OCTOBER 2024

The Future of Skills: The UK’s Productivity Puzzle in the AI Era - As artificial intelligence reshapes industries at breakneck speed, the United Kingdom finds itself at critical juncture in workforce development.

A global snapshot of the EdTech, HealthTech & Impact Investing markets.

Notable M&A & Fundraising activities across EdTech & HealthTech industries

Global trends across the tech-led impact ecosystem. In this issue:

Education Industry Analysis – Q3 2024

Healthcare Industry Analysis - Q3 2024

The Future of Skills: The UK’s Productivity Puzzle in the AI Era

By Charles McIntyre, CEO at IBIS Capital

As artificial intelligence reshapes industries at breakneck speed, the United Kingdom finds itself at critical juncture in workforce development.

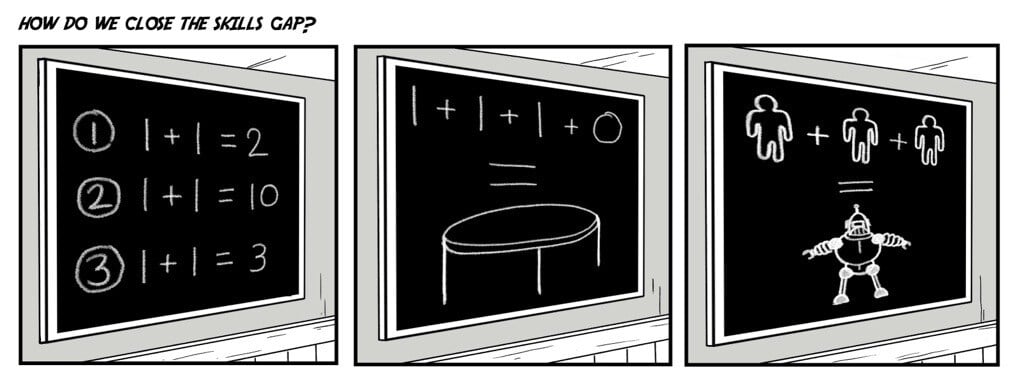

The UK's notorious "productivity puzzle" persists, with output per hour stagnating since the 2008 financial crisis. Between 1997 and 2007, UK labour productivity grew by an average of 2.3% per year. However, since the financial crisis this growth rate plummeted to just 0.4% annually. At the heart of these issues lies a fundamental mismatch between the skills workers possess and those demanded by the market.

We are at an interesting inflexion point, where future skill requirements are going to be radically different from those of today. CBI and McKinsey highlighted several years ago that 90% of the UK workforce would need to be re-skilled by 2030. Addressing the productivity problem, is not just solving today’s problems but also anticipating tomorrow’s.

The challenge is that adopting artificial intelligence in the workplace in itself will not solve the productivity problem. To illustrate the point, in an Accenture survey of 1,200 CEOs and other top executives, 74 percent said that they plan to use artificial intelligence to automate tasks in their workplace over the next few years. Yet only 3 percent reported planning to significantly increase investments in training over the same period. Without a symbiotic approach to investment in training and AI, we will fail to deliver on the potential productivity gains.

A surprising twist, is that the very technology causing disruption may hold the key to solving the skills crisis. AI-powered tools are emerging as game-changers in identifying and developing crucial workforce competencies. These systems can provide real-time, personalised skill evaluations and learning recommendations at a scale previously unimaginable.

The UK government recently release its Skills England Report which amongst other things argued that AI will be a key component to addressing the UK’s productivity challenge, particularly as more than 75% of all jobs globally will demand some digital competency by 2030. The challenge is how to turn sentiment into real action.

In July this year, the AI Opportunities Action Plan was launched under the leadership of Matt Clifford reporting into the UK’s Secretary of State for Science, Innovation and Technology. Now we have to wait and see whether there is an opportunity to accelerate the UK into the 21st Century or just enjoy the warm glow of government rhetoric without the initiative for action.

🌳 Demand Growth for Green Skills More than Doubling Supply: LinkedIn Study

Current trends indicate that there will be more than twice as many jobs requiring green skills as there will be qualified workers available to fill those roles. (ESG Today)

👩🏽🎓 The view from here: How the “Big Four” study destinations are adapting in a year of change

With government policy interventions in major study destinations, changing student preferences, evolving technologies, and heightened competition for talented students, new strategies and approaches around student recruitment are emerging. (ICEF Monitor)

🤖 OPINION: Schools need more ways of knowing if AI and EdTech tools are working

More guidance is needed to keep potentially harmful, untested technologies out of classrooms. (The Hechinger Report)

🙅🏽♀️ Women’s HealthTech ‘less likely’ to get funding if woman is on founding team

Research also shows pitches from female founders less likely to succeed if using phrases such as ‘women’s rights’. (The Guardian)

🌐 Why HealthTech innovators must pay attention to climate and COP 29 conversations

In the pursuit of sustaining and saving lives, the health tech sector has made remarkable strides in addressing disease, enhancing diagnostics, and improving patient care. Yet, there is an undeniable gap between the future of human health and the health of our planet. (Health Tech World)

🤖 From Crawling to Caring: The Evolution of Clinical Practice with AI and Its Transformative Impact on Healthcare

As clinicians begin to rely more on AI, they will also need to cultivate new skills, particularly around critical interpretation of AI-generated insights, to fully leverage its potential in patient care. (MedCity News)

📊 McKinsey Technology Trends Outlook 2024

Which technology trends matter most for companies in 2024? New analysis by the McKinsey Technology Council highlights the adoption, development, and industry effects of advanced technologies. (McKinsey Digital)

🤖Can investing in AI ever be sustainable?

The year 2020 will forever be remembered by investors for the rapid growth in provider and client interest in sustainable investment strategies, however more recently investor angst about the performance of some sustainable investment funds has resulted in outflows and scepticism from clients. (FT Adviser)

📈 Rewiring technology for sustainable growth

The rate, scale and breadth of technological advancement is the most extensive it has ever been. While this brings wide-ranging opportunities, technology faces its own sustainability challenges. How does the sector balance rising demand and rapid evolution with an improved sustainability footprint? (Allianz Global Investors)

Education

Source: Capital IQ

Health

Source: Traxcn

2Up to $520m

Education

Source: Capital IQ

Health

Source: Traxcn

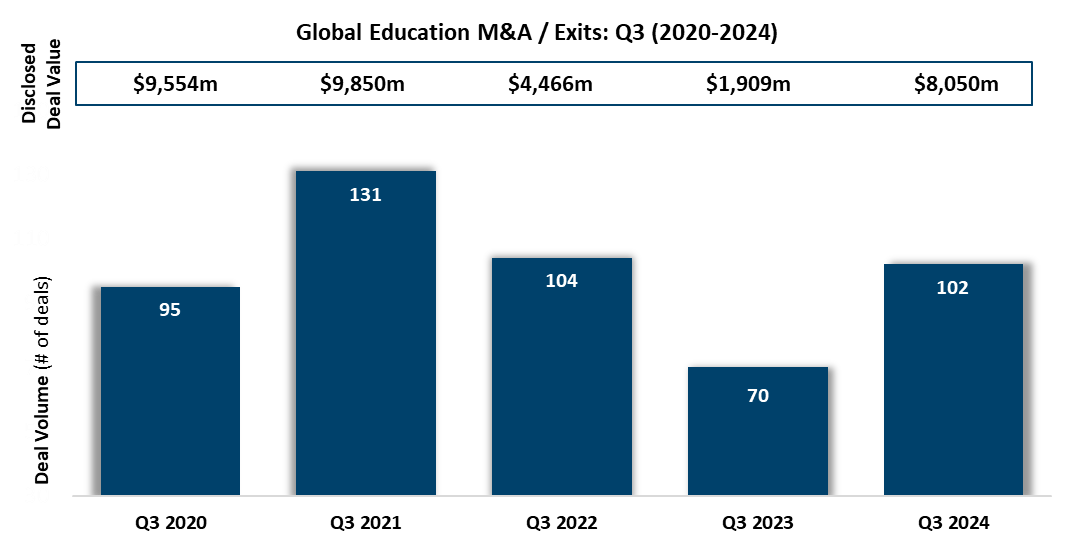

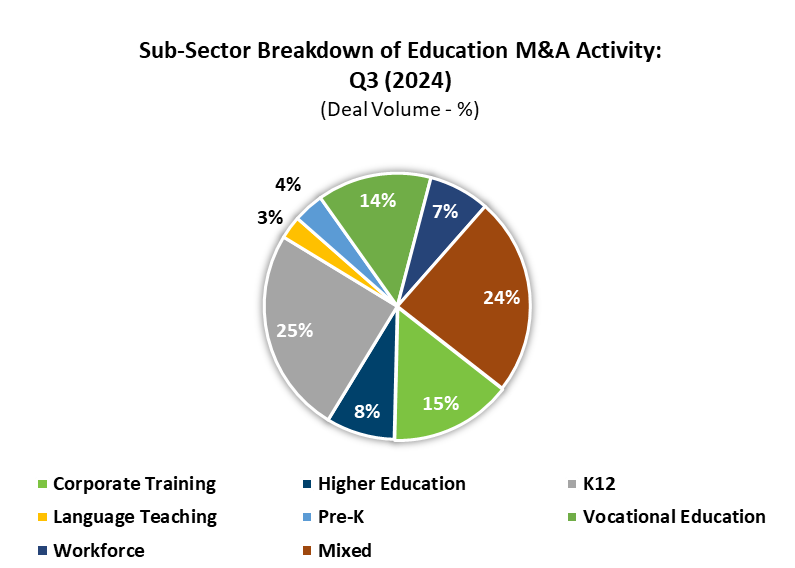

Global education M&A activity across Q3 2024 saw an increase in both deal volume and disclosed deal values. M&A deal volume increased by 46% from 70 in Q3 2023 to 102 in Q3 2024. In a similar manner, deal values increased by 322% from $1,909m in Q3 2023 to $8,050m in Q3 2024. The largest proportion of deals relate to the K12 subsector accounting for 25% of the total deal volume. Notable deals in the sector include;

- $1.6bn acquisition of US-based platform provider of billing and payments services for students, Transact Campus, Inc, by US-based software solutions provider to the Education and Healthcare industry, CBORD Group.

- $470m acquisition of Australia-based provider talent management software solutions, PageUp People Limited, by private equity firm EQT Partners

- $670m acquisition of one of the world’s leading K12 education groups, Globeducate by Wendel, a French investment company

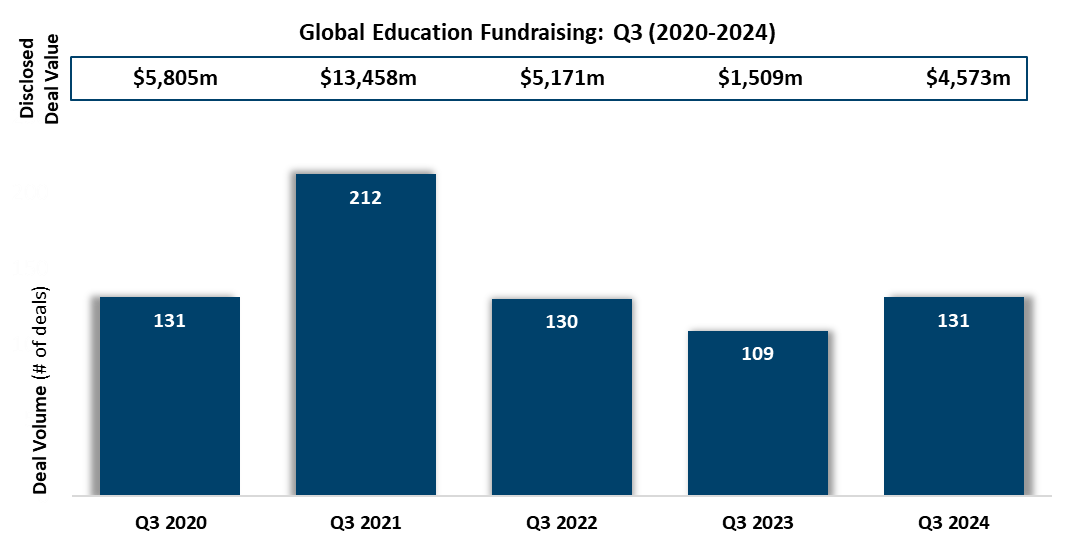

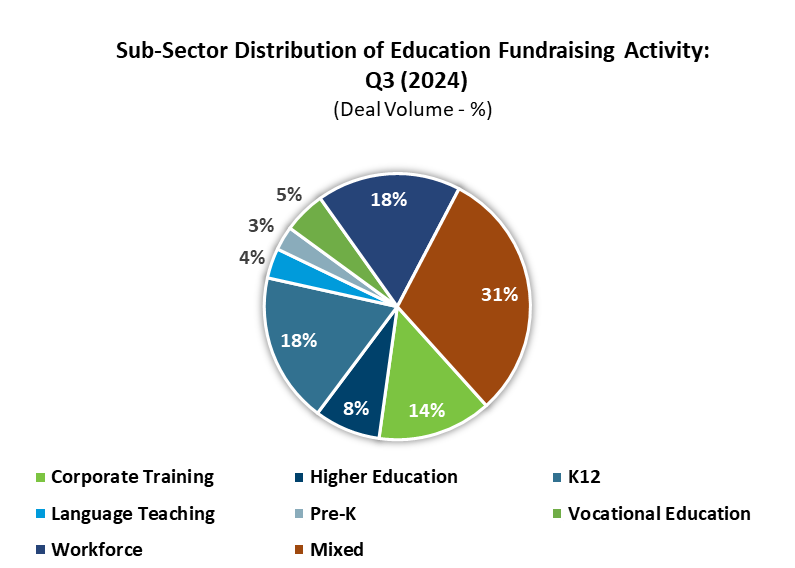

Fundraising activity saw its first Q3 positive outturn since 2021. Q3 2024 deal volumes increased to 131 from 109 in Q3 2023. Notably 31% of fundraising activities incorporated companies operating across mixed sub-sectors, with 18% focused on K12 and 18% on Workforce. Significant fundraising activities included the $210m raise by India-based education startup Physics Wallah, which achieved a valuation of $2,800m. Fundraising activity saw a major increase in disclosed deal values, increasing to $4,573m in Q3 2024 from $1,509m in Q3 2023, representing a 203% increase. Evidently, there has been increased activity across the Testing, Inspection, and Certification (TIC) sector, evident by the recent IPOs. These include the $980m Secondary Public Offering of US-based TIC services provider, UL Solutions.

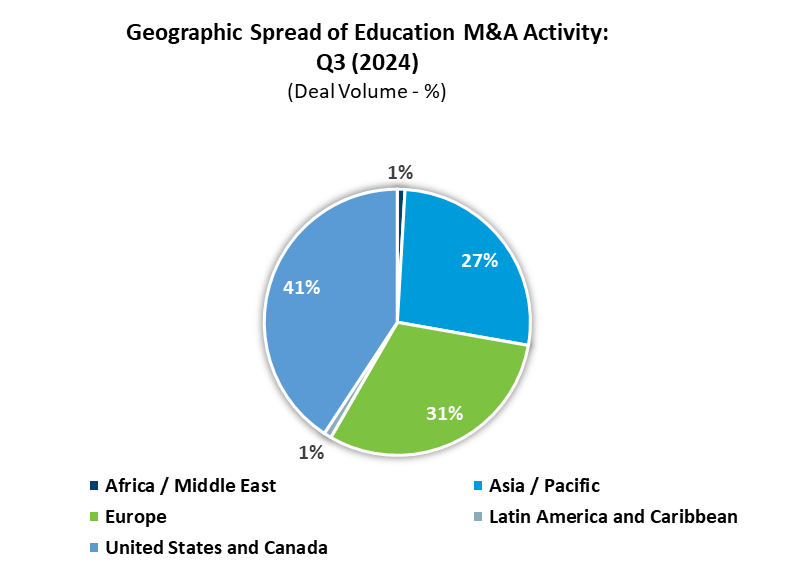

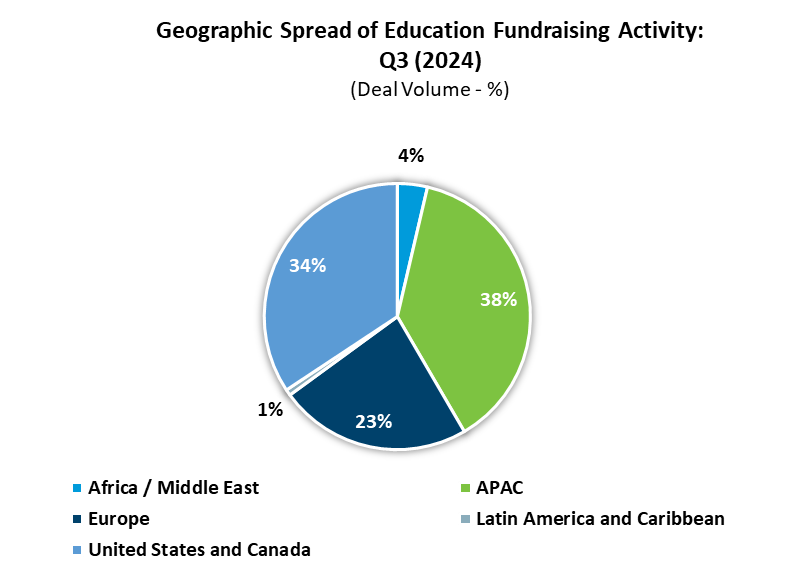

Geographically, APAC takes the lead in fundraising activities, accounting for 38% of deal volumes, followed by a strong presence in the United States and Canada, which represents 34% of all deals. The geographical breakdown across the M&A education landscape shows a relatively equal distribution across three geographical areas. The United States and Canada represents 41% of total deals, followed by Europe and the APAC region, representing 31% and 27%, respectively.

Notes

1.Source: Capital IQ

2.Includes deals announced but not yet closed

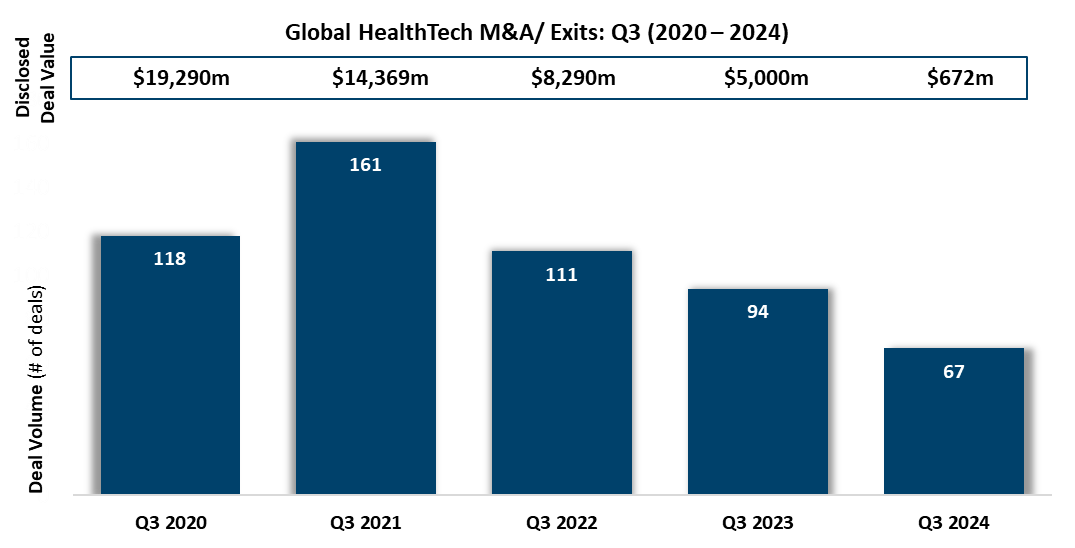

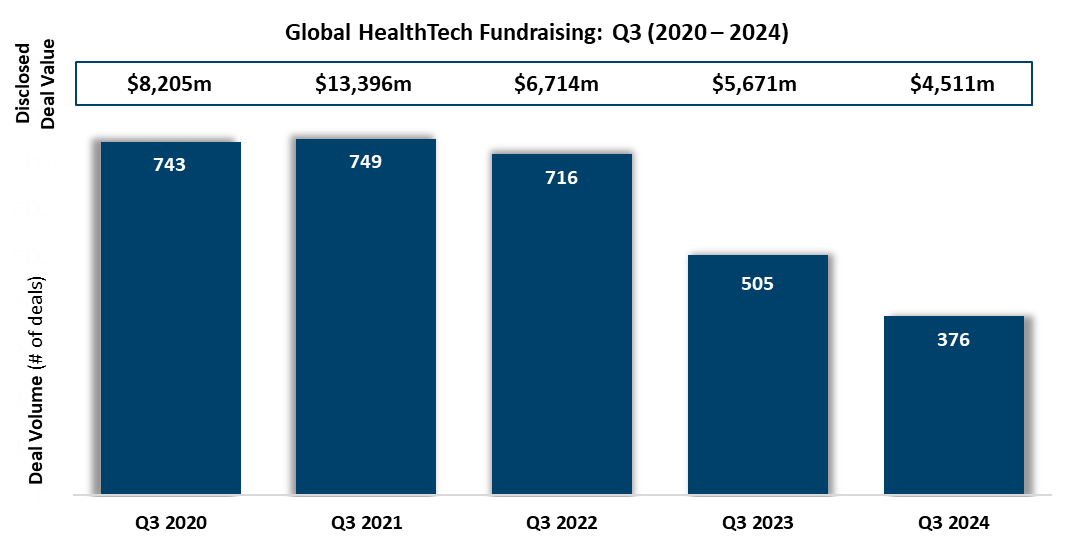

Q3 2024 Global HealthTech activity across the M&A and Fundraising space has shown a decrease in volumes and disclosed values compared to Q3 periods in prior years, though this appears to be more prominent across M&A. Despite varying results, notable transactions in the quarter highlight the strong interest amongst investors and strategic acquirers to continue investing into the sector, albeit at lower levels.

Global HealthTech M&A deal volumes decreased by 29%, from 94 in Q3 2023 to 67 in Q3 2024. In the same breadth, fundraising activity realised a decline in volumes by 26%, falling to 376 completions in Q3 2024, compared to 505 in Q3 2023. However, year-on-year Q3 fundraising deal volume performance between 2022-2024 shows the fall in fundraising volumes is occurring at a slower rate, similar to what was seen in Q2 2024.

Disclosed M&A deal values across the global HealthTech space fell by 87%, reducing to $672m in Q3 2024 from $5,000m in Q3 2023. While this may not stem from market concerns, the lack of disclosure could indicate potential stagnation from an investment perspective, potentially affecting future M&A activity. In a similar turn, global HealthTech fundraising deal values decreased from $5,671m in Q3 2023 to $4,511 in Q3 2024, representing a 20% decrease.

Recurring trends across the M&A and fundraising market remain, such as the enthusiasm pertaining to Generative AI and its ability to enhance clinical care and operational performance, the role of data aggregation and analytics and the expanding Femtech market. Recent transactions related to these areas include:

- Sale of UK-based provider of care pathway management solutions, Lumeon, to US-based provider of data and technology solutions, Health Catalyst. The acquisition will help support Health Catalyst AI capabilities, helping to improve clinical operations and enhancing care conditions.

- Sale of US-based healthcare workforce management solutions provider, Qgenda, to US-based conglomerate, Hearst Corporation. The acquisition will help Qgenda innovate their product suite and enhance its workforce management solution with the support of Heart’s infrastructure.

- Flo, the UK-based AI mobile femtech application successfully raised $200m in a series c, making it the first digital consumer women’s health app to reach unicorn status1 .

- Huma, the UK-based healthcare AI company successfully raised $80m in a series D round as it launches its Huma Cloud Platform to support companies across the therapeutics and disease management space through the use of Generative AI2.

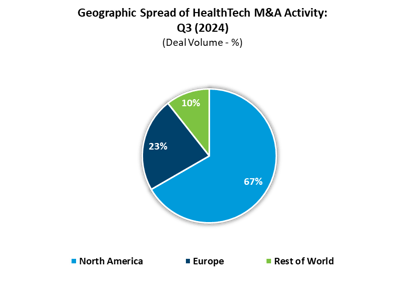

Though we noted a significant decrease in disclosed deal values across the M&A market, North America remains the most active region, accounting for 67% of transactions. Despite Q3 2024 portraying a fall in Global HealthTech M&A activity, it is evident that investors and strategic acquirers remain active in the market and are willing to invest in opportunities that provide significant upside.

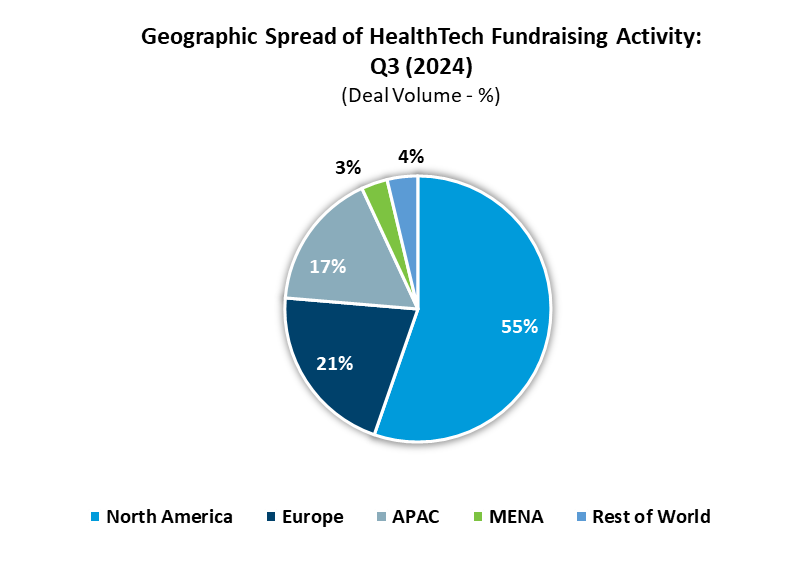

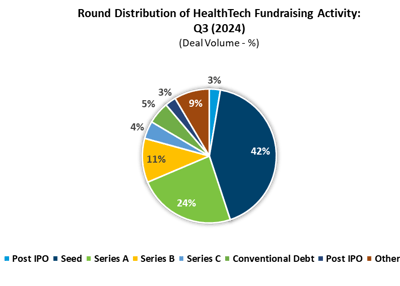

In terms of fundraising activity, North America continues to lead, contributing to 55% of total activity. However, significant fundraising efforts have been noted in the Asia-Pacific region, accounting for 17%, and in Europe, comprising of 21% of fundraising activity. A detailed analysis of fundraising by stage reveals a strong presence of early-stage investments, particularly in the Seed and Series A categories, which together represent 42% and 24% of global fundraising activity.

Sources

(1) Digital Health, 2024.

(2) Huma, 2024.