JANUARY 2025

A la recherche du temps perdu before the Avatars get there first - In our efforts to perfect the machine, we seek to make it in our likeness. None more so than in the rise of the avatar, which has now received the life giving breath of generative AI.

A global snapshot of the EdTech, HealthTech & Impact Investing markets.

Notable M&A & Fundraising activities across EdTech & HealthTech industries

Global trends across the tech-led impact ecosystem. In this issue:

Education Industry Analysis – Q4 2024

Healthcare Industry Analysis - Q4 2024

A la recherche du temps perdu before the Avatars get there first

By Charles McIntyre, CEO at IBIS Capital

It is curious that in our efforts to perfect the machine, we seek to make it in our likeness. None more so than in the rise of the avatar, which has now received the life giving breath of generative AI. We look at the screen and the face that stares back at us, albeit awkwardly, seeks to give human reassurance with a smile or two, but its lips don’t quite synch and it doesn’t always really understand us. Nevertheless, there is the beginning of a relationship between human and machine.

In the world of learning, artificial intelligence has been harnessed to address our human insecurities: practice and repetition away from the scrutinising eye of the teacher; personalisation to create bespoke content and interventions to address our individual weaknesses; personal prompts and incentives to encourage productive learning habits; and now the missing piece, emotional engagement to create learning jeopardy and reward.

Developments in large language models such as ChatGPT-4o are giving rise to real-time conversation and visual data interpretation that can allow the camera to recognise your mood and contextualise its response accordingly. The result is an emotionally “aware” human-looking avatar-teacher ready to engage with us in pretty much any language under the sun, at any time in any place. We can already see the direction of travel in the world of language learning with the recent arrival of Speak.com, proudly shouldering a $500m valuation and setting its sites on being the alternative future to Duolingo. Speak.com wants you to chat away to an avatar at the end of your arm. Au revoir flashcards, I hear you say.

But is this what we want? I like humans, I like talking to them, sharing experiences and having a good old emotive time. The perfect avatar can do a lot, and really can instruct me, but will I care enough to do my homework, feel proud when it says “well done”. For me at least the answer is no. What I want is a bit of both, the avatar to perfect me as best it can, and then unleash me on a real human teacher where I can ask how they liked their cappuccino. With online learning platforms accessing tutors all over the world, there is no reason why we can’t create a seamless experience mixing human and avatar learning. So, as we fashion our new gods, let’s add a little soul and remember that after all, we at least, are still human.

🤖 How a looming talent shortage threatens the AI boom

As AI technology advances, the industry has identified a new hurdle: a critical lack of skilled professionals that can drive its next phase of innovation. (The Financial Times)

🌍 International higher education: US sector predictions for 2025

Amid an ever-shifting political, economic and demographic landscape, The PIE spoke to industry leaders in the US about their hopes, fears and predictions for international higher education in 2025. (The Pie News)

🤖 Nvidia’s AI avatar sat on my computer screen and weirded me out

Nvidia unveiled a prototype AI avatar at CES 2025 that lives on your PC’s desktop. The AI assistant, R2X, looks like a video game character, and it can help you navigate apps on your computer. (TechCrunch)

👩🏽💻 Innovation in digital health: Why is it so important to act responsibly?

The Labour Government’s vision for growth is aligned to the success of one of the fastest growing ecosystems in the UK: technology. But what does this mean for the health sector, and why is it so important to ensure that we innovate responsibly? (Health Tech World)

🧷 AI in Healthcare Cybersecurity: A New Era of Digital Health Protection

In an age where healthcare breaches cost the industry billions annually, AI is emerging as a powerful ally. However, as Krunal Manilal Gala highlights in his groundbreaking study, this technological leap comes with ethical and regulatory challenges that demand urgent attention. (TechBullion)

🔍 2025 predictions: Digital Health Networks’ leaders look ahead

The government’s focus on a shift from ‘analogue to digital’ offers new promise for the world of NHS digital and technology in 2025. But questions remain unanswered around how this will work in practice, with more details eagerly awaited in the forthcoming NHS 10 year health plan. (Digital Health)

💰 As private equity fundraising goes south, whither impact investing in 2025?

Institutional investors and other limited partners are getting impatient to get their money back from private equity funds. Relations between many general partners and their limited-partner investors have become fraught. (ImpactAlpha)

💰 Why returns have been slow to follow investment in digital health

Medical tech is increasingly mainstream but needs path to profitability. (The Financial Times)

📈 Investment in online education groups plummets following rise of AI

Global investment in online education companies has fallen to its lowest level in a decade as the industry comes under pressure from the rapid rise of AI. (The Financial Times)

Education

Source: Capital IQ / Tracxn

Health

Source: Traxcn

Education

Source: Capital IQ / Tracxn

Health

Source: Traxcn

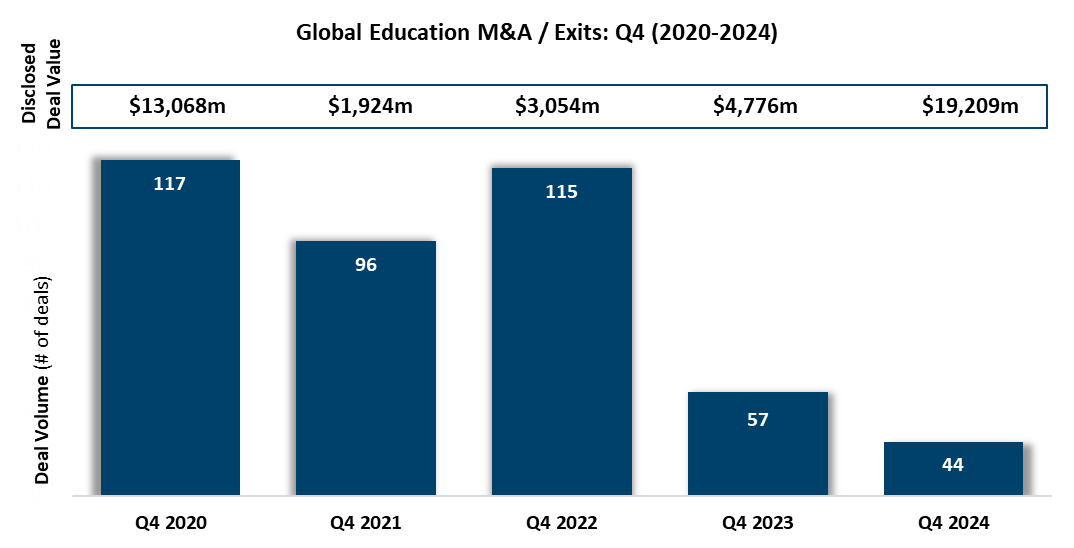

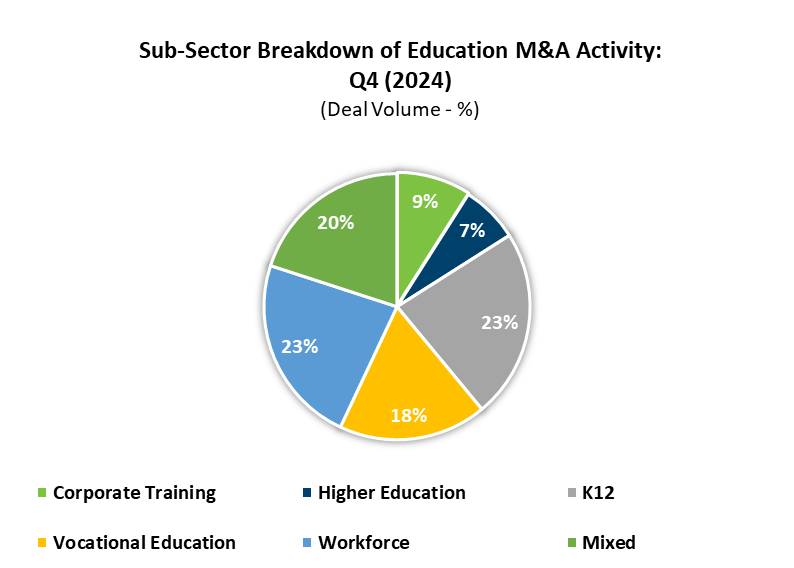

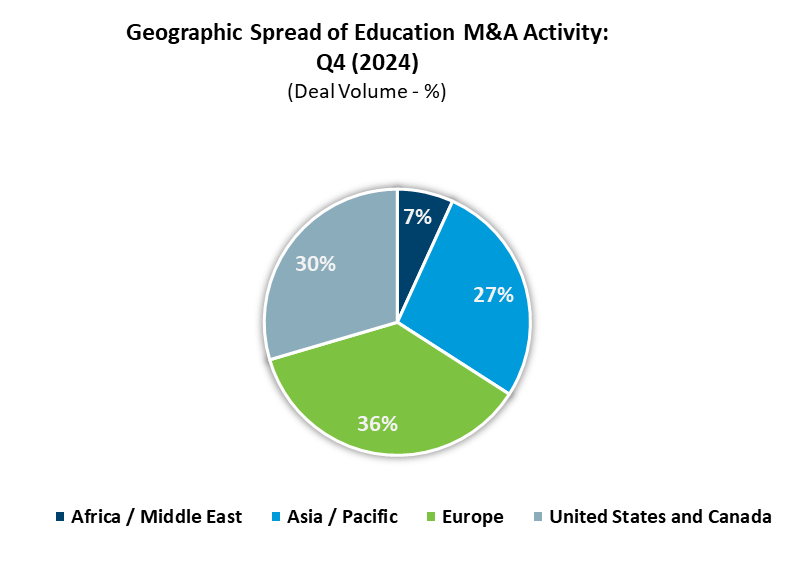

Global education M&A activity in Q4 2024 saw a further decrease in deal volumes, dropping by 23% to 44 transactions compared to the same period in 2023. However, despite the decline in the number of deals, there was a substantial increase in deal values, which surged by 302% to $19,209m, up from the $4,776m recorded in Q4 2023. The major contributor to this increase was the acquisition of Nord Anglia Education for $14,500m, led by a consortium including EQT, Neuberger Berman, and the Canada Pension Plan. Nord Anglia Education’s growth can be attributed to its acquisitive strategy. Since 2008, the group has expanded its portfolio from six schools to over 80 institutions, delivering educational services to more than 85,000 students globally.

Notable Q4 deals include:

- The acquisition of US-based healthcare test preparation provider, Archer Review, by Leeds Equity Partners. The acquisition aligns with Leeds Equity Partners investment criteria in respect to acquiring companies in the professional education space alongside promoting services that target the healthcare sector

- The acquisition of UK-based augmented reality provider focused on enhancing workplace learning & development, Zapper, by US-based digital innovation company Infinite Reality for $45m.

- The acquisition of Think Learning and Chambury Learning by Totara, the UK-based Learning Management System (LMS) provider, enhancing its expertise in the healthcare and public sector markets.

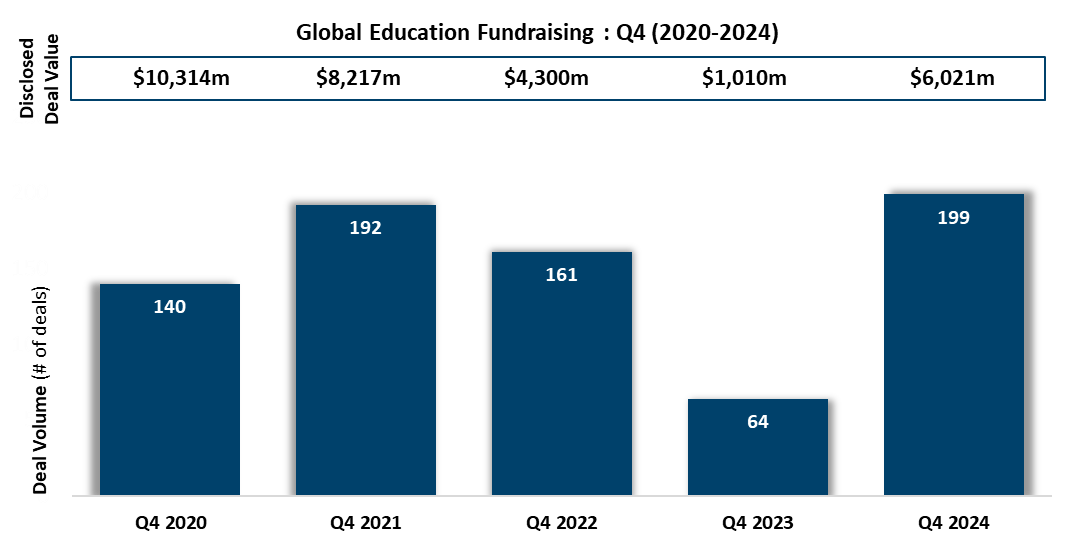

Fundraising activity rebounded in Q4 2024 to 199 reported deals, reversing a consistent Q4 annual decline since 2021. Both deal volumes and values increased by 211% and 496%, respectively, with a total of disclosed deal value of $6,021m.

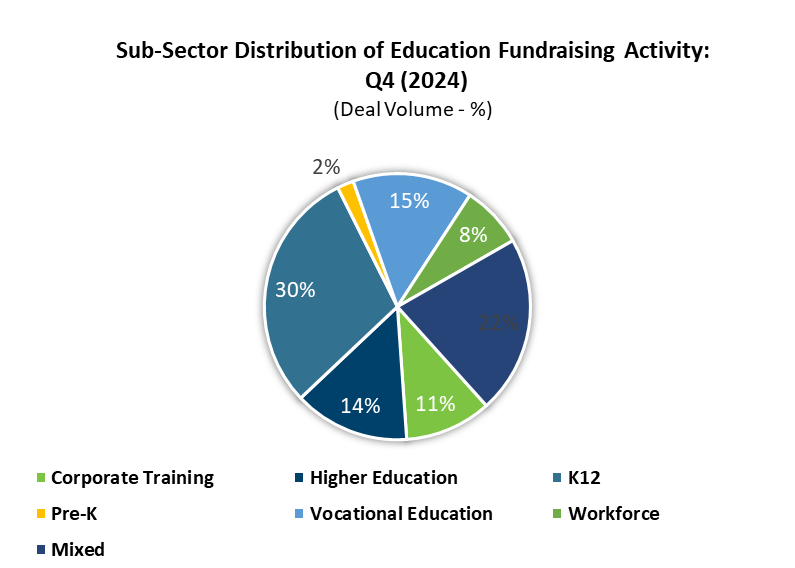

As with the M&A market, the K12 sector accounted for the majority of fundraising activities contributing to 30% of total fundraising deals. Notable K12 transaction includes the $80m Series B raise by SchoolLinks, the US-based AI platform offering student-focused solutions. Other notable transactions include:

- The IPO of US-based KinderCare Learning Companies, the US-based provider of childhood education services. Private equity firm Partners Group acquired KinderCare in 2015 and, following the IPO, Partners Group holds approximately 71% of the KinderCare’s common stock.

- $40m Series A raise by Magma Path, the Sweden-based provider of digital math tools for teachers.

- $37m growth round raise by Ignite Reading PBC, the virtual tutoring platform

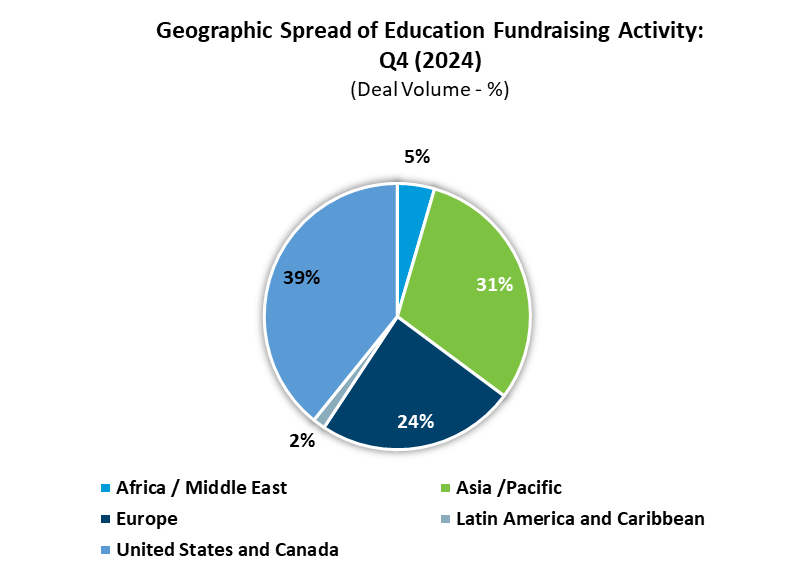

Geographically, the Unites States & Canada accounted for 39% of fundraising activities, followed by APAC with 31%. Europe remained relatively active accounting for 24% of fundraising volumes.

Notes

1. Sources: Tracxn, CapitalIQ, Partners Group

2. Includes deals announced but not yet closed

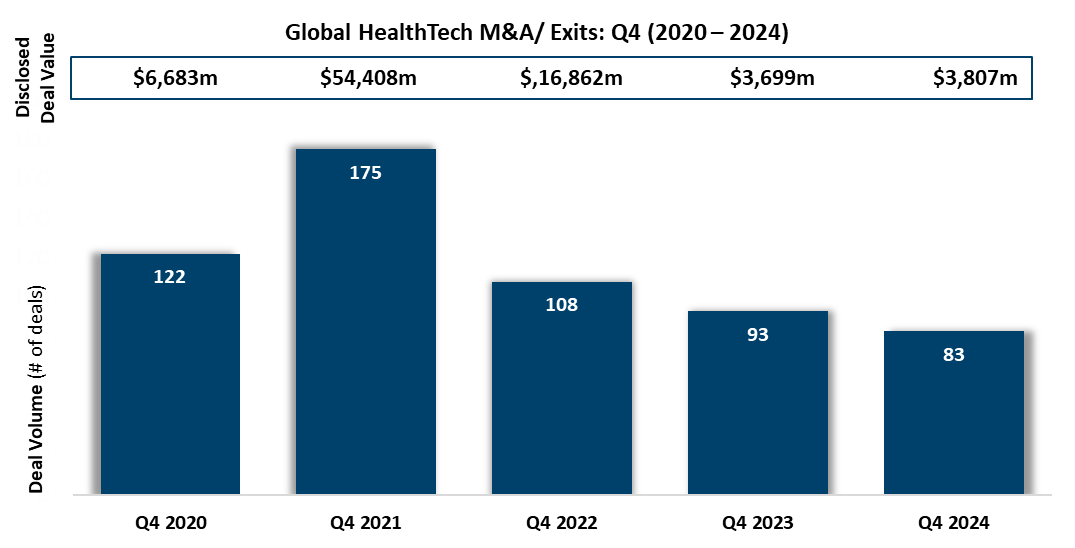

Q4 2024 Global HealthTech activity in the M&A space has seen a decline in both deal volumes and value compared to the sector’s peak in 2021. Global HealthTech M&A deal volumes declined by 11%, from 93 deals in Q4 2023 to 83 deals in Q4 2024. Deal values, however, showed a slight increase of 3%, reaching $3,807m in Q4 2024, compared to $3,699m in Q4 2023. Despite this modest increase, the value remains significantly lower than the pre-pandemic level of $6,683m in Q4 2020.

Q4 M&A activity suggests Investor interest has centred on the Healthcare IT services sector, with particular focus on areas such as administrative solutions, value-based care, and hospital information systems. Recent transactions in this space have centred on these key areas, including:

- $2,800m sale of US-based practice management platform for gastroenterologists, Gi Alliance, by US-based drug distributor Cardinal Health. The partnership between GI Alliance and Cardinal Health will benefit both parties by combining their shared vision to create a national platform that delivers high-quality care and stronger support for independent physicians.

- $101m sale of New Zealand based provider of health and precision medicine solutions, Orionhealth to Canada based medical artificial intelligence company, Healwell AI. The acquisition of Orion Health will drive Healwell's profitability and growth while expanding access to AI-driven healthcare solutions for both companies.

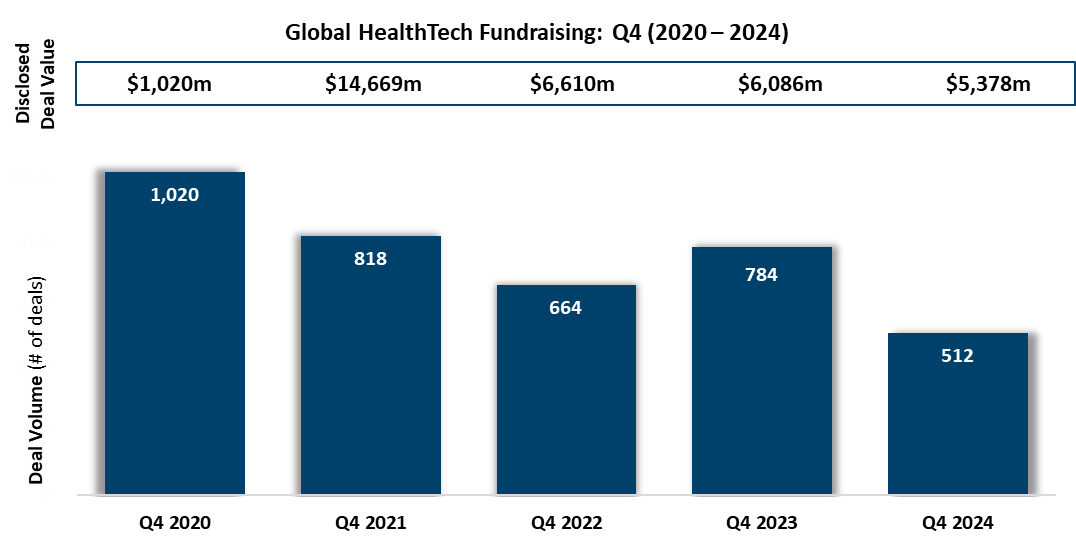

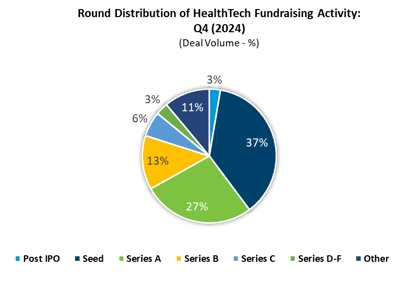

Fundraising activity in Q4 2024 saw a 35% decline in the Global HealthTech market, with a total of 512 fundraises, falling by 282 compared to Q4 2023. Similarly, disclosed deal values decreased by 12% year-on-year in Q4, totalling $5,378m. Investor interest in the fundraising space reflects trends observed in the M&A market, with a notable emphasis on Healthcare IT, particularly in clinical operations and hospital information systems. Additionally, Q4 2024 saw significant investor interest in two subsectors: Healthcare booking platform space and Wearable Technology providers targeting the health and wellness sector. Consciously, consumers, organisations and governments recognise the importance of proactive health management, allowing founders to capitalise on a growing wellness market. Notable transactions include:

- $200m series D raise by Oura, the Finland based provider of smart wearable fitness tracking rings which has raised a total funding amount of $421m. Oura has demonstrated strong financial and commercial growth, expanding its global presence, doubling revenue and membership, and securing strategic partnerships and acquisitions across retail, military, and healthcare sectors.

- $100m series C raise by Remodel Health, the US-based healthcare benefits management platform for employees. Oak HC/FT and Hercules Capital provided the growth investment funding to support Remodel Health’s leadership teams' expansion strategy.

- $12m series B raise by Orange Health, the India-based provider of internet first clinical labs offering home diagnostic test services. Investors included Access, Y Combinator, and Amazon Smbhav Venture Fund. To date, Orange Health has received $47m in total funding, and the new funding will ensure the firm can accelerate their production expansion and recruitment activities to support their diagnostics services.

The Lifesciences sector garnered strong interest from investors across the investment lifecycle, with notable private equity involvement. For example, HIG Growth Partners’ growth equity investment in Carebox, the US-based digital platform that connects patients and physicians seeking clinical trials. In the drug discovery sector, Cradle, the Netherlands-based provider of chemoproteomics solutions for protein design and development raised $73 million in a Series B round. The additional funding will support Cradle’s expansion in research, engineering, and operations to advance its goal of delivering AI-powered protein engineering to labs worldwide.

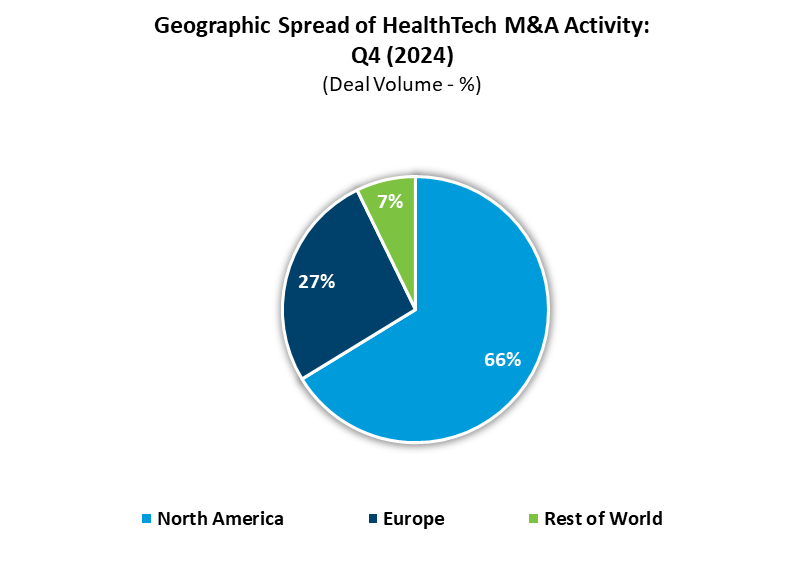

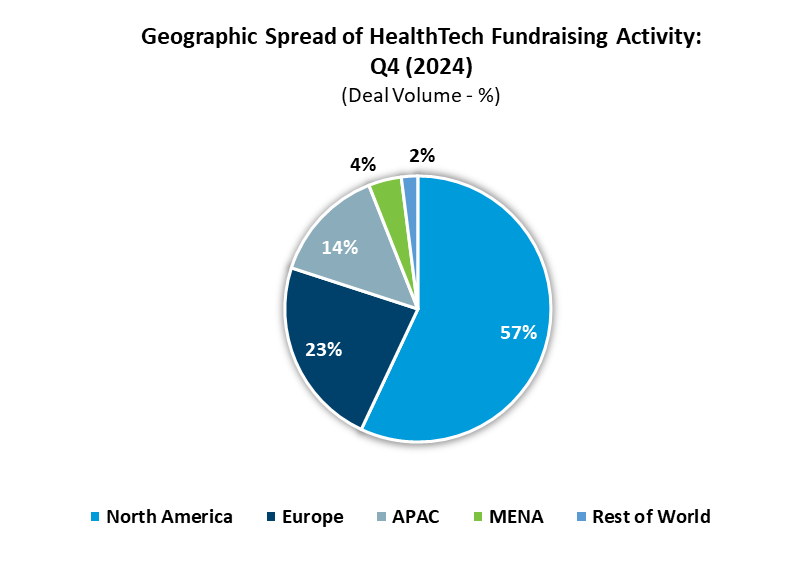

Overall, North America continues to show positive momentum, accounting for 66% of global HealthTech-related M&A transactions. Europe and the Rest of the World (ROW) represent 27% and 7%, respectively. Similar dominance is observed in the fundraising market, with North America comprising 57% of fundraising activity. Europe follows with 23%, while the Asia-Pacific region accounts for 14%. The remaining 6% of fundraises is attributed to the MENA region and ROW.

Notes

1. Source: Tracxn, GlobalNewswire, MobiHealthNews, DefensesScoop, PR Newswire, Inc42

2. Includes deals announced but not yet closed