JULY 2024

A Look Back at London EdTech Week 2024 - A community-led array of insightful discussions, workshops, networking opportunities, and more.

LETW Sponsor Spotlight - Exclusive insights & industry trends from London EdTech Week Gold Sponsor, Goodnotes, & Silver Sponsor, Datasite.

GLP-1 Agonists: A Miracle Cure in Tackling Global Obesity? - While GLP-1 agonists offer a promising solution, a multifaceted approach is needed to address the global obesity crisis.

A global snapshot of the EdTech, HealthTech & Impact Investing markets.

Notable M&A & Fundraising activities across EdTech & HealthTech industries

Global trends across the tech-led impact ecosystem. In this issue:

Education Industry Analysis – Q2 2024

Healthcare Industry Analysis - Q2 2024

A Look Back at London EdTech Week 2024

London EdTech Week 2024 (17–21 June) was a whirlwind of inspiration and connection, bringing together educators, innovators, and industry leaders from around the globe to explore the latest advancements in education, training and work. Rich with insightful discussions, networking opportunities, and inspiring sessions, the event was a true celebration of global EdTech.

Here are the key themes and standout moments from the week:

AI in Education

AI was a hot topic, with sessions diving into its potential to transform the way we teach and learn. From Goodnotes' exploration of "Teaching and Learning with AI" to CheckIT Learning's session on "Neuroscience & AI," attendees learned how AI can personalize learning, empower students, and even enhance resilience. HolonIQ furthered the dialogue with a roundtable examining the impact of AI on education outcomes in Europe and benchmarking it against other regions.

Leadership and Growth in the Digital Age

The week also delivered on providing tools and strategies for businesses to thrive. HIK Training’s "Authentic Leadership in the Digital Age" focussed on practical leadership strategies combined with Gallup's research to help leaders succeed in a remote and digital world, while broader challenges and opportunities were on the agenda at the EdTech Executive Summit, co-hosted by AWS and EDT&Partners, offering a platform for industry experts to discuss key topics, including entering new markets, the use of AI, improving operational efficiency, and quality frameworks in EdTech.

A Global EdTech Stage

Global market trends and best practices were also on the agenda with EDGE Tutor's session on the Asia-Pacific’s innovative educational strategies, sharing insights on effective tutoring practices and technological integration in the region. The International Education Workshop, hosted by IBIS Capital and EF Education First, explored the global education landscape with discussions on best practices from around the world, highlighting the role of technology in facilitating global access, equity, and upward mobility for students. techUK's European EdTech Marathon zoomed in on the thriving EdTech scene across Europe, offering insights on funding, partnerships, and growth strategies, while Cooley & Oppenheimer's session provided specific insights for European EdTech companies looking to expand into the US market.

Real-World Applications and Best Practices

The question of effectively evaluating educational technology solutions resonated throughout the week. A workshop hosted by IOE, UCL's Faculty of Education and Society, and led by the Global EdTech Testbed Network explored the concept of testbeds. Experts shared valuable insights from international testbed initiatives, prompting discussions on how to adapt this approach to the specific needs of the English school system.

Goodnotes hosted sessions showcasing real-world AI use cases in education and the workplace, as well as best practices for cultivating a positive and productive work environment. The concept of product-market fit was the focal point of a session hosted by EdTech product advisor & coach, Matt Walton in partnership with Brighteye Ventures, showcasing some success stories of EdTech companies who successfully went about finding it.

Building Bridges and Fostering Innovation

Networking opportunities were plentiful starting with Brighteye Ventures and Oppenheimer’s customary Opening Reception to kick off the week’s activities. Fitness enthusiasts were treated to Holon IQ's "networking run, jog or walk" along the river, providing a chance to connect with industry peers in a more active setting. The Global Startup Mini Summit, co-hosted by UCL EdTech Labs, MindCET and SEK Labs, provided a platform for startup founders, investors and industry experts to build connections and delve into the challenges and changes shaping education through innovation. Ufi Ventures' networking drinks specifically focused on the future of workforce development, fostering connections between investors and operators in the sector.

The flagship event of the week, IBIS Capital’s EdTechX Awards Gala Dinner brought together some of the sector’s greatest minds at the exquisite Hurlingham Club in London for a fun evening of celebration, networking, great food and a keynote speech delivered by our founders Charles McIntyre and Benjamin Vedrenne-Cloquet on their vision for the future of learning and work. Discover the winners of the prestigious EdTechX Awards here and browse the Gala Dinner Gallery here.

London EdTech Week 2024 was a resounding success, leaving attendees energized and brimming with ideas for the future of education. It was a powerful reminder of the transformative potential of EdTech when coupled with collaboration, innovation, and a commitment to shaping a future where learning is accessible, engaging, and empowering for all. Bring on London EdTech Week 2025!

Catch up on all the event's comments and feedback on LinkedIn here & visit the London EdTech Week website here.

A big thank you to the London EdTech Week sponsors, hosts and partners.

Sponsor Spotlight

Exclusive Insights & Industry Trends from Our Gold and Silver Sponsors

Gold Sponsor

Goodnotes has seen a 2,000% increase in adoption across UK schools. Discover what's driving this surge and how digital paper and AI are transforming education. Read more

Silver Sponsor

Datasite facilitates around 14,000 new deals annually. Read an exclusive Q&A with Babur Mirza, Senior VP of Sales at Datasite, on the latest trends and challenges in the EdTech sector's M&A and fundraising landscape. Read more

GLP-1 Agonists: A Miracle Cure in Tackling Global Obesity?

By Sophia Nasser, Investment Banking Analyst at IBIS Capital

. As society has advanced, we have successfully tackled countless issues, but this progress has also given rise to new challenges. Obesity is a prime example. Despite the unparalleled access to information, global obesity rates have continued to increase. In 2022, 43% of adults worldwide were classified as overweight, a dramatic increase from 25% in 19901. Sedentary lifestyles and poor dietary habits are major factors behind this alarming trend.

The impact of obesity spans from individual health to societal burdens, therefore a comprehensive approach is needed to address it effectively. Despite the plethora of “solutions” available, obesity remains a persistent and growing global challenge.

A notable recent advancement is the development of glucagon-like peptide 1 (“GLP-1”) agonists. Initially designed for type 2 diabetes, some GLP-1 agonists, like Novo Nordisk’s Wegovy, have been specifically made and approved as weight loss drugs due to high demand2. These drugs mimic the hormone GLP-1, which lowers blood sugar and can regulate appetite and food intake3. The popularity of GLP-1 agonists as a weight loss treatment has surged, partly due to endorsements from celebrities, increasing public awareness. This increased demand has caused global shortages, which are expected to persist throughout 2024 (4).

Whilst GLP-1 agonists offer a potential solution to the obesity epidemic, there are limitations. One major concern is the high cost, which limits accessibility, especially in low- and middle-income countries where obesity rates are rising rapidly1. This raises concerns about equity and sustainability combating obesity with pharmaceutical solutions alone. It would be a mistake to rely solely on GLP-1 agonists as a "miracle" cure for obesity. The shortages also raise potential concerns about diverting medication originally intended for diabetes patients.

While GLP-1 agonists represent a significant advancement in the treatment of obesity, they are not a panacea. A holistic approach that integrates medical, behavioural and environmental strategies is essential for tackling the obesity epidemic. By addressing the root causes and ensuring equitable access to treatments and support, we can progress in combating this complex issue whilst striving to avoid unintended consequences.

Sources: 1World Health Organization, 2IBIS Capital 2024 HealthTechX Global Report ; 3Cleveland Clinic ; 4The BMJ

👌🏽 Why we need global minimum quality standards in EdTech - The lack of universal monitoring standards for EdTech quality and impact hinders progress towards education for all.(World Economic Forum)

🦄 How To Catch A Unicorn In The Ed Tech Industry - Why is it that despite significant financial backing, very few educational technology companies have reached unicorn status? (Forbes)

🤖 Future of work & productivity (2024) - GenAI is already reshaping work at an unexpected scale — but while companies have been relatively quick to adopt the technology, research shows companies are lacking a dedicated strategy for using AI. (Sifted)

📑 FDA publishes updated draft guidance on clinical trial diversity - The agency issued a new outline of its proposed requirements for the racial and ethnic diversity action plans that will eventually be mandatory components of studies on drugs, devices and other medical products. (Fierce Biotech)

🌐 Scaling national e-health: Best practices from around the world - We examined best practices from around the world to identify proven ways to implement e-health successfully. These insights could help other countries unlock their own e-health potential. (McKinsey Insights)

🤖 “Robotic-based” Home Care is Actually More … Human - Is it possible to be pro-human and pro-tech at the same time when it comes to our healthcare? (MedCity News)

🙏🏽 Cautious optimism returns to the private equity impact market - There was a lull in private equity impact fund raising in 2023 following a banner 2022. But there are now signs that normality is returning to the market. (Impact Investor)

💰 Edtech Funding Has Not Hit Bottom - Education is not a hot area for venture investors lately. (Crunchbase News)

🦄 Where's Europe's next digital health unicorn? - Funding has been falling for digital health startups — but there are some real areas of promise in the sector. (Sifted)

Education

Source: Capital IQ

Health

Source: HealthTech Alpha

Education

Health

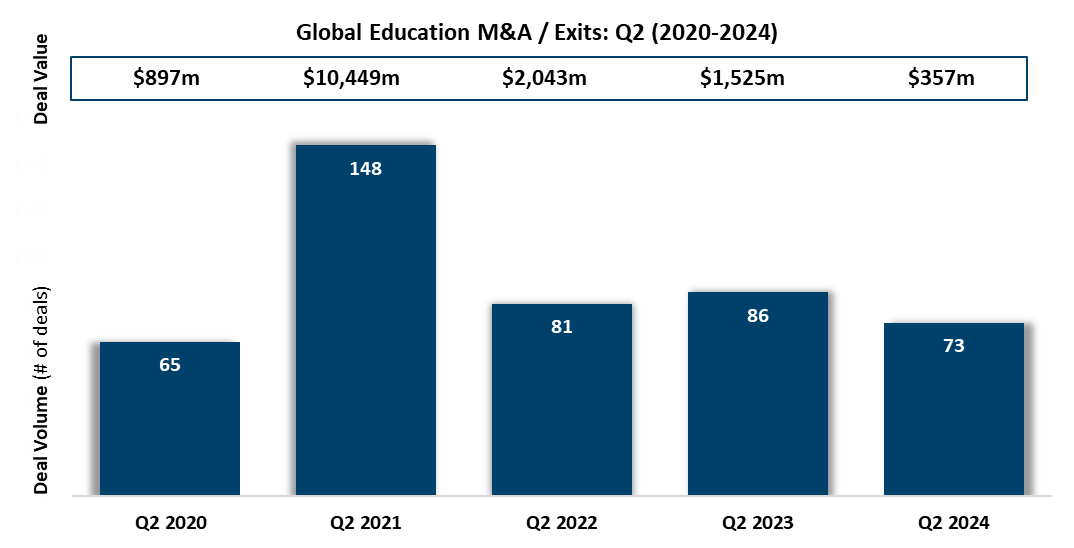

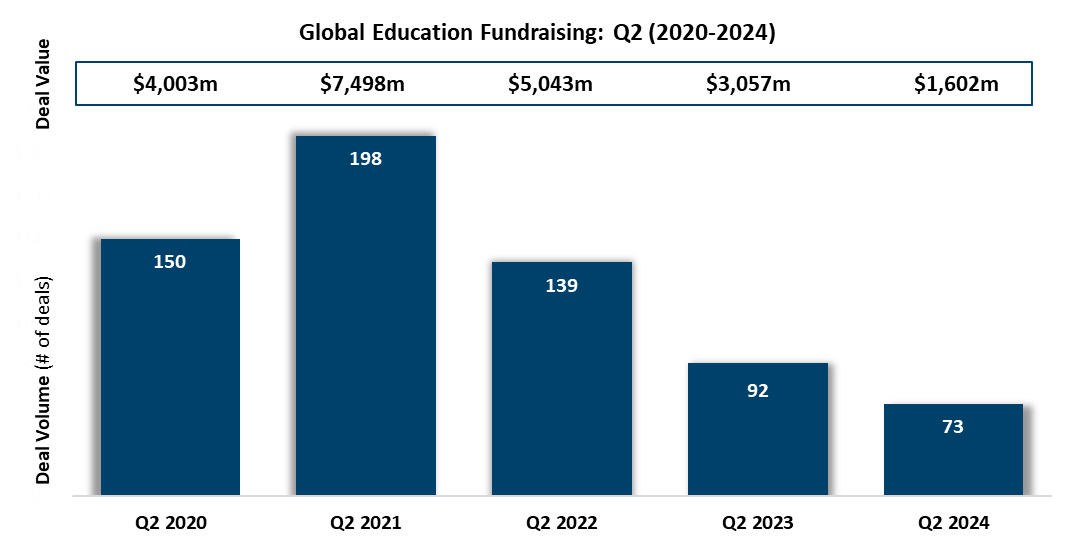

In Q2 2024, global education deal-making reached both its lowest deal volume and deal value for both fundraising and M&A transactions, compared to previous quarters from 2020 onwards. M&A deal volume fell by 15% from 86 in Q2 2023 to 73 Q2 2024. Disclosed M&A deal value decreased by $1,168m, compared to the same quarter in the previous year, representing a decrease of 77% and disclosed fundraising deal value decreased by $1,455m, compared to the same quarter in the previous year, representing a decrease of 48%. Both these decreases were driven by the higher amount of undisclosed deal values in the most recent quarter.

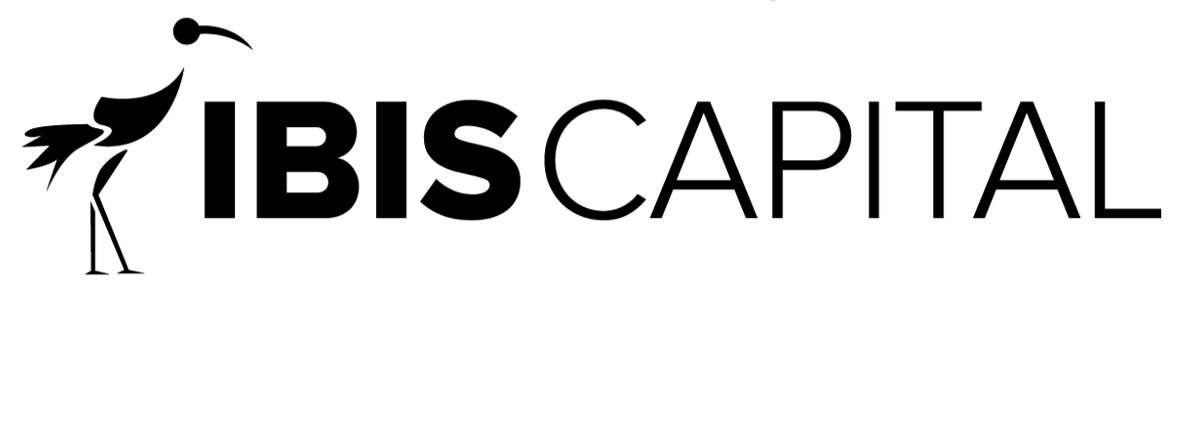

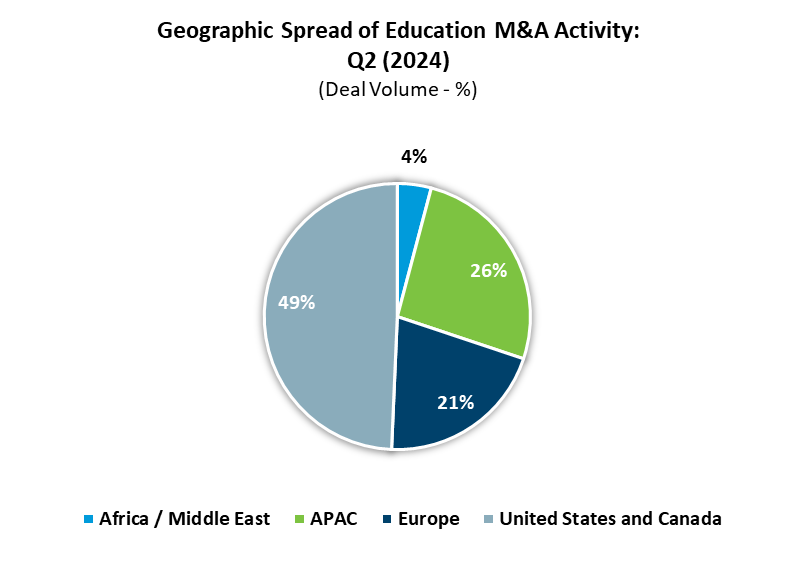

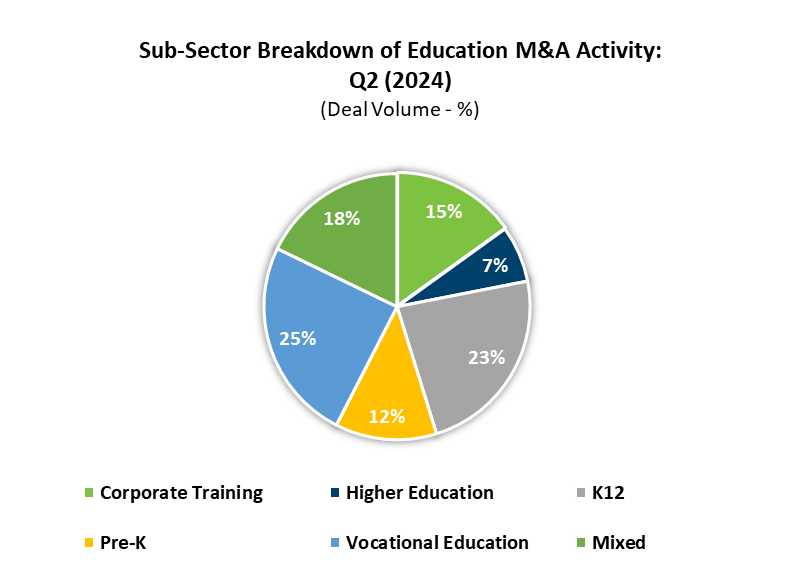

As in previous years, the United States and Canada continued to be dominant geographies accounting for nearly half of the M&A deals in Q2 2024, followed by APAC and Europe accounting for 26% and 21%, respectively. Strategic buyers dominated the space in Q2 2024, making up 83% of transactions. Significant M&A transactions included the acquisition of Keypath Education by their already majority shareholder Sterling Partners for $125m. The transaction will lead to the delisting of Keypath Education from Australia’s stock exchange. Another key transaction is the acquisition of a 5% stake in K12 Techno Services by Singapore-based private equity firm Venturi Partners, showcasing signs of increased activity within the Indian EdTech landscape. In terms of sector distribution of Education, M&A this quarter was split fairly evenly with Vocational Education receiving the highest activity at 25% and K12 receiving 23% in terms of deal volume.

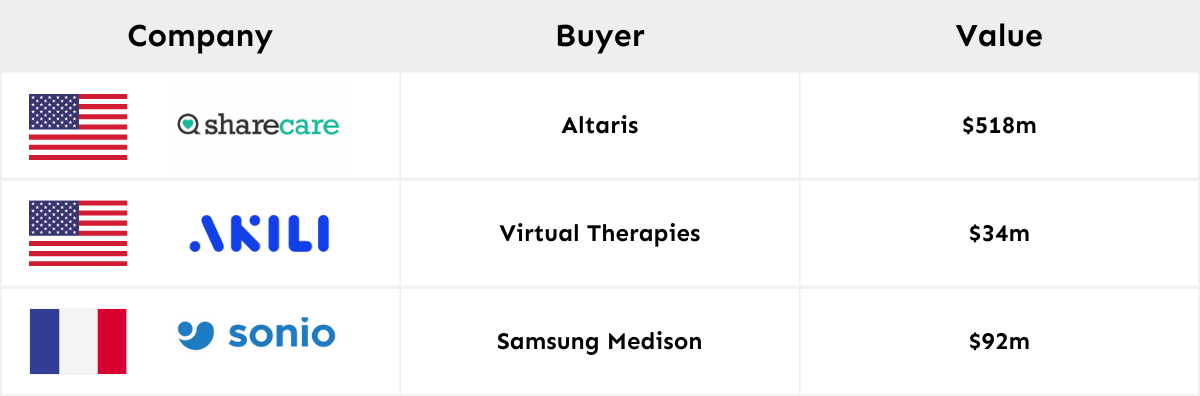

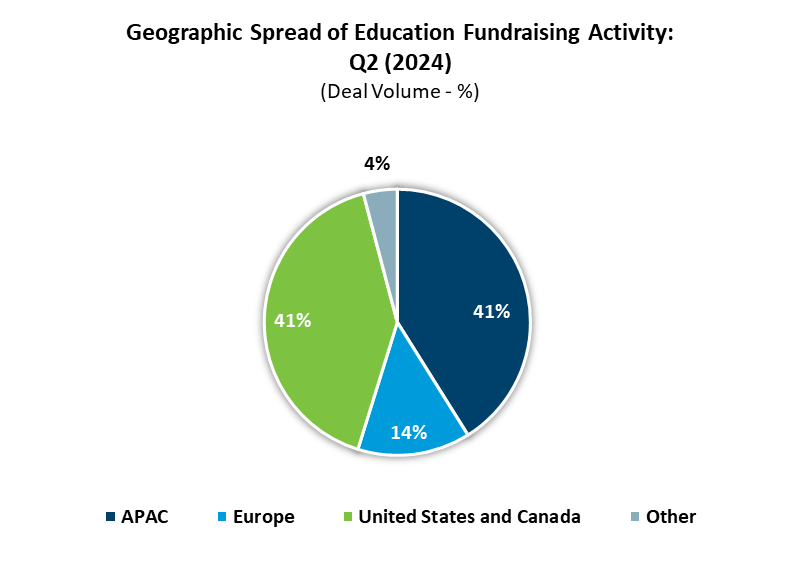

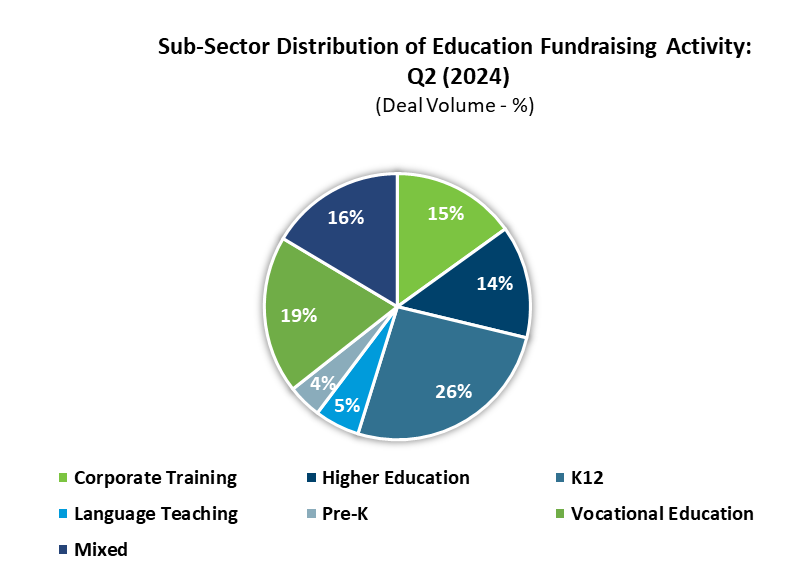

In terms of capital raises, fundraising deal volume decreased by 21% from 92 in Q2 FY23 to 73 in Q2 FY24. Both deal volume and disclosed value in Q2 FY24 was the lowest compared to previous quarters from 2020 onwards. Geographic spread of education fundraising activity was similar to M&A with 41% of deals coming from the US and Canada and 41% coming from APAC. One notable fundraise was Alef Education’s IPO, which raised $515m and was the first IPO of the year in Abu Dhabi. However, Alef Education’s shares dropped on the first day of trading, which perhaps indicates an uncertain sentiment towards the public markets and IPOs.

Notes

1.Source: Capital IQ

2.Includes deals announced but not yet closed

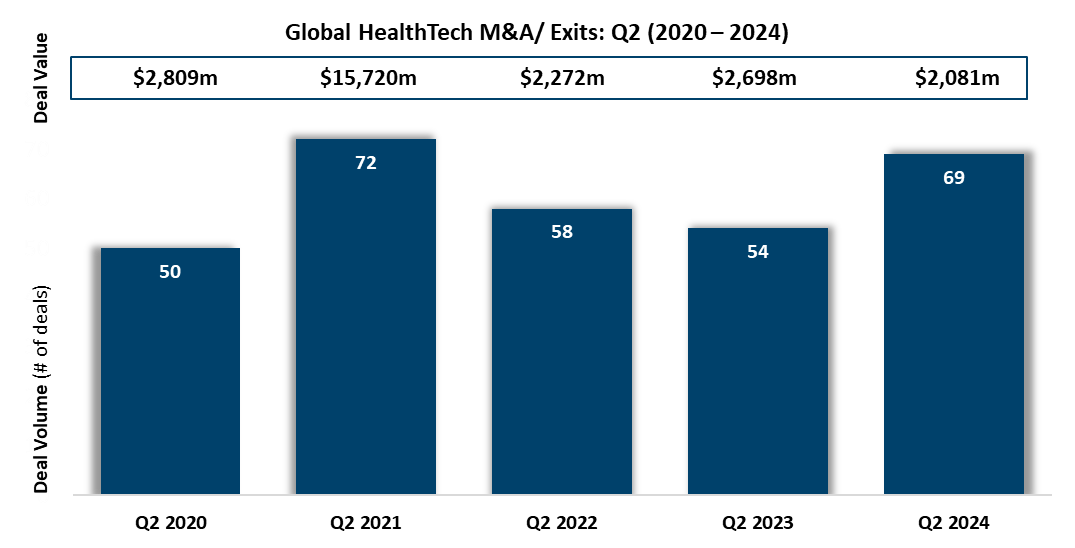

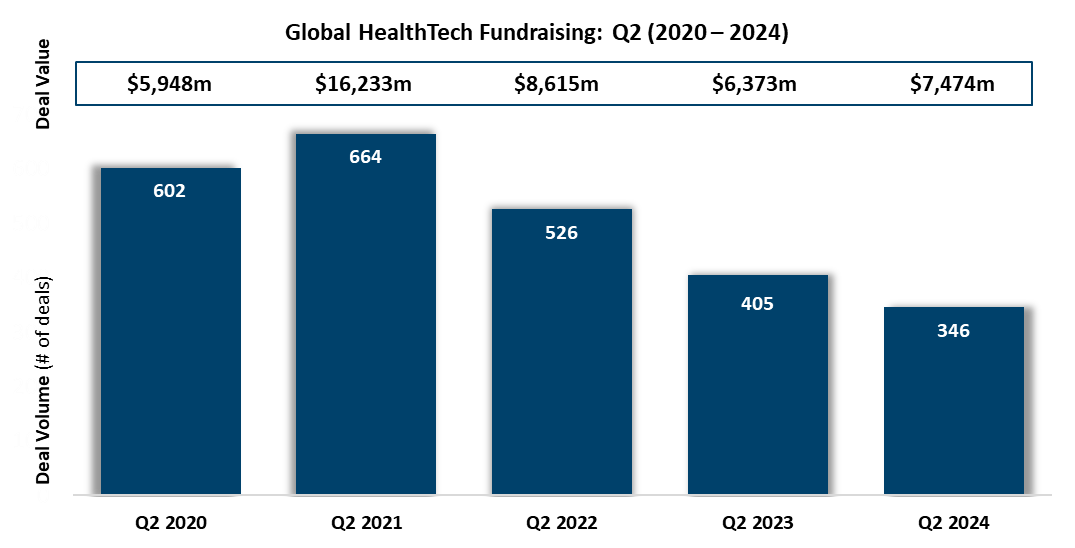

With increases in M&A deal volume and fundraising disclosed deal value, global HealthTech activity appears to be more positive across Q2 2024. Global HealthTech M&A deal volume increased from 54 in Q2 2023 to 69 in Q2 2024, representing a 28% increase. Although M&A deal volumes increased, disclosed deal values decreased by $617m, representing a 23% decline. On the other hand, Global HealthTech fundraising deal volume decreased from 405 in Q2 2023 to 346 in Q2 2024, representing a 15% decrease. This shows an improvement with the year-on-year declines in fundraising deal volumes declining at a slower rate. Despite the decrease in deal volume, HealthTech fundraising disclosed deal values increased by $1,101m, representing a 17% increase. This signifies an increase in the round sizes and quantum that Global HealthTech companies are raising.

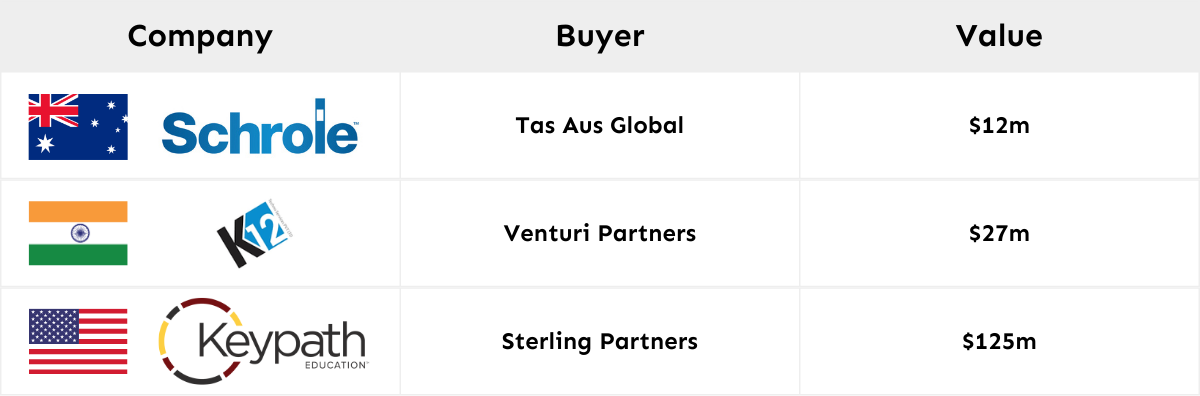

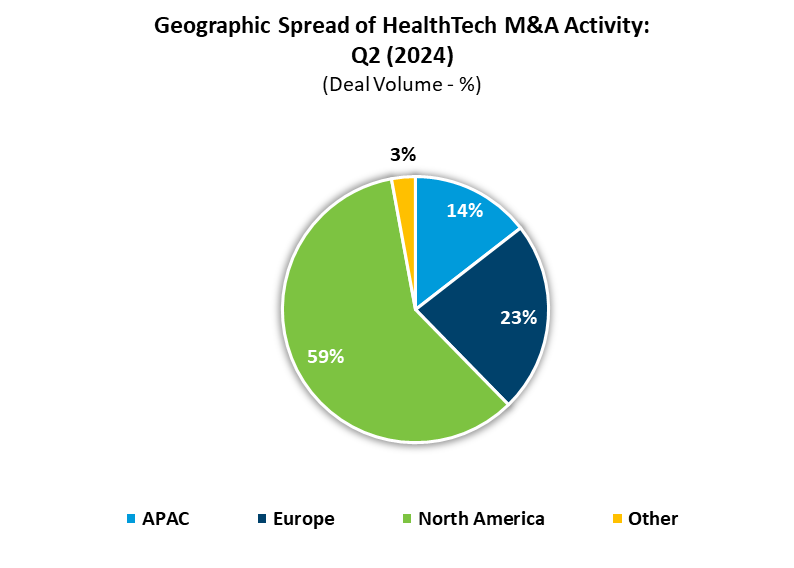

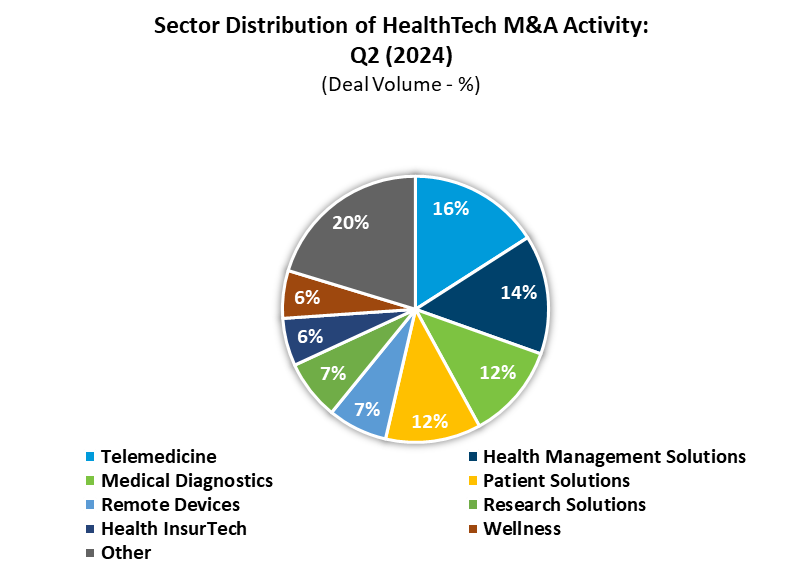

Nearly 60% of all M&A transactions in Q2 2024 came from North America, followed by Europe and APAC, which represented 23% and 14% of transactions, respectively. In terms of sector distribution of M&A activity, 16% of deals were within Telemedicine, followed by 14% from Health Management Solutions. A notable HealthTech deal within the population health management sub-sector was Altaris’ $518m acquisition of NASDAQ-listed Sharecare, a digital health company that helps people manage all their health in one place. The acquisition will lead to the de-listing of the company from the NASDAQ. Another significant private deal is the $34m acquisition of Akili by Virtual Therapeutics, which follows the announcement of a restructuring of the company and a reduction in the workforce. The digital therapeutics sub-sector continues to have difficulties as companies work to find a sustainable path to market.

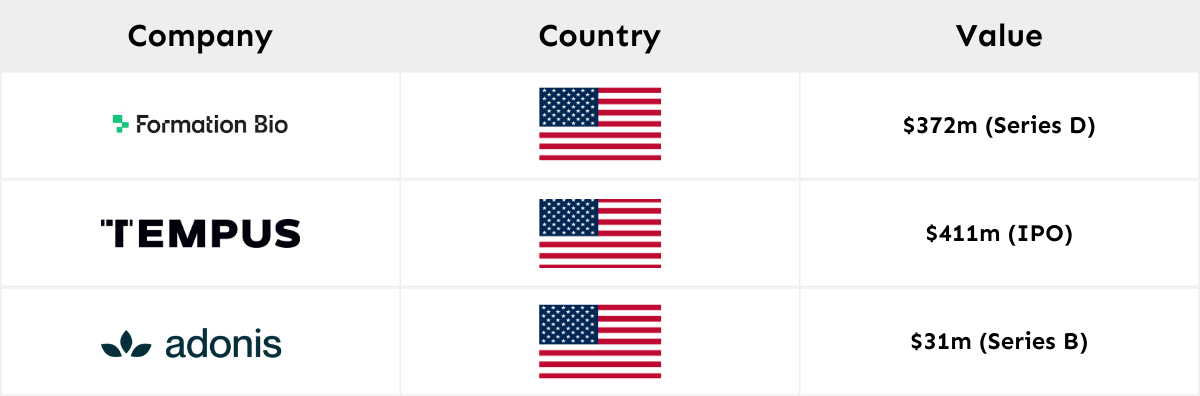

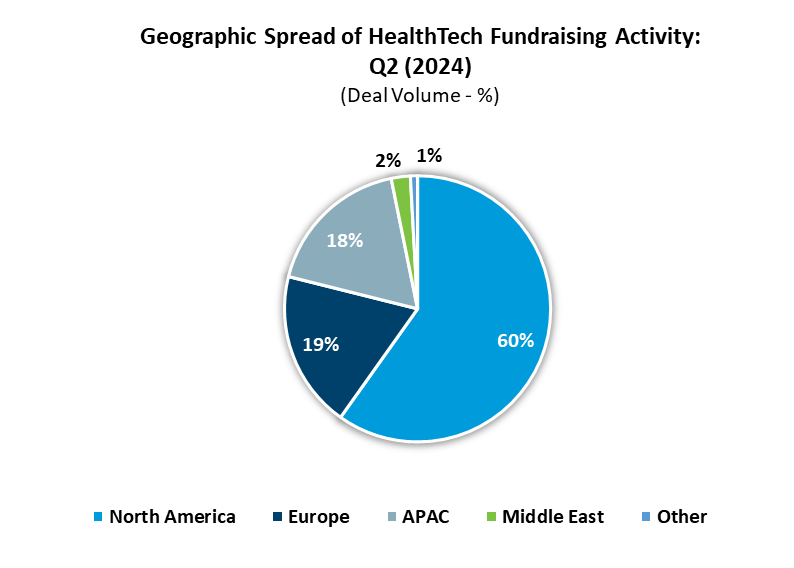

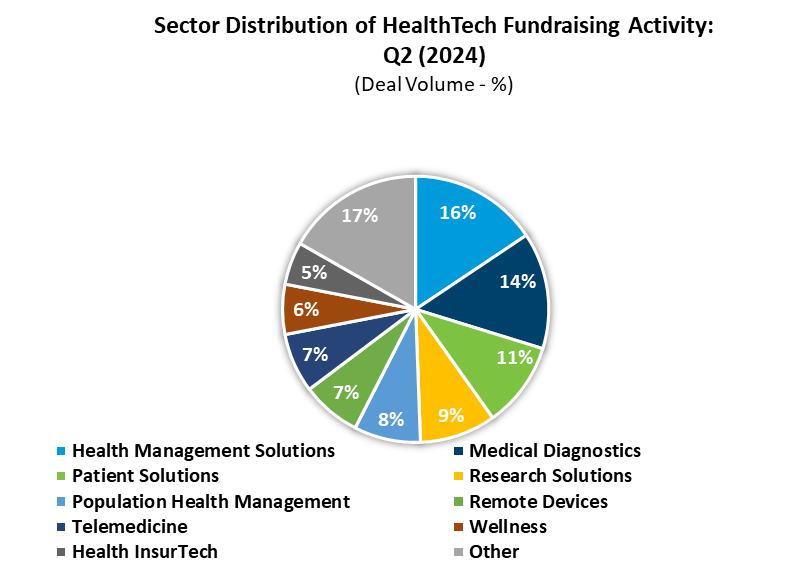

The increase in disclosed deal values within global HealthTech fundraising shows positive signs moving forward for the sector. Unsurprisingly 60% of deals took place in North America, followed by Europe and APAC, with 19% and 18%, respectively. The largest sector that activity came from was Health Management Solutions with 16% of deal activity, followed by 14% from Medical Diagnostics and 11% coming from Remote Devices. Reported deal value across Q2 2024 was supported by multiple $100m+ deals from North America. A significant deal to note was Formation Bio’s $372m series D funding round led by Andreessen Horowitz. Another significant transaction from the US was Tempus’ IPO, in which it raised $411m. Tempus sells genomics diagnostics tests across oncology, neuropsychiatry, radiology and cardiology to clinicians and hospital systems. The increase in global HealthTech deal volume and disclosed deal values across M&A and fundraising shows promising signs for the second half of 2024.

Notes

1. HealthTech Alpha

2. Includes deals announced but not yet closed