October 2025

Extraordinary claims in digital health require extraordinary evidence - High standards are the key to durable value. If you can prove your product works in the toughest conditions, you will outlast the hype cycles. Evidence is your moat. Because without it, extraordinary claims are just noise.

A global snapshot of the EdTech, HealthTech & Impact Investing markets.

Notable M&A & Fundraising activities across EdTech & HealthTech industries

Global trends across the tech-led impact ecosystem. In this issue:

Education Industry Analysis – Q3 2025

Healthcare Industry Analysis - Q3 2025

Extraordinary claims in digital health require extraordinary evidence

By Paul Wicks, Independent Consultant at Wicks Digital Health

Digital health is full of bold proclamations: AI that makes doctors into “superhumans”. An app that replaces physiotherapy. A headset that treats major depressive disorder with low power electrical impulses. These are not just incremental features, they have the potential to be paradigm-shifting claims but as Carl Sagan taught us, paradigm shifts demand evidence that is equally extraordinary. I believe that because for the past 20+ years I’ve been helping digital health companies generate, structure, and communicate the kind of evidence that convinces skeptical clinicians, regulators, payers, and pharma to give new technologies a chance to flourish.

The broader sector learned about evidence the hard way. During the ZIRP era and the COVID telehealth boom, dozens of companies made huge promises without the data to back them. A wave of “Uber-for-doctors” clones raised quick money, bought ads, and declared victory. But when cheap capital dried up, the first to fall were those without robust clinical evidence or real-world outcomes. Slick marketing couldn’t save them when regulators, payers, and patients asked: does this actually work? An exciting vision will get you a first meeting, but by the time the PhD’s are getting pulled in for their opinions they’re inevitably going to say “Show us the evidence” and they won’t settle for a preprint or a predatory journal.

The survivors share a common trait: evidence. Take Big Health, whose digital therapeutics for insomnia and anxiety have published 18 randomised controlled trials in leading journals. They’ve shown long-term benefit without drugs, a huge achievement. And yet even with gold-standard evidence, reimbursement isn’t automatic. Health systems still wrestle with how to pay for software-based care, which shows just how high the bar really is.

Or look at Sword Health, which started in the crowded digital MSK market. While many rivals vanished, Sword doubled down on clinical trials, real-world outcomes, and economic data to prove they could reduce surgeries and opioid use. They didn’t just survive the bubble — they grew into one of the most valuable health-tech companies in Europe, and the first ever Portuguese health unicorn.

Then there’s Click Therapeutics, which has made pharma partnerships its cornerstone. Pharma does not play around with unverified claims; regulatory-grade evidence is the entry ticket. Click’s FDA clearance for CT-132, a prescription digital therapeutic for migraine, came off the back of multiple RCTs and direct engagement with regulators. Their strategy is simple: align with the evidentiary standards of drug development, not the looser rules of consumer tech.

Contrast that with the fallen. Symptom checkers claiming 97% accuracy on opaque pilot studies conducted in-house. Mental health apps that trumpeted therapy-level results without peer-reviewed trials. Wearables that promised life-saving insights but published little beyond glossy PDFs. They were darlings of the pandemic telehealth boom, but when capital became scarce, evidence-light businesses were the first to be cut loose.

The lesson is clear: in digital health, extraordinary claims require extraordinary evidence. Not just a white paper. Not a pilot. Not a curated dataset that works in your lab but fails in the wild. We’re talking prospective, pre-registered, adequately powered, multi-site studies; transparency about algorithms and biases; independent replication; long-term safety data; and clear economic endpoints. Without this, products won’t scale, regulators won’t approve, and payers won’t reimburse.

This is not about slowing innovation. High standards are the key to durable value. If you can prove your product works in the toughest conditions, you will outlast the hype cycles. Evidence is your moat. Because without it, extraordinary claims are just noise.

If you want to see who’s doing it right (and just maybe who isn’t) join us at HealthTechX on 5 November, where the real debates about evidence, adoption, and survival in digital health will take centre stage.

📊 Q3 2025 Education Trends: AI, Immersive Tech & Skills Learning

Education trends continue to focus on AI-powered personalization and automation, immersive and hybrid technologies, and evolving learning models including microlearning and skills-based education. (Harmelin Media)

🤖 The agentic organization: Contours of the next paradigm for the AI era

Companies are moving toward a new paradigm of humans working together with virtual and physical AI agents to create value. We share lessons from early adopters—and what you can do next. (McKinsey & Company)

.💻 AI Boom Drives Surge in Demand for Tech Skills in 2025

The online learning platform Udemy has seen a fivefold increase in AI-related enrollments this year, but some experts warn against falling for hype that frames AI as a quick fix for issues in education and the workforce. (Government Technology)

🏥 Health tech leaders react to plans for new NHS online hospital in England

Prime Minister Keir Starmer made a significant announcement last week with plans to launch an ‘online hospital’ by 2027. (Health Tech World)

🌟 NICE accelerates access to innovation across the NHS

The National Institute for Health and Care Excellence has announced a major expansion of its HealthTech evaluation programme, placing medical devices, diagnostics and digital tools on equal footing with medicines in the NHS approval process. (National Health Executive)

📈 2025 M&A trends in the healthcare industry

The healthcare sector continues to attract robust activity in the mergers and acquisitions (M&A) space, showing remarkable resilience even amidst economic and regulatory uncertainty. (RSM)

📈 European Digital Health Bucks The Trend

The European Digital Health landscape is undergoing a significant transformation, evolving beyond the initial hype to a phase where tangible results and proven impact dictate investment.

(Galen Growth)

.💰 Driven by AI, edtech funding rebounds with 5X surge in H1 2025

Funding activity surged more than fivefold year-on-year, with capital largely flowing into companies focused on study-abroad services, workforce skilling platforms and startups leveraging artificial intelligence (AI). (The Economic Times) I

💰 Q3 Venture Funding Jumps 38% As More Massive Rounds Go To AI Giants And Exits Gain Steam

Global venture funding gained significantly in Q3 2025, closing up 38% year over year, Crunchbase data shows, as massive funding deals, particularly for giants in the AI sector, continued to lead.

(Crunchbase News)

Education

Source: Capital IQ / Tracxn

Health

.png)

Source: Capital IQ / Tracxn

Education

Source: Capital IQ / Tracxn

Health

Source: Capital IQ / Tracxn

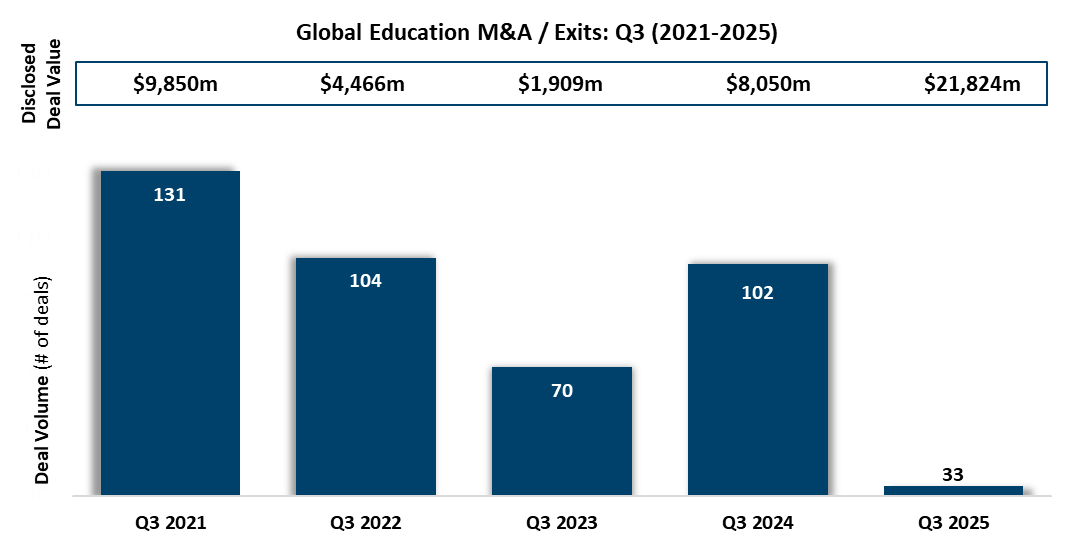

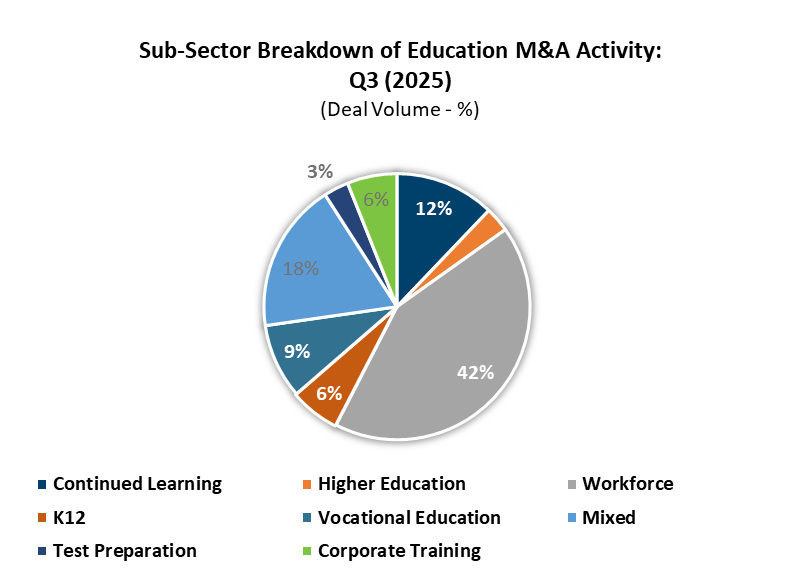

Global M&A activity across the education sector in Q3 2025 was characterised by a continued divergence between deal volume and aggregate transaction value. While deal count declined sharply year-on-year, overall disclosed value surged to record highs, underlining investor and strategic focus on scale acquisitions in workforce and enterprise learning solutions. M&A activity in the quarter saw a 68% decrease in deal count, with 33 transactions recorded, while aggregate disclosed deal value surged by 171% to $22 billion, up from $8 billion in Q3 2024.

Despite the sharp fall in the number of transactions, the value surge was largely driven by a small cluster of high-value strategic deals, particularly within the workforce enablement and enterprise technology verticals. Examples include:

- Workday, the US based enterprise HR & finance platform, acquired Sweden based AI native knowledge management platform Sana Labs and US based Paradox. The primary focus for these acquisitions was to enhance Workday’s artificial intelligence and agentic capabilities through the automation of tasks and user experience.

- Dayforce, the US based human capital management platform, was acquired by a consortium including Abu Dhabi Investment Authority and Thoma Bravo, underscoring the ongoing private equity interest in large-scale workforce SaaS assets.

- TechnoPro, the Japan based staffing and services provider, was acquired by Blackstone, where the strategic rationale was to extend its exposure to engineering and professional staffing services across Asia.

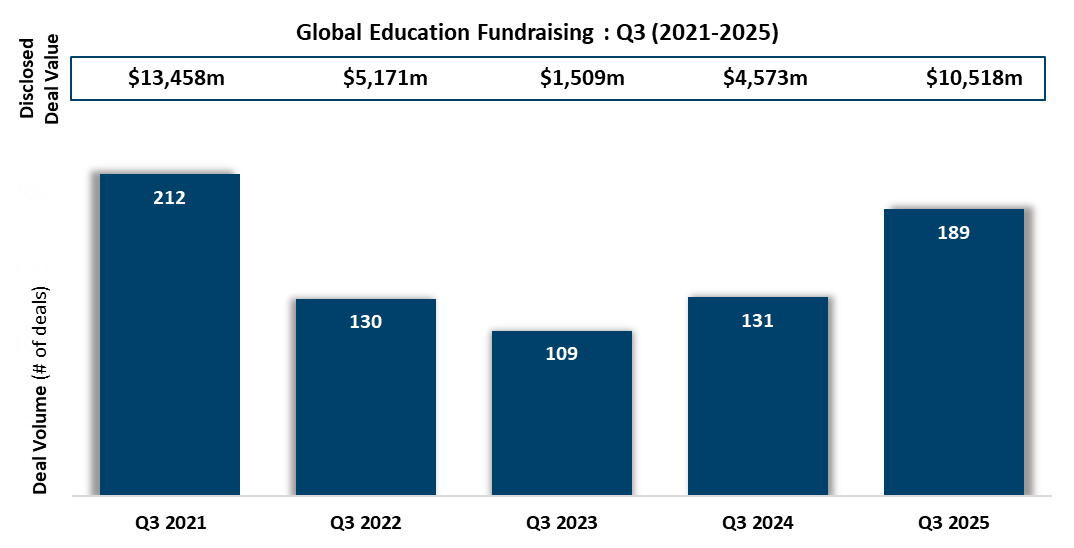

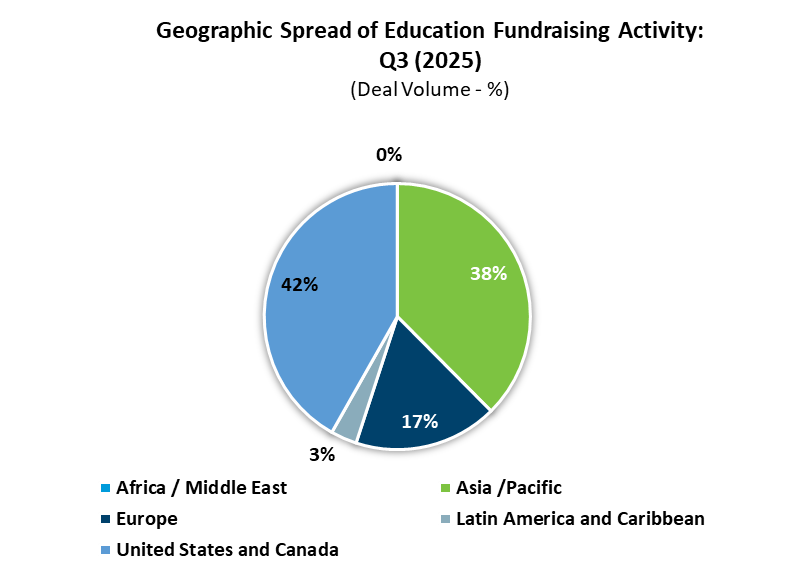

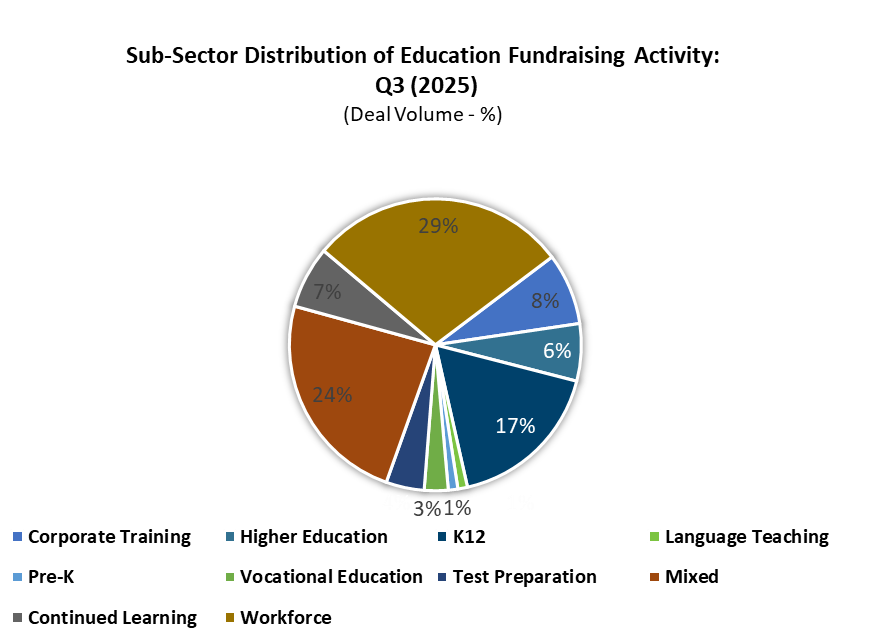

Fundraising across the education and workforce sectors maintained robust momentum in Q3 2025, with both deal volume and aggregate value rising sharply year-on-year. Deal volume reached 189 transactions, while disclosed value climbed to $11 billion, reflecting continued investor appetite for AI-powered learning, workforce SaaS, and student financing platforms remained resilient, supported by continued global interest in scalable, tech-enabled human capital solutions. Notable transactions include:

- Lingokids, the Spain based K12 English learning app, secured a $120 million Series D to help support its growth plans to become the ultimate digital destination for kids.

- MyEdspace, a UK based K12 online learning platform, secured a $16 million Series A raise to accelerate the development of its interactive tutoring and adaptive learning tools.

- Edsights, the US based Ai-powered student retention platform, secured a $80 million Series B round led by KMI Management, aimed at expanding its predictive analytics platform for student retention and engagement.

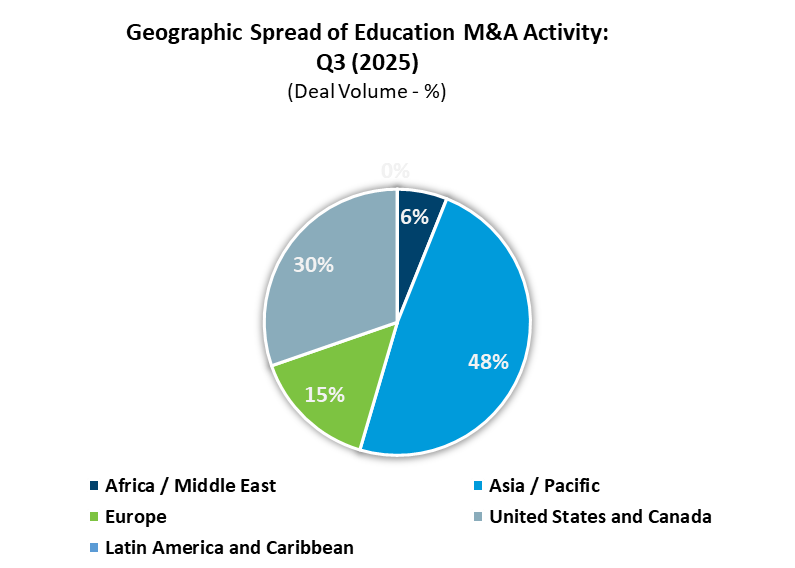

The fundraising landscape in Q3 2025 continued to demonstrate strong depth across all stages, signalling a healthy pipeline for both early- and late-stage education platforms. While North America maintained its dominance in large funding rounds, the Asia Pacific region led in overall deal count and early-stage innovation, underscoring its growing role as a hub for emerging education and workforce technologies. Investor interest remained concentrated in AI-driven learning, student analytics, and HR SaaS solutions, reflecting sustained confidence in scalable, technology-enabled models that enhance learning outcomes and workforce productivity.

The United States and Canada continued to lead global fundraising activity, though Asia Pacific remained a significant growth driver, reflecting sustained investor confidence in India and Southeast Asia. Europe’s share of global fundraising moderated slightly compared to Q2, consistent with a rotation toward later-stage growth rounds in North America and Asia.

Global HealthTech investment in Q3 2025 marked an important inflection point following three consecutive years of contraction in aggregate transaction value. After consistent declines since 2021, total sector deal value rose from $10.9 billion in Q2 2025 to $11.9 billion in Q3 2025, signalling renewed investor confidence and strategic re-engagement across selected high-growth subsectors.

This rebound was largely concentrated in the EMEA region, which added approximately $460 million in additional deal value, offsetting a decline in U.S transaction totals. However, the recovery in value came amid a continued decline in overall deal volumes, with venture capital deal counts falling by roughly one-third in the United States.

Reflecting these mixed dynamics, average VC deal sizes climbed sharply, reaching $15.7 million, the highest level recorded since before 2021. The quarter’s results suggest a consolidation phase, where investor selectivity remains high but valuations for quality assets are stabilizing and, in certain niches, expanding again.

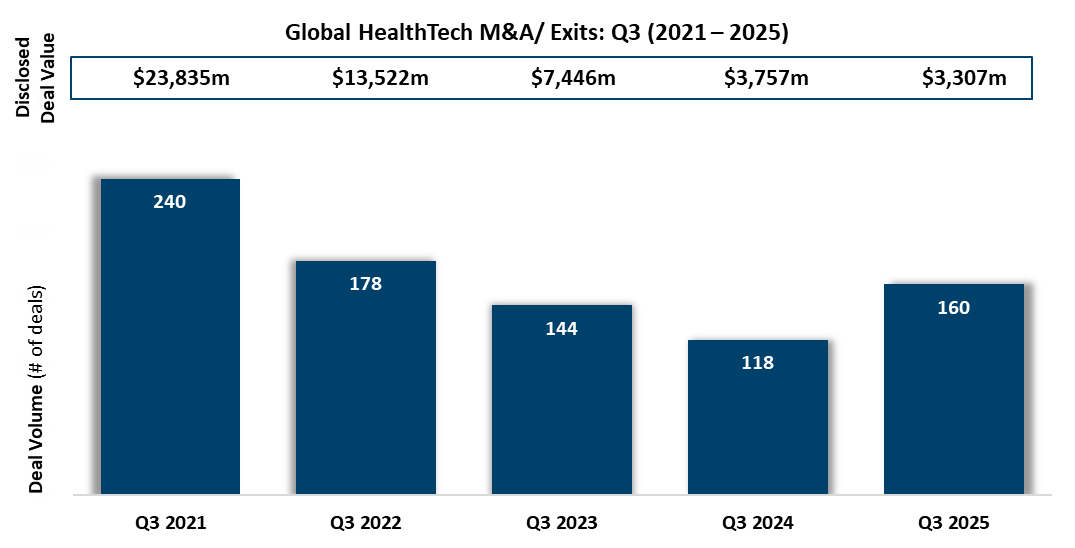

M&A activity in HealthTech during Q3 2025 remained stable in value terms, despite minor year-on-year contraction, reflecting an ongoing shift toward strategic, high-value acquisitions over volume-based dealmaking.

M&A activity in Q3 2025 recorded 160 transactions, representing a 36% increase year-on-year, while aggregate disclosed deal value reached $3.31 billion, reflecting a 12% decline compared to $3.76 billion in Q3 2024. This divergence between rising deal volume and moderating total value suggests a market shift toward smaller, strategically focused acquisitions rather than large-scale consolidations, as investors and corporates continue to prioritize targeted innovation and operational synergies over headline deal size

Key transactions include:

- Waystar, the US based provider of healthcare payments software, acquired Iodine Software, the US based AI clinical intelligence software provider for $1 billion. A landmark transaction intended to accelerate Wayster’s leaderiship in clinical intelligence and revenue optimisation through AI integration. The deal demonstrates the strategic convergence between financial and clinical systems to enhance hospital productivity and patient outcomes.

- Tempus AI, a U.S.-based developer of AI-driven pathology solutions, has acquired Paige, a digital pathology company, for $81 million. The acquisition is expected to significantly accelerate Tempus’ efforts to build the largest AI foundation model in oncology by combining genomic and imaging data at scale.

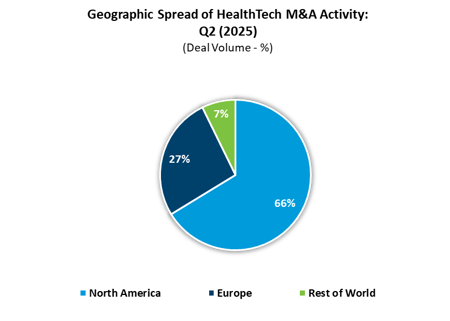

North America continued to dominate global M&A activity by volume and value, driven by large-scale U.S.-based consolidations. Meanwhile, EMEA demonstrated renewed momentum, supported by strategic acquisitions targeting AI-enabled health infrastructure, while APAC and LATAM remained comparatively subdued in activity but continued to attract niche investment in telehealth and diagnostic software.

Global fundraising across HealthTech remained robust in value despite further declines in deal count, illustrating a sustained concentration of capital toward fewer, higher-quality assets.

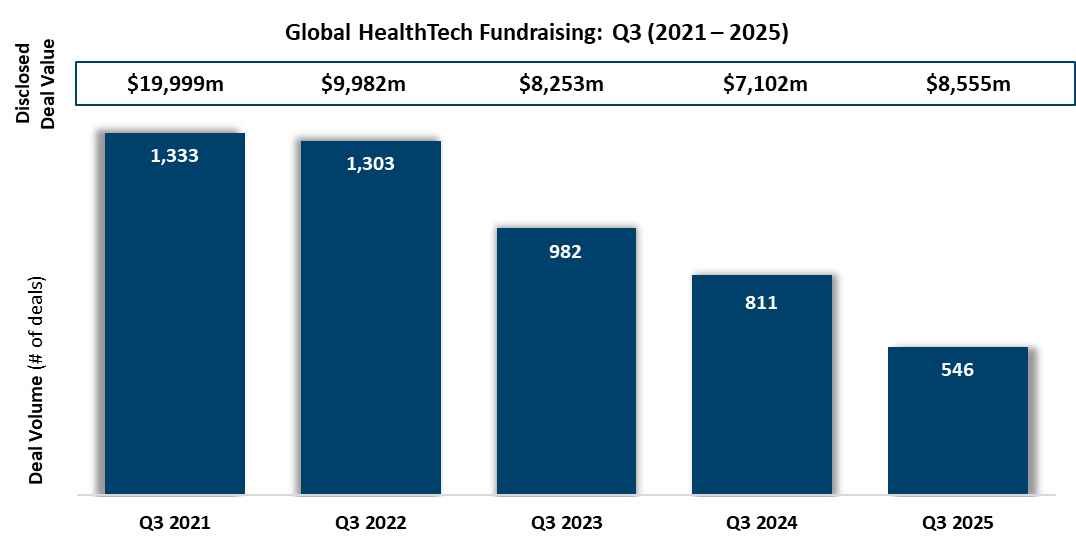

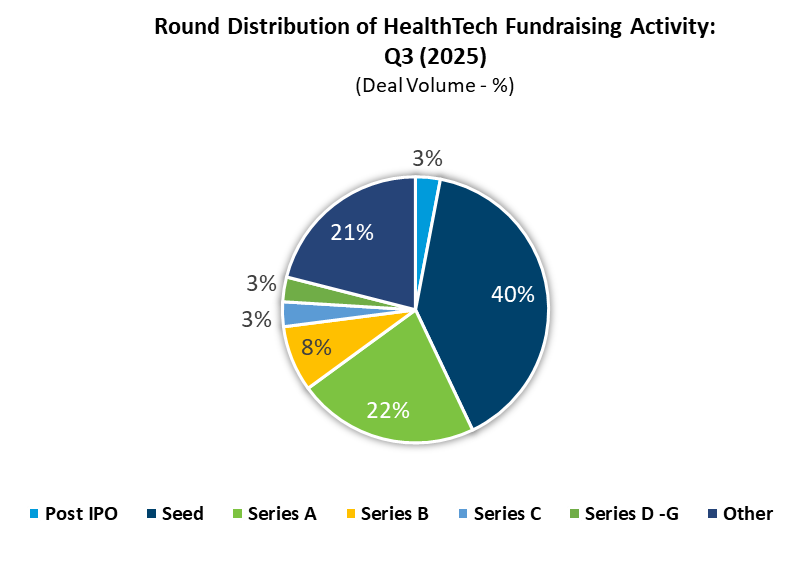

Fundraising activity in Q3 2025 totalled 546 transactions, marking a 33% year-on-year decline from 811 deals in Q3 2024, while aggregate disclosed deal value rose 20% to $8.56 billion, up from $7.10 billion in the same period last year. This contrast between falling deal volumes and rising overall value highlights a continued shift toward larger, later-stage rounds, as investors concentrate capital in proven HealthTech companies with strong commercial traction, differentiated technology, and clear scalability potential.

The decline in transaction count across all regions, paired with rising total value, highlights a “flight to quality” dynamic, with investors prioritizing companies that demonstrate proven commercial traction, differentiated intellectual property, and scalable AI-driven clinical or consumer health applications.

The decline in transaction count across all regions, paired with rising total value, highlights the “flight to quality” dynamic, investors prioritising companies with proven commercial traction, differentiated IP, and scalable AI-driven clinical or consumer health applications. Key Fundraises

- Oura Health (Finland) raised $875 million in a Series E round, valuing the company at [placeholder valuation]. The funding is expected to support Oura’s expansion into preventive health monitoring, personalized wellness analytics, and integration with clinical-grade digital diagnostics.

- Cyted, the UK based diagnostics company, successfully raised $44m in a Series B financing round led by EQT Life Sciences. The raised will help accelerate Cyted’s diagnostics platform into the US.

- Charm, a UK-based AI-driven cancer drug developer, has successfully raised $80 million in a Series B round. The funding will enable the company to advance the development of its best-in-class menin inhibitor for acute myeloid leukaemia (AML), with plans to begin clinical development in 2026.

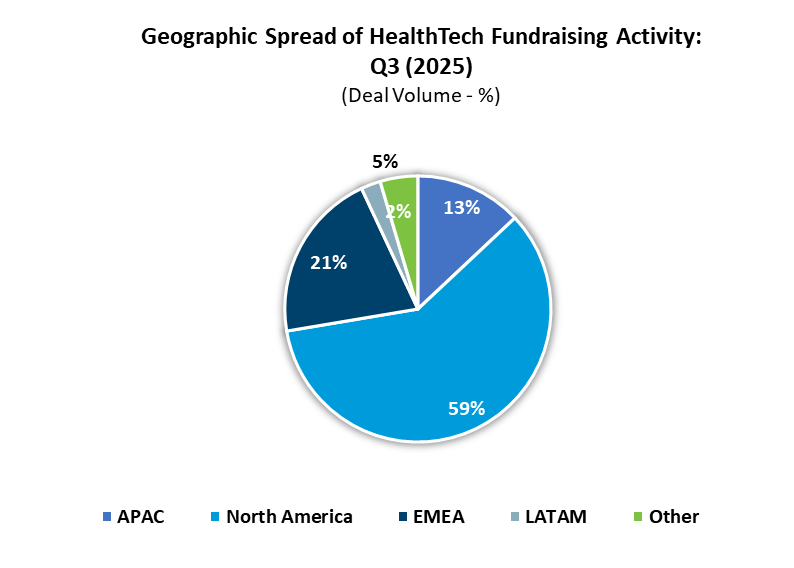

North America retained the majority share of fundraising activity, reflecting strong late-stage rounds in the U.S. and Canada. EMEA sustained its growth trajectory, buoyed by high-profile Series B and C rounds in digital health platforms and AI infrastructure. APAC’s share remained stable, with activity concentrated in Japan, South Korea, and India, while Latin America accounted for a small but emerging segment of early-stage healthtech innovation.

Overall, value growth amid falling deal volumes in Q3 2025 underscores rising investor selectivity, with capital increasingly directed toward established HealthTech platforms demonstrating clear paths to profitability and clinical adoption. Artificial intelligence remains the central driver of both M&A and fundraising activity, underpinning continued advancements in diagnostics, digital pathology, and patient data management.

.png)