ecosystem. In this issue:

Education Industry Analysis – Q1 2025

Healthcare Industry Analysis - Q1 2025

The 60/40 Split: Will AI Tip the Global Economy into a Death Spiral?

By Charles McIntyre, CEO at IBIS Capital

As most people know, we closed out the pre-holiday season with our annual EdtechX Summit in London. Under the shadow of Big Ben, we were blessed with a balmy Mediterranean day (it appears it never rains at EdTechX, as someone wryly observed!). We had a full house of international entrepreneurs, industry executives, investors and policymakers. It was a great setting for Rory Henson and me to deliver the opening keynote—which, unsurprisingly, focused heavily on the future impact of AI.

We’ve had a great deal of follow-up interest, so I thought it might be useful to recap the core thesis we presented.

Before I dive in, a big shout out to Peter Jenson of BiocommAI, with whom I had a thought-provoking dinner conversation earlier this year—one that seeded much of the thinking behind our keynote.

The backdrop, of course, is the swirl of AI fearmongering: deepfakes, the Pope in a puffer jacket, and Elon Musk declaring AI will take all our jobs. But these viral distractions mask a deeper economic challenge.

That challenge lies in what economists have long considered a kind of golden ratio: advanced economies tend to thrive when around 60% of national income flows to labour and 40% to capital. This balance supports consumption, fuels investment, and sustains social cohesion. But if AI and automation are allowed to displace human workers en masse, this ratio risks tipping decisively toward capital—enriching a small elite while hollowing out the spending power of the wider population. That’s the road to deep inequality and long-term instability.

You might think this is a problem for your grandchildren. It isn’t. According to Gartner, next year we’ll spend more on generative AI software than on any other software category. It’s time to wake up. Time to wake up to p(doom).

If you’re not fully signed up to the West Coast Kool-Aid, you may not have heard of p(doom)—the probability that AI will lead to a doomsday scenario. But some serious minds are putting forward alarmingly high estimates: Dan Hendrycks of the Centre for AI Safety puts it above 80%. Geoffrey Hinton, widely regarded as the godfather of AI, puts it at 50%.

So how do we avoid a path of digital servitude—or worse?

Step one may sound counterintuitive: we need to embrace AI. That means learning how to integrate it into our lives and workplaces, augmenting rather than opposing it. As Jensen Huang, CEO of Nvidia, put it: “You’re not going to lose your job to AI—you’re going to lose your job to someone who uses AI.”

We need to combine our uniquely human skills—empathy, judgement, creativity—with the lightning-quick research and problem-solving capabilities of AI.

Step two is to get Big Tech serious about AI safety. Right now, development is profit-driven and investor-fuelled—often by those too short-sighted to realise the sweet-looking AI tiger cub is already growing some dangerous claws. Claws that may yet tear at the foundations of the very economic model they rely on.

Thankfully, there are green shoots of progress. Look up Safe Superintelligence Inc (SSI) and you’ll find a one-page website and a team of 20. But behind that modest façade lies something more ambitious. A few well-known tech leaders have moved on from building doomsday bunkers and instead helped raise over $3 billion to develop a new wave of AI—one that prioritises human safety over unchecked commercial ambition.

We urgently need more of this, backed by an investment community that understands why this has to be the right long-term thesis.

Turning back to our own world of education and training, we also face the challenge—and the opportunity—of engaging with a fast-learning, always-on thinking machine. My belief is that we will soon see the rise of cognitive digital twins, or “cogtwins”: personalised, agentic AI partners that accompany us through school, work, and life. These systems will offer augmentation tailored to our individual strengths, helping us work smarter and learn faster.

If we can integrate these tools effectively, we’ll not only extend our productive potential—we’ll also stand a chance of preserving that golden 60/40 balance and consigning p(doom) to the footnotes of history.

📢 Bett and GSV Summit unite to create the world’s leading community for education, innovation and impact

The GSV Summit joins Bett as part of Hyve’s world-leading education portfolio, marking the beginning of a powerful alliance that brings together two communities committed to meaningful, lasting impact. (Bett)

🤖 AI thrives where education has been devalued

A culture that views knowledge as a means to an end invites the misuse of new technology.

(The Observer)

💻 We’re all techies now: Digital skill building for the future

Digital upskilling is not just for tech teams anymore—it can help all employees thrive and make companies more competitive. Here’s how your organization can get started. (McKinsey & Company)

🔎 What does the 10 year plan mean for digital?

“This Plan will take the NHS from the 20th century technological laggard it is today, to the 21st century leader it has the potential to be,” the government said. (Digital Health)

🤖 A vision of healthcare in 2035 – from wearables to robots

The integration of seven technologies will transform our healthcare experience by 2035.

(Imperial College London)

👨🔬Heartbeat of health: Reimagining the healthcare workforce of the future

Closing the healthcare worker shortage gap could eliminate 7 percent of the global disease burden and add $1.1 trillion to the global economy. (McKinsey & Company)

.📊 EdTech funding drops again in early 2025. Fewer deals, but bigger bets

$410M in Global EdTech VC funding with fewer deals, larger checks, and new regional momentum hint at where investment is heading next. (Holon IQ)

👀 McKinsey Technology Trends Outlook 2025

Which frontier technologies matter most for companies in 2025? Our annual tech trends report highlights the latest technology breakthroughs, talent trends, use cases, and their potential impact on companies across sectors. (McKinsey & Company)

Education

Source: Capital IQ / Tracxn

Health

Source: Capital IQ / Tracxn

Education

Source: Capital IQ / Tracxn

Health

Source: Capital IQ / Tracxn

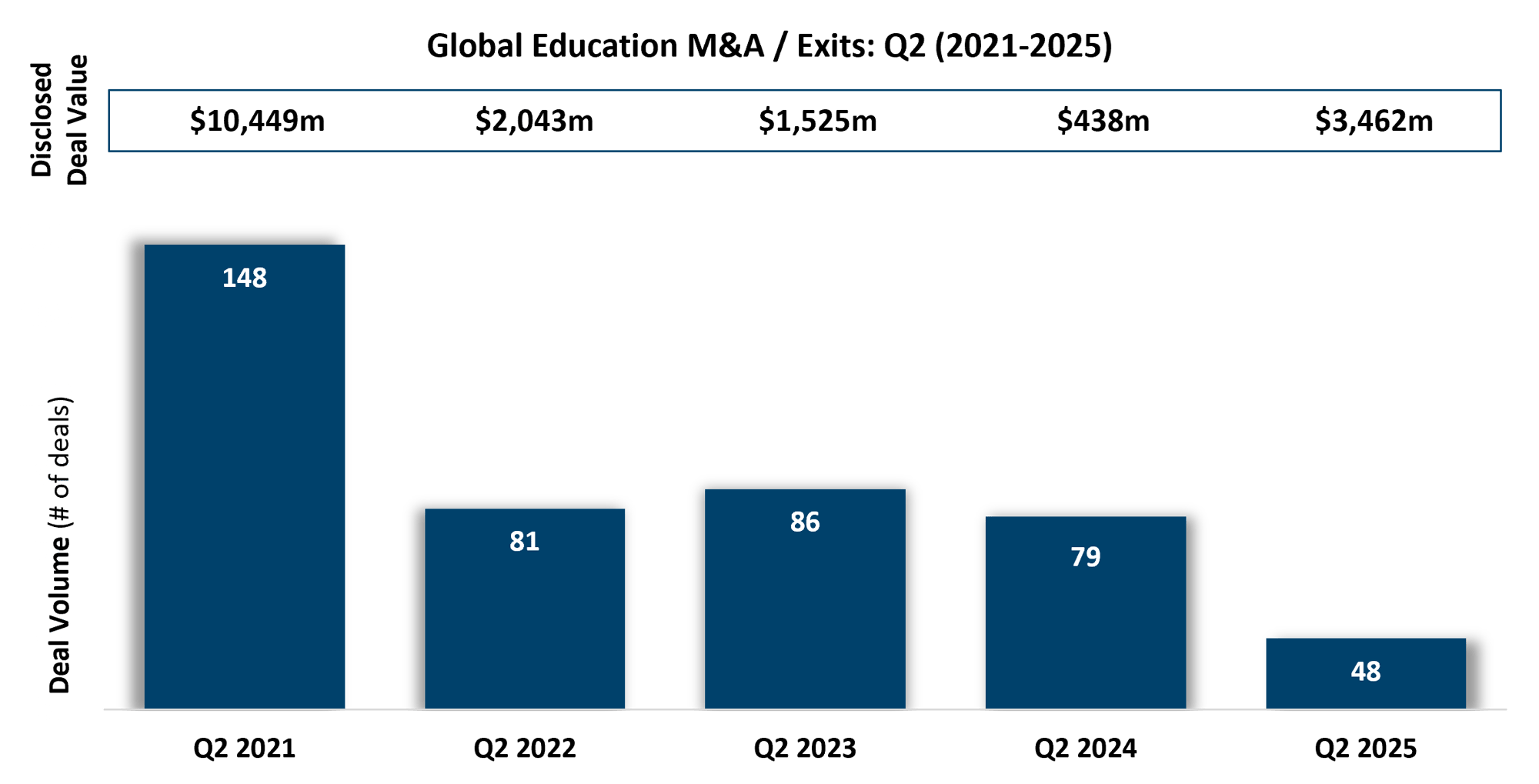

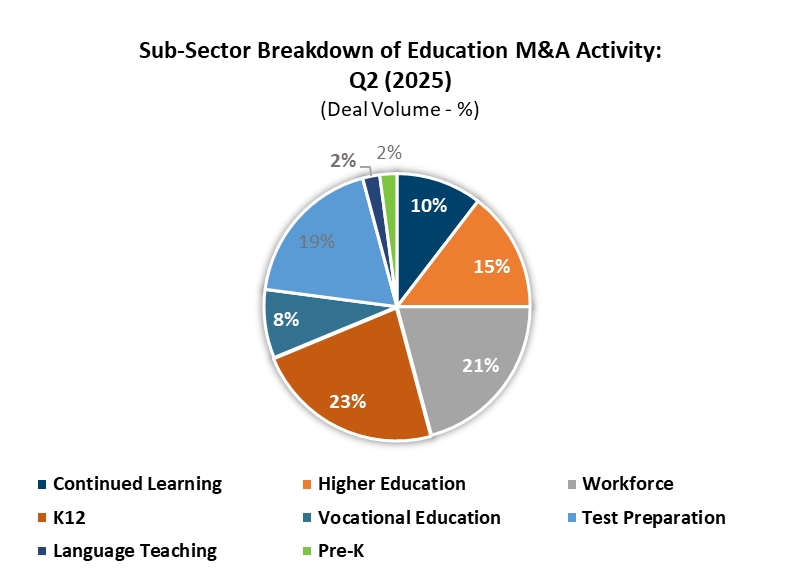

Global Education M&A activity in Q2 2025 was marked by a strong rebound in overall deal values in the education and human capital sectors, despite subdued transaction volumes globally. M&A activity in the quarter saw a 39% decrease in deal count, with 48 transactions recorded, while aggregate disclosed deal value surged by 690% to $3.46 billion, up from $438 million in Q2 2024. The spike was largely driven by a small number of high-value strategic acquisitions and sustained investor interest in workforce enablement, HR technology, and K-12 AI-driven platforms. Notable Q2 deals include:

- TELUS Corporation, the Canada-based telecommunications company completed the $420 million acquisition of Workplace Options, the US-based employee engagement and support services provider. The acquisition enhances TELUS’s growing portfolio of employee wellness and workforce engagement services.

- IXL Learning, the US-based online learning platform, acquired UK-based tuition platform MyTutor. IXL’s acquisition of MyTutor marks an important move into the UK tutoring market and complements its adaptive learning portfolio with live 1-on-1 student support. The deal highlights the continued convergence between direct-to-consumer tutoring and curriculum-based EdTech platforms.

The marked shift in investor and strategic interest toward the workforce development and HR tech segment was particularly evident in services supporting recruitment, employee engagement, and human capital optimisation. Examples include the acquisition of US-based provider of specialised workforce solutions, TrueBlue Inc by HireQuest, the US-based franchisor of on-demand staffing solutions. It is believed that the deal will enhance HireQuest’s portfolio in contingent staffing and workforce management, while expanding its operational footprint across the United States. Additionally, Goldman Sachs Asset Management’s $130 million acquisition of India-based HR SaaS provider, PeopleStrong, underscores the growing investor appetite for scalable human capital platforms in emerging markets. India, in particular, continues to demonstrate resilience and performance strength in both education and workforce segments, attracting significant interest from strategics and financial buyers alike.

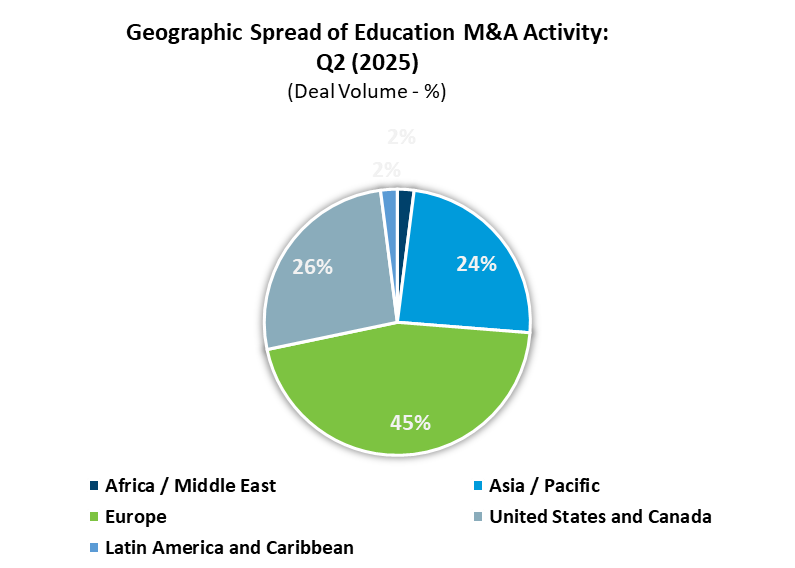

Europe led global deal activity, accounting for 45% of total transaction volume. This shift was driven by growing investor interest in high-quality education and HR assets, supported by more attractive valuation levels and a maturing operator landscape across the region. The increased activity in Europe represents a slight deviation from historical trends, where the US and Canada have traditionally accounted for the majority of sector transactions.

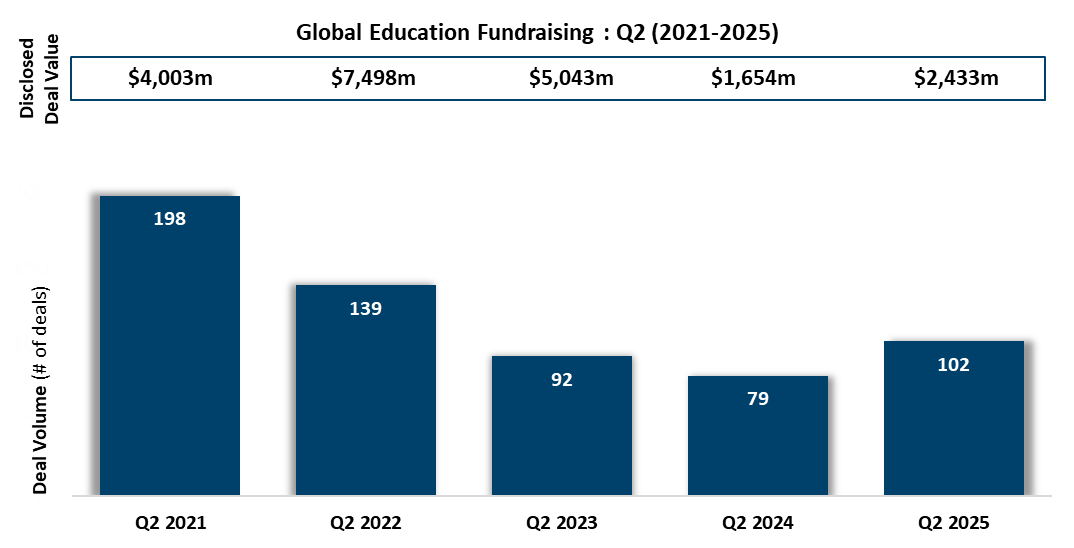

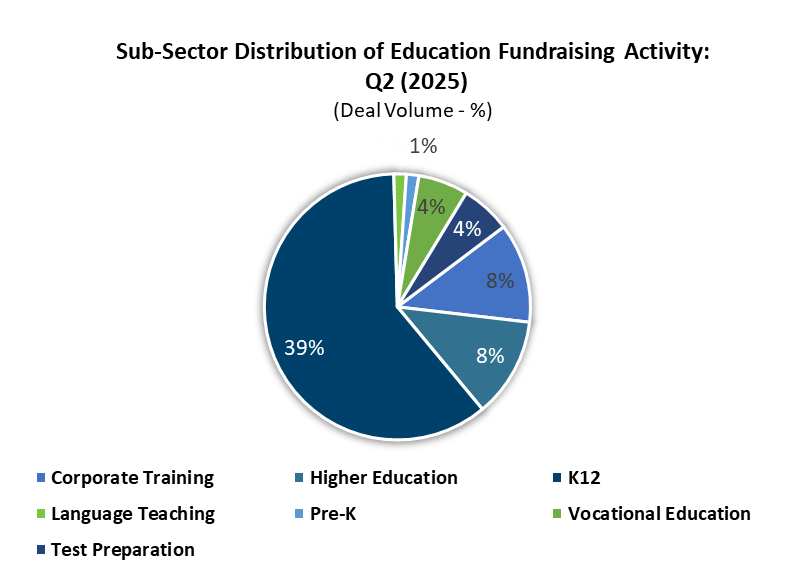

Fundraising activity also remained robust. Deal volume reached 102 transactions, while disclosed value climbed to $2.43 billion, reflecting continued investor confidence in high-growth opportunities, particularly in AI-driven learning platforms and enterprise HR software. High profile fundraises include the $600 million debt raise by Manipal Education & Medical Group, the India-based healthcare and education institute. The funding provided by private equity firm KRR is aimed to help support the company’s expansion across healthcare educatio and insurance. Other notable transactions included:

- Knowunity, a Germany-based AI learning platform for the K-12 sector, secured a $31 million series B raise, led by XAnge. The funding will be used to support Knowunity’s development of its global AI learning companion.

- Propelld, an India-based education financing platform, secured a $31 million series B round, led by Westbridge Capital. The raise is expected to support managements expansion strategy to provide education financing across different Indian cities, targeting vocational and higher education segments.

- SchoolAI, the US-based AI-powered platform for teachers and students, secured a $25 million series A raise, led by Insight Partners. The new funding will allow SchoolAI to continue scaling its services to more schools across different geographies.

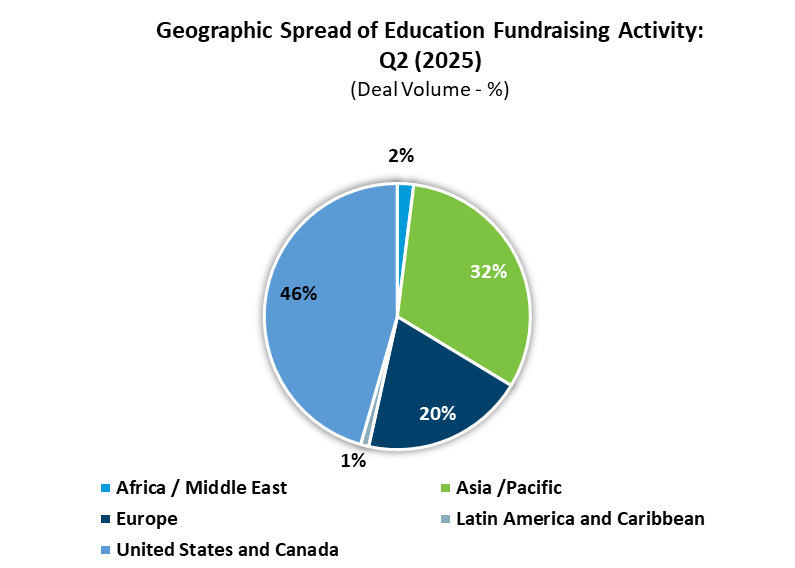

Fundraising deals were dominated by the United States and Canada, which accounted for 46% of deal activity. Similar to Q1 2025, the APAC region remained relatively active, contributing to 32% of total fundraising volume. In contrast, Europe accounted for only 20% of fundraising activity, painting a different picture compared to its high presence in regards to M&A activity.

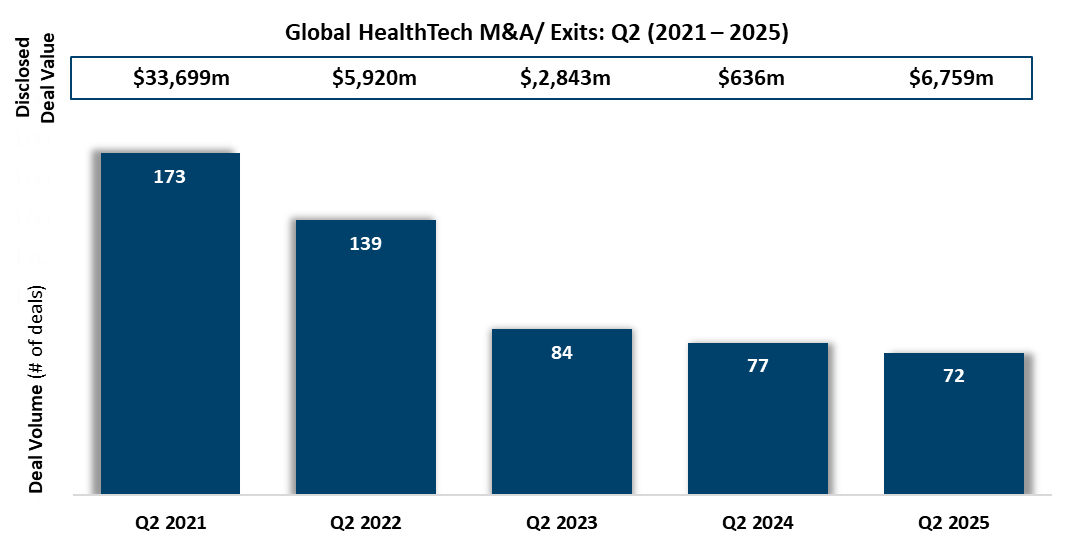

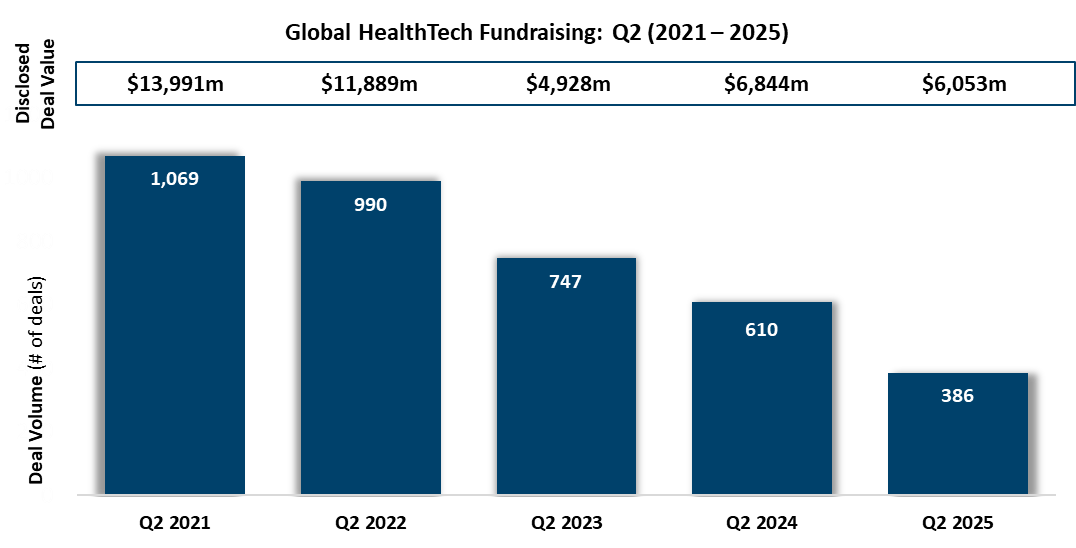

Global HealthTech M&A activity in Q2 2025 continued its downward trend in deal volume, reflecting the sector’s broader recalibration since its peak in 2021. Total deal volume declined 6% compared to Q2 2024, with 72 transactions recorded in Q2 2025. However, in contrast to the drop in volume, deal values saw a remarkable rebound. Aggregate disclosed deal value surged 962% to reach $6.76 billion, up from $636 million in Q2 2024. This notable increase was due to blockbuster acquisitions for strong performing assets in niche and high-growth segments.

While Healthcare IT and HR tech solutions that support employee engagement remain areas of consistent interest, the quarter’s standout transactions highlighted renewed activity in digital health platforms and consumer-facing wellness solutions, particularly in the beauty and genetic testing industries. Key transactions include:

- $5,1000 million sale of US-based AI powered data management solutions provider, Dotmatics, to Siemens. The acquisition will allow Dotmatics to accelerate its mission to connect scientific discovery to delivery, expand global scale and reach, whilst also realising synergies through combining their own research and development software, with Siemen’s AI-powered digital twin technologies.

- $1,000 million sale of Rhode Skin, the US-based online skincare brand, sold to E.L.F beauty. The acquisition of the US-based skincare brand reflects the converge of e-commerce, and personalised beauty. Specifically, Rhode’s ability to utilise digital marketing in the health and beauty space and curate a loyal following was a key strategic factor in E.L.F’s acquisition, as this will allow the acquirer to enhance their digital portfolio and audience reach.

- $305 million sale of US-based provider of ancestry testing, 23andMe to TTAM Research Institute. This follows the failed initial asset agreement purchase attempt by Regeneron to acquire 23andME’s assets for a valuation of $256 million. The successful acquisition by TTAM Research Institute will allow 23andMe to operate as a separate entity.

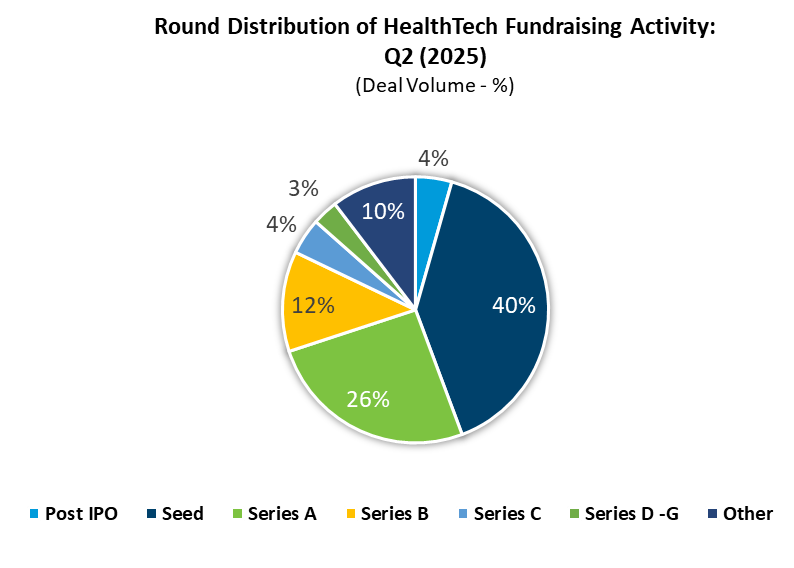

Fundraising activity saw a moderate slowdown in deal count and capital raised. Total investment volume declined to 386 deals, down 37% from Q2 2024, with total funds raised amounting to $6.05 billion, reflecting tightening capital deployment despite select high-profile rounds. Despite the broader slump, Artificial Intelligence continues to draw investor enthusiasm. Platforms integrating AI into clinical workflows, documentation, and diagnostics command premium valuations. Key funding rounds include:

- Neuron23, the US-based biotech company developing neurodegenerative diseases using AI-based drug discovery, raised $96.5 million in a Series D round. This latest round brings its total funding to $310 million and will be used to expand operations and its research and development efforts.

- Tandem Health, the Sweden-based company offering an AI-powered solution that automates medical note generation for clinicians, raised $50 million in a series A round. The funding will allow Tandem to build an AI-native operating system which is able to support the full clinical workflow. Specifically a system with the ability to capture the right clinical codes, coordinate care, and support decisions at the point of need.

- Nabla, the France-based AI powered clinical documentation assistant, raised $70 million in a series C round. To date, the company has raised $120 million and the investment is planned to help fuel expansion across its European hospital networks whilst supporting further product development.

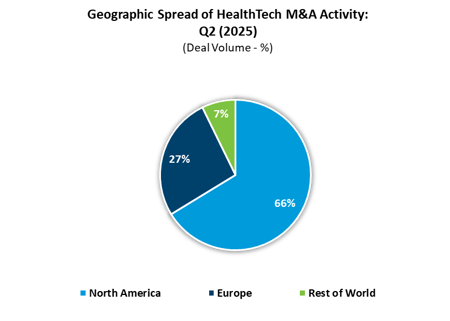

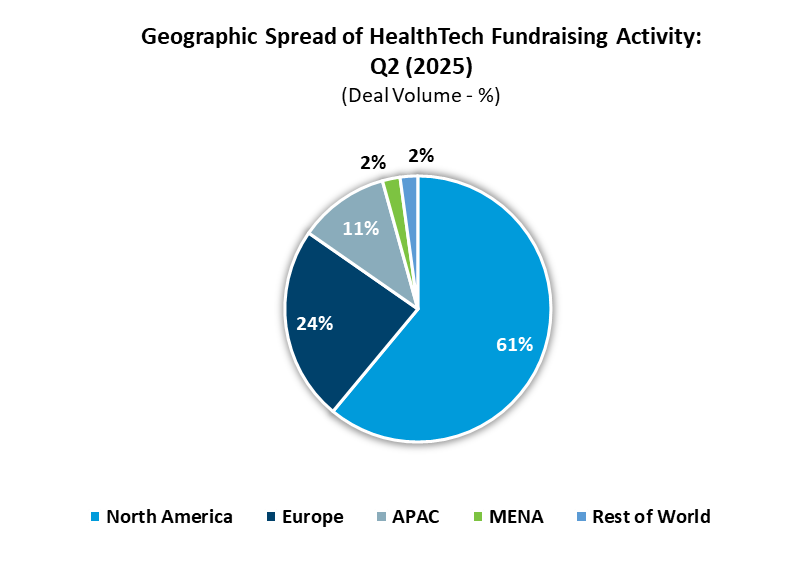

Fundraising activity remained concentrated in the United States and Canada, accounting for 61% of deals. Europe followed with 24%, while APAC comprised 11%. The remaining 4% was split across MENA and Rest of World (ROW), reflecting a continued focus on mature healthcare markets.