January 2026

How the Grok Ate Itself - We now live in a synthetic world where the boundaries between real and artificial are blurred. As AI reshapes how content is created and consumed, the ethical stakes are high. Without aligning responsibility on both sides, the very systems we’ve created risk turning in on themselves - and on us.

A global snapshot of the EdTech, HealthTech & Impact Investing markets.

Notable M&A & Fundraising activities across EdTech & HealthTech industries

Global trends across the tech-led Education, Training and Health sectors.

Education Industry Analysis – Q4 2025

Healthcare Industry Analysis - Q4 2025

How the Grok Ate Itself

By Charles McIntyre, CEO at IBIS Capital

It took AI just 18 months to generate as many images as photography produced in 150 years. We now live in a synthetic world where the boundaries between real and artificial blur with each swipe. At first, this may seem harmless - who cares if a photo of a sunset was imagined by an algorithm? But when privacy, manipulation, and sexualisation enter the mix, the stakes rise fast. Society can no longer shrug and scroll on.

The instinctive response is to build walls. Grok goes behind a paywall. Australia bans under-16s from social media. The UK launches a consultation on whether to follow suit, while Ofsted declares war on phones in schools. These gestures reassure the public - and make for neat headlines - but in reality, they’re more symbolic than structural. For every wall there’s a tunnel, for every restriction a VPN. Barriers may slow the flow, but they never stop it.

What we keep forgetting is that the flow itself is exponential. The tools once reserved for developers and designers now live inside every phone. Anyone can conjure up an image - of a rabbit, a sunset, or something far less innocent - in seconds. While governments and regulators wrestle with bans, the rest of us should be teaching young minds (and older ones, too) how to navigate this new synthetic reality.

Because this isn’t just about keeping children safe online; it’s about rethinking how we teach ethics in a world run by algorithms. Ethics shouldn’t be an optional module in a computer science degree; it should be built into coding itself and reinforced through education, governance, and policy.

Without a joined‑up approach linking protection, governance, and education, our attempts at control will collapse under their own contradictions. AI ethics needs to be integral to school curricula and to corporate compliance alike. In an AI world, both production and consumption must be ethically aligned. Otherwise, the Grok - and the rest of us with it - will end up devouring ourselves.

⚙️A US productivity unlock: Investing in frontline workers’ AI skills

For tech investments to pay off in higher frontline productivity, workers will need new skills. That means investing in human capabilities before deploying AI widely. (McKinsey & Company)

👩🎓UK ministers scrap foreign students target in shift to overseas hubs strategy

Government replaces recruitment goal with plan to increase ‘education exports’ to £40bn a year by 2030. (The Guardian)

💻Creating Opportunities For All In The Intelligent Age

The accelerating advance of artificial intelligence and emerging technologies is fundamentally reshaping societies and economies, creating both opportunities and challenges. (World Economic Forum)

🤯 The human advantage: Stronger brains in the age of AI

The rise of artificial intelligence highlights how investment in “brain capital” (brain health and brain skills) can boost resilience, productivity, and growth. (McKinsey & Company)

🌟 2026 predictions: Health tech suppliers have their say

With additional funding for NHS technology announced in the Autumn Budget, the growing prominence of AI in healthcare, and the 10-year health plan gathering pace, anticipation is building across the digital health sector as we move into 2026. (DigitalHealth)

🤖 OpenAI launches ChatGPT Health to review your medical records

OpenAI has launched a new ChatGPT feature in the US which can analyse people's medical records to give them better answers, but campaigners warn it raises privacy concerns. (BBC News)

📈 Private Equity And Venture Capital: How AI Changes Value Creation

Artificial intelligence is forcing a fundamental rethink of how Private Equity and Venture Capital firms evaluate and create value in their portfolio companies. Traditional investment metrics need updating as AI transforms industries. (Forbes)

💭 Microsoft boss says a nation’s wealth now depends on the price of AI

Satya Nadella argues at Davos that artificial intelligence must be focused on improving everything from health to education. (The Times)

💰 European Venture Funding Nudged Higher In 2025, While AI Led For The First Time

Venture funding to Europe-based startups last year gained only slightly, around 9% year over year, reaching $58 billion, with AI emerging as the region’s leading sector for startup investment for the first time, an analysis of Crunchbase data shows. (Crunchbase)

Education

Source: Capital IQ / Tracxn

Note: Coursera/Udemy merger expected to complete in H2 2026

Health

Source: Capital IQ / Tracxn

Education

Source: Capital IQ / Tracxn

Health

Source: Capital IQ / Tracxn

Global M&A activity across the education sector declined in Q4 2025, with both deal volumes and disclosed values falling year-on-year, although several thematic areas remained active. Aggregate disclosed deal value decreased by 73% versus Q4 2024 to approximately $5.0bn, while deal volumes declined modestly to 40 completed transactions, compared with 44 in the prior-year period.

Despite the overall slowdown, transaction activity in Q4 2025 was underpinned by a continued focus on lifelong learning, with particular momentum in corporate training, workforce upskilling and professional skills development outside traditional education pathways. This segment of the edtech market reflects increasing emphasis by employers on productivity enhancement, skills acquisition and workforce adaptability in response to evolving labour market demands. Consistent with Q3 2025, both strategic and financial acquirers continued to target platforms capable of delivering demonstrable productivity gains and measurable skills outcomes, positioning these assets as enablers of broader workforce transformation initiatives. This investment focus reflects efforts by employers to capture efficiency gains anticipated from the adoption of artificial intelligence and related technologies. Key examples include:

-

Online learning platforms Coursera and Udemy have agreed to a $2.5 billion merger combining Udemy’s extensive marketplace with Coursera’s university partnerships to create a leading skills platform. The merger aims to offer a broader range of courses and leverage AI for personalized learning, consolidating the online education sector and addressing weakening demand post-pandemic, with plans for significant cost savings and platform innovation.

-

Reducate, the Netherlands based edtech group, acquired UK-based education and professional online learning company Learna. The acquisition highlights Reducate’s roll-up approach in continued learning, positioning Learna as part of Reducate’s broad strategy to acquired CPD and skills-focused businesses.

-

LearnUpon, the US based learning management system provider, acquired Courseau, a US based AI-driven learning content platform, highlighting demand for AI-enabled tools that accelerate course creation, enhance personalisation and improve the efficiency of enterprise training delivery.

Separately, M&A activity across the K-12 sector was characterised by several notable transactions, particularly within education software and technology services providers serving schools, albeit driven by distinct strategic rationales. Examples include:

-

Private equity firm Permira acquired The Key Group, a UK-based K12 management information systems platform, to support its growth initiatives across the K12 sector. Since its initial acquisition by CBPE, The Key Group has executed a series of strategic acquisitions, including Arbor and GovernorHub, as well as adjacent capabilities such as TimeTabler and SAMpeople, strengthening its end-to-end product offering for schools.

-

Private equity firm Warburg Pincus acquired Raptor Technologies, an integrated school safety software platform, for $1.7bn. The transaction reflects the continued growth of the school safety technology market and Raptor’s opportunity to further consolidate the sector through its scaled platform and expanding customer base.

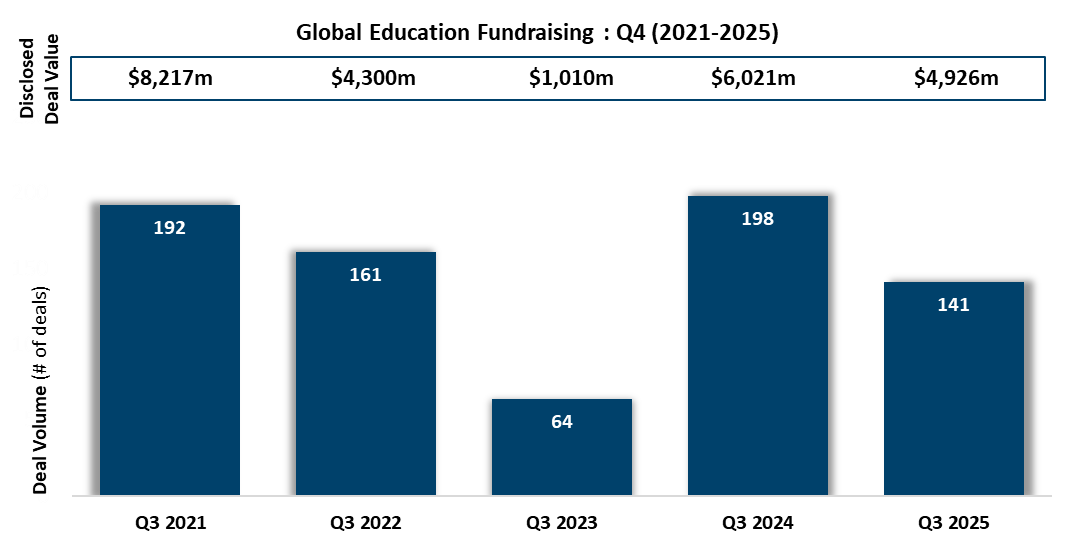

Fundraising across the education and workforce sector softened in Q4 2025, with both deal volume and aggregate value declining compared to Q4 2024. Total deal volume reached 141 transactions, with $5bn in disclosed funding. Similar to M&A activity, investor focus remained centred on lifelong learning and continuous upskilling, with capital concentrated in solutions directly addressing skills gaps and workforce productivity.

Investment continues to concentrate on AI-powered personalised learning platforms, as enterprises seek scalable solutions that adapt training to individual needs. A notable example is Yoodli, a US-based platform that uses AI to simulate real-world scenarios and deliver personalised learning pathways. The company recently raised a $40m Series B to accelerate investment in AI-driven coaching and personalisation.

Beyond professional training, demand for continuous learning is also increasing among broader audiences across markets. This is reflected in the $16m funding round raised by Obeo, a US-based AI-powered course generation platform, which officially launched in September 2025, highlighting growing investor interest in tools that enable accessible, on-demand skills development.

As echoed in the M&A market, K–12 fundraising accounted for a significant share of deal activity (25%), with capital largely directed toward personalised learning solutions. Notable transactions included:

-

$20m Series B raise by Parallel, a provider of virtual special education services designed to address shortages of qualified special education professionals. The funding will support Parallel’s national expansion and the continued development of its clinical technology, with the aim of operating across all 50 states within the next two years.

-

Flint, a US-based personalised learning platform for schools, raised $15m in a Series A, co-led by Basis Set Ventures and Patron. The investment will be used to accelerate product development and expand the company’s footprint across school districts.

-

Magma Math, a US-based AI-powered mathematics platform focused on student-centred learning, secured $10m from existing investor Five Elms Capital to support geographic expansion and the development of new AI-enabled teaching and learning solutions.

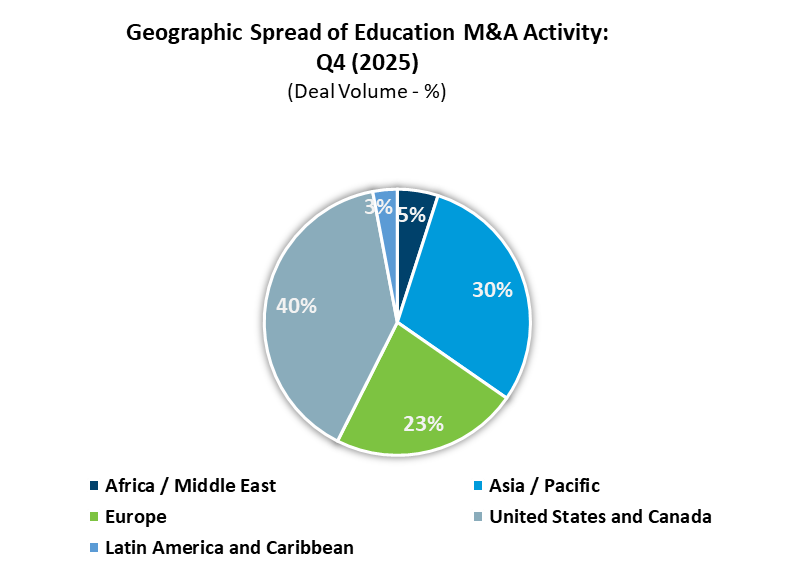

Unlike prior quarters, which were dominated by the United States and Canada, Q4 saw Asia Pacific match North America in deal volume, with each accounting for 40% of transactions. This shift highlights growing investment activity across the region, driven primarily by strong momentum in India, where both private and public edtech markets remain active. Europe accounted for 17% of total fundraises in Q4. A similar geographic distribution was observed in the M&A market, with deal activity again concentrated in the United States and Asia Pacific.

Q4 2025 Global HealthTech M&A saw significant growth in value versus 2024 in the face of declining deal volumes, with transaction value near-doubling from $6.8bn to $13.4bn despite 20% fewer deals – reflecting the significant year on year growth in average transaction values (£116m vs $47m in 2024).

This dynamic also played out across the fundraising landscape, where a 27% decline in volume contrasted with a 30% increase in total fundraising value ($7.0bn vs $5.4bn in FY24), driven by a shift in volume towards high-income countries (US & Canada increased share of volume from 56% to 59%) and more mature businesses (25% of all raises were Series B and above, versus 21% in 2024).

Q4 2025’s value growth marks the largest year in market activity since 2022, with combined deal values surpassing $20bn.

A glance at some of the largest and most pivotal M&A transactions in Q4 reveal a renewed focus on data management infrastructure embedded into clinical workflows, with high switching costs and mission-critical status. Across treatment (GE Healthcare’s $2.3bn acquisition of Intelerad) and clinical trials (Thermo Fisher’s $9.4bn acquisition of Clario), the premium on the ability to collect and leverage clinical data continues to climb, with AI and consumerisation of healthcare creating opportunities to differentiate through the rapid deployment of regulatory-grade information.

Fundraising activity saw a continuation of the shift towards higher-value, later-stage rounds, with average raises (where deal values were reported) jumping again from $10.5m to $18.7m (2023: $7.8m). This was underpinned primarily by the near-doubling of average deal value in the US, Canada and Europe, where landmark raises for Oura (Finland, Series E - $900m), Function Health (US, Series B - $298m) and Tebra (US, Series D - $250m) were especially noteworthy.

However, these headline transactions belie a bifurcating market, with significant investor interest in mature propositions with scale and proven unit economics (and a path to consistent profitability), versus a long tail of small raises, with earlier-stage founders competing for a shrinking pool of risk capital. As if to illustrate the point, Series D+ rounds grew in size by 72% on average, Series C rounds by 84%; meanwhile Seed tickets grew on average by only 20%, remaining well below their 2022 highs.

The growth of debt financing as an alternative funding source continued apace, with Aledade’s Ares-backed $500m credit facility ensuring an almost sevenfold increase in total funding since 2022 – reflecting an easing monetary policy environment and an increased willingness from lenders to underwrite healthcare cashflows.

Geographically, the US retained its dominance of large rounds but notable non-US signals appear: Europe (Oura, CoMind, SheMed), China (Shenshi / Deep Intelligent Pharma), India (Inito, Ultrahuman, others), Israel (Biobeat, Sensi), and a steady European Series A/Seed stream (UK, France, Germany, Nordics). A similar picture appears in M&A, with the notable re-emergence of APAC as the only region to grow in deal volume and value (although still dwarfed by the scale of US deals). Europe was the only region that saw a marked decline in M&A value, with Q4 2024 inflated by TA’s $1.3bn buy-out of Nexus AG.