JUNE - JULY 2023

- EdTechX Summit 2023 - celebrating a decade of connectivity and insight

- AI in Healthcare - a Venture Capital perspective

- Unveiling the 2023 EdTechX Award Winners

- Gender pain and diagnostics - breaking barriers in women's health

A global snapshot of the EdTech, HealthTech & Impact Investing markets.

Notable M&A & Fundraising activities across EdTech & HealthTech industries

Global trends and innovation across the tech-led impact ecosystem.

In this issue:

Education Industry Analysis – Q2 2023

AI in Healthcare - Q2 2023 Industry Analysis

EdTechX Summit 2023: Exploring the intersection of human development and artificial intelligence

EdTechX was delighted to host our highly anticipated 10th anniversary EdTechX Summit last month on 22nd June. Held at the spectacular Tobacco Dock in the heart of East London’s thriving enterprise zone, this year’s summit celebrated a decade of connectivity and insight, bringing together global visionaries, thought leaders, and game-changers from across the globe for a day of immersive exploration, innovation, meaningful connections and real-world impact.

Under the overarching theme of H-2-AI, the 2023 EdTechX Summit gave special consideration to the intersection of human development and artificial intelligence, exploring the significant shift in the relevance of human skills and learning and its impact on the way we live and work. Through three distinct tracks - Now & Next, Future of Work, and Impact - and through its Innovation Showcase, EdTechX unveiled the latest technological advancements shaping the future of learning, and reassessed the challenges and requisite strategies to navigate a machine-driven world and ensure a positive impact on the future of work, education, and society as a whole.

Keynote Addresses and Inspiring Discussions

The customary insightful keynote delivered by EdTechX founders, Charles McIntyre and Benjamin Vedrenne-Cloquet, opened proceedings with a look back over the last 10 years of both EdTechX and EdTech before looking to the future and ‘The Next Disruption’. Other luminaries from the fields of education, training, technology, and investment then took to the stage to share their knowledge, experience, and pioneering ideas through a series of captivating keynote addresses and inspiring discussions. From the transformative power of AI in driving change in learning to the battle for Gen Z talent; from the controversy on ChatGPT to the dynamic new world of work; from the classroom of 2030 to the significance of impact investing, and much in between — the day's agenda was a captivating display of insightful and thought-provoking addresses, delivered by a diverse range of over 100 esteemed experts and visionaries. From renowned industry leaders and global corporations to influential figures from prestigious universities and research institutions as well as prominent investors shaping the future of impact investing, the lineup showcased a breadth of aspirational perspectives and experiences, closing with an incredibly inspiring plenary keynote on overcoming adversity delivered by disabled adventurer and motivational speaker, Darren Edwards.

Breakthrough Innovations

The Innovation Showcase and International Pavilions stood out with an impressive array of pioneering businesses and leading learning tech ecosystems, all driving innovation in their respective fields and regions. From mission-driven social enterprises and classroom technologies to language learning solutions and software technologies, our visitors witnessed an inspirational display of productivity and human creativity, highlighting and celebrating the cutting-edge advancements in the fields of education and work.

Networking and Collaboration

Abundant opportunities for networking and collaboration saw valuable connections being forged among participants from diverse sectors and backgrounds. EdTechXConnect, a 1-2-1 meeting service and dedicated meeting lounge onsite allowed for the exchange of knowledge, experiences, and best practices, as well as the opportunity to expand professional circles and build meaningful relationships amid an environment of mutual learning and collaboration. At the end of the day, the closing cocktails gave all our esteemed visitors, speakers and sponsors a chance to unwind, catch up with old contacts and establish connections with new ones.

Awards Gala Dinner

For the first time at EdTechX, the Summit culminated in a thrilling evening of celebration, commemorating the winners of the 2023 EdTechX Awards with a three-course Gala Dinner and awards presentation. Seventeen deserving education and training companies took centre stage, showcasing outstanding talent and accomplishments within the industry. Find out more here.

___________________________________

Thank you to all the participants, sponsors and partners for making this summit a resounding success. We are excited to continue our journey together and look forward to the positive impact we will create in the future.

By Helena Barman, Investor at Eight Roads Ventures

There is one topic in the venture capital community that is drowning out every other at the moment - Artificial Intelligence (AI). It’s hoped that AI can solve many of healthcare’s productivity challenges. In 2022 VC investment into startups building AI for healthcare in Europe and the US reached $13.2B.*

Progress has been hastened by three key factors: exponential increases in compute power, increases in model size (enabled by algorithmic advances) and more accessible healthcare data available for training. Groundbreaking examples of what is now possible have been further catalysing momentum, including the likes of AlphaFold2 (by Google Deepmind) accurately predicting 3D models of protein structures and GPT4 (by OpenAI) performance on US medical licensing exam.

We’re excited to see many new companies tackling this opportunity from both the infrastructure layer and the application layer. By infrastructure, I am referring to the foundational models that enable new workflows or insights, as well as the digital plumbing that powers these models. For mundane administrative tasks such as summarization and writing, we expect the foundational models to come from tech giants like Microsoft/Open AI and open source. However, many specialized scientific and health applications require domain-specific AI models focused on specific tasks. For example, Cradle.bio helps biologists design improved proteins with design suggestions, while our portfolio company Insilico medicine uses AI models to identify novel targets and molecules.

The big question here is whether we need (or can build) healthcare-focused multi-modal foundational models that solve safety and ethics concerns. Companies like Conjecture.dev are researching this in earnest.

The rise of data-hungry AI models has created a need for new data infrastructure. Instead of scientists hacking together bits of code to create bespoke processes, the likes of Sequera Labs helps scientists to assemble and deploy repeatable, scalable data analysis pipelines, and Lamin Labs helps them build a shared data layer to track and manage different forms of data. New forms of data require new infrastructure, and companies like Zetta Genomics are building data management systems for very large genomics datasets. With so much data out there, it can be challenging to find the data you need. Our portfolio company Elucidata curates 43k datasets, using AI to sort and filter them.

Next, let’s discuss the application layer. I define this as the AI enablement of workflows, products or services, resulting in increased efficiency and improved outcomes. Just as "big data" was once a massive strategic initiative on corporate agendas, AI will become a thread woven throughout every part of the system.

Currently, much of the focus has been on operational and administrative use cases that free up scientists’ or clinicians’ time. For example, Tortus is building a voice-controlled AI interface for clinicians to interact with Electronic Health Records, while Nabla provides note-taking tools for clinicians. Once the low-hanging fruit has been automated, these companies can then tackle the higher-impact, and therefore higher risk issues. Our portfolio company Eleos Health begins by automating workflows for mental health clinicians, and over time, once they have access to this rich data set, they hope to codify and optimise the mental health treatment itself. For many years, there has been much hope, but limited adoption of clinical decision-support tools. However, there is evidence that we are turning a corner here, with many new promising companies emerging such as Idoven in the cardiovascular space, Ibex in cancer diagnostics, and AIVF and Fairtility in the IVF space.

The main challenge will be ensuring safety and promoting adoption. The World Health Organization (WHO) recently warned “precipitous adoption of untested systems could lead to errors by health-care workers, cause harm to patients, erode trust in AI and thereby undermine (or delay) the potential long-term benefits and uses of such technologies around the world”. In pre-clinical pharma R&D, adoption has been more rapid, as the regulatory constraints that apply from the clinical phase onwards are not as stringent. In healthcare delivery, we believe that the automation of low-risk operational workflows will happen relatively quickly. However we anticipate cautious adoption of AI-enabled tools tackling high-risk workflows such as diagnostics and clinical decision-making.

If you’re building a startup in the space, we’d love to hear from you (LinkedIn). Eight Roads is a global venture capital firm, with 450+ investments, $11bn in AUM, and offices in the US, China, India, Japan, and Europe. Our London-based team partners with entrepreneurs at the Series A to C stages in Europe and Israel.

Source:*Pitchbook deals within Pharmaceuticals, Healthcare delivery and Biotechnology industry AND Artificial Intelligence & Machine Learning vertical in Europe and US

EdTechX Awards 2023 Winners Unveiled!

Last month, EdTechX were thrilled to announce the winners for their highly anticipated 2023 EdTechX Awards. For the first time ever, the awards presentation took place during a celebratory gala dinner on the evening of the EdTechX Summit in London on 22nd June. The expanded format offered a more meaningful platform and greater exposure to the finalists and winners, bringing together a high-quality community of founders, business leaders, and investors for a closing celebration of innovation and impact across the global EdTech and WorkTech sectors.

This year, the EdTechX Awards showcased winners across 16 categories, encompassing a range of growth stages, geographies, learning life stages, and social missions. These organizations were singled out for their exceptional talent, dedication, and innovation in their respective fields, with their contributions significantly advancing the global EdTech and WorkTech landscape.

"We are thrilled to recognize and honour the remarkable achievements of our winners," said Benjamin Vedrenne-Cloquet, Partner at IBIS Capital and Co-Founder of EdTechX & IMPACTX2050 . "These organizations have demonstrated exceptional talent, dedication, and innovation in their respective fields. Through technology, their contributions are significantly advancing the global EdTech and WorkTech landscape, and we are proud to showcase their accomplishments."

The winners in each category were selected by an experienced panel of experts from IBIS Capital who evaluated the nominees based on a comprehensive set of qualitative and quantitative criteria, including the candidates' financial position, strength of business model, strategic milestones, and overall trajectory of the company.

Discover the complete list of winners and their respective categories here or click here for the full list of finalists.

The EdTechX Awards serve as a testament to the transformative power of technology in education, training, and work, and aim to inspire excellence, foster innovation, and promote best practices within the industry. From early-stage innovators to mature profitable businesses, these award winners are at the forefront of shaping the future of learning and career development, and their accomplishments inspire the entire industry.

Congratulations to all the finalists and winners of the EdTechX Awards 2023! Your dedication, talent, and innovation are setting new standards and paving the way for a brighter future in the EdTech and WorkTech landscape.

Breaking Barriers in Women's Health

The gender pain gap represents a significant and pervasive issue impacting millions of women worldwide, yet it remains an area that has received insufficient attention in medical research. Take, for instance, the prevalence of menstrual cramps, affecting approximately 90% of women and resulting in substantial discomfort and productivity decline. Regrettably, the available solutions, such as over-the-counter painkillers, fail to address the distinctive physiological needs of women.

Another troubling reality is observed within diagnostics, where women frequently encounter delayed diagnoses compared to men across more than 700 diseases. This disparity is especially prominent in female-specific conditions, which, if left undetected, can lead to long-term consequences like infertility, chronic pelvic pain, and other debilitating conditions.

Stepping into this arena, Daye, a gynecological health platform, emerges as a pioneer in the field of women's health by addressing the management of gynecological health. With a mission to tackle the ubiquitous gender pain gap and enhance diagnostics for women, Daye focuses on developing groundbreaking products and services that empower women to overcome the obstacles associated with gender pain and diagnostics.

At the core of Daye's mission lies their innovative line of menstrual tampons. Going beyond their traditional function, Daye's first-generation tampon represents the world's first pain-relieving menstrual tampon, providing much-needed relief for the countless women enduring menstrual cramps. By specifically addressing this widespread issue, Daye offers a tangible solution designed to cater to the female physiology.

Continuing their pursuit of innovation, Daye has introduced their second-generation tampon – an at-home diagnostic tool. This revolutionary tampon empowers women to gain valuable insights into their gynecological health from the comfort of their own homes. It is capable of detecting sexually transmitted infections (STIs), human papillomavirus (HPV), and fertility-inhibiting pathogens, thereby preventing the long-term complications that may arise from delayed diagnoses.

Daye's dedication to sustainability is evident in their practices. As a certified B Corporation, they invest in material science innovation to create sustainable products. For instance, they have developed a flushable tampon wrapper to eliminate plastic waste from packaging and a water-soluble tampon applicator to reduce microplastics and combat pollution in our oceans. Furthermore, Daye's utilization of organically certified fibers in their products underscores their commitment to both efficacy and environmental responsibility.

Beyond their product offerings, Daye actively engages in collaborations with leading institutions such as Liverpool Women's Hospital and the Mayo Clinic. Through the anonymization and sharing of vaginal microbiome data, Daye contributes to critical research on gynecological health, focusing on conditions such as endometrial cancer, polycystic ovary syndrome (PCOS), and endometriosis. These collaborations aim to bridge the gender gap in medical research and foster a deeper understanding of female-specific conditions.

Daye's holistic approach sets them apart as a transformative force within the healthtech industry. By effectively addressing the fundamental issues of gender pain and diagnostics, Daye empowers women to proactively manage their health, advocates for equitable healthcare, and envisions a future where comprehensive and personalized gynecological care is accessible to all women.

To learn more about Daye and the work they are doing, watch an enlightening conversation on a recent episode of HealthTechX Stories with the company’s founder, Valentina Milanova.

Groups including Chegg and Duolingo say new tech presents opportunities as they fight to compete. Financial Times Read more

We need to transition to a green economy and therefore green skills, which can help lead to increased competitiveness for businesses, drive economic growth and create new employment opportunities. UNSSC Read more

There’s been speculation that the hype around the metaverse has been replaced by excitement about artificial intelligence, especially in the business world. But what about the metaverse’s promise to revolutionize education? EdSurge Read more

Rather than focusing solely on disruption, HealthTech startups working with established partners concentrate on proving demonstrable ROI, clinical value, dollars saved, better outcomes and improved healthcare economics.

MedCityNews Read more

HealthTech Magazine Read more

Three areas—EdTech, early childhood, and income-share agreements—provide promising investment opportunities for impact investors interested in the education sector. The Bridgespan Group Read more

Deonta Wortham of RockHealth.org offers three questions that investors can ask themselves to ensure they are acting on the promise of digital health to impact the lives of all. ImpactAlpha Read more

Big institutional investors are increasing pressure on technology companies to take responsibility for the potential misuse of artificial intelligence as they become concerned about the liability for human rights issues linked to the software. Financial Times Read more

Education

Health

Education

Health

Sources: S&P Capital IQ, HealthTech Alpha, Crunchbase

2Deal relates to planned purchase of Gologiq fintech assets only

3 Deal announced but not yet closed

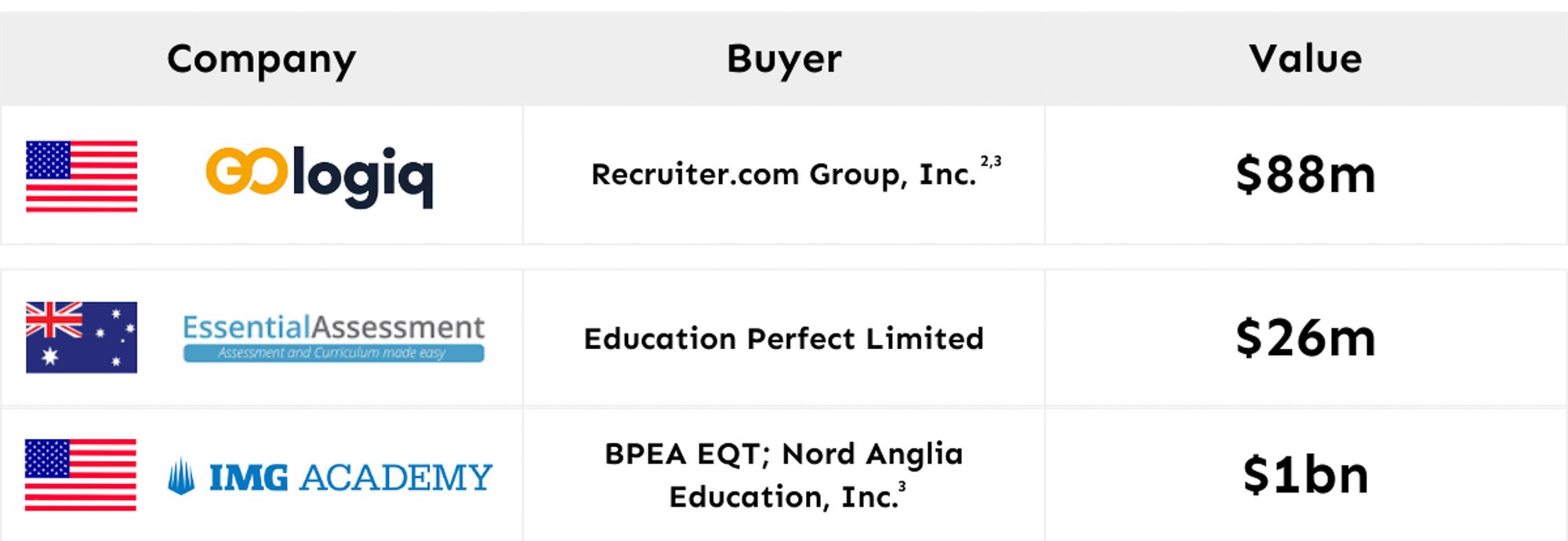

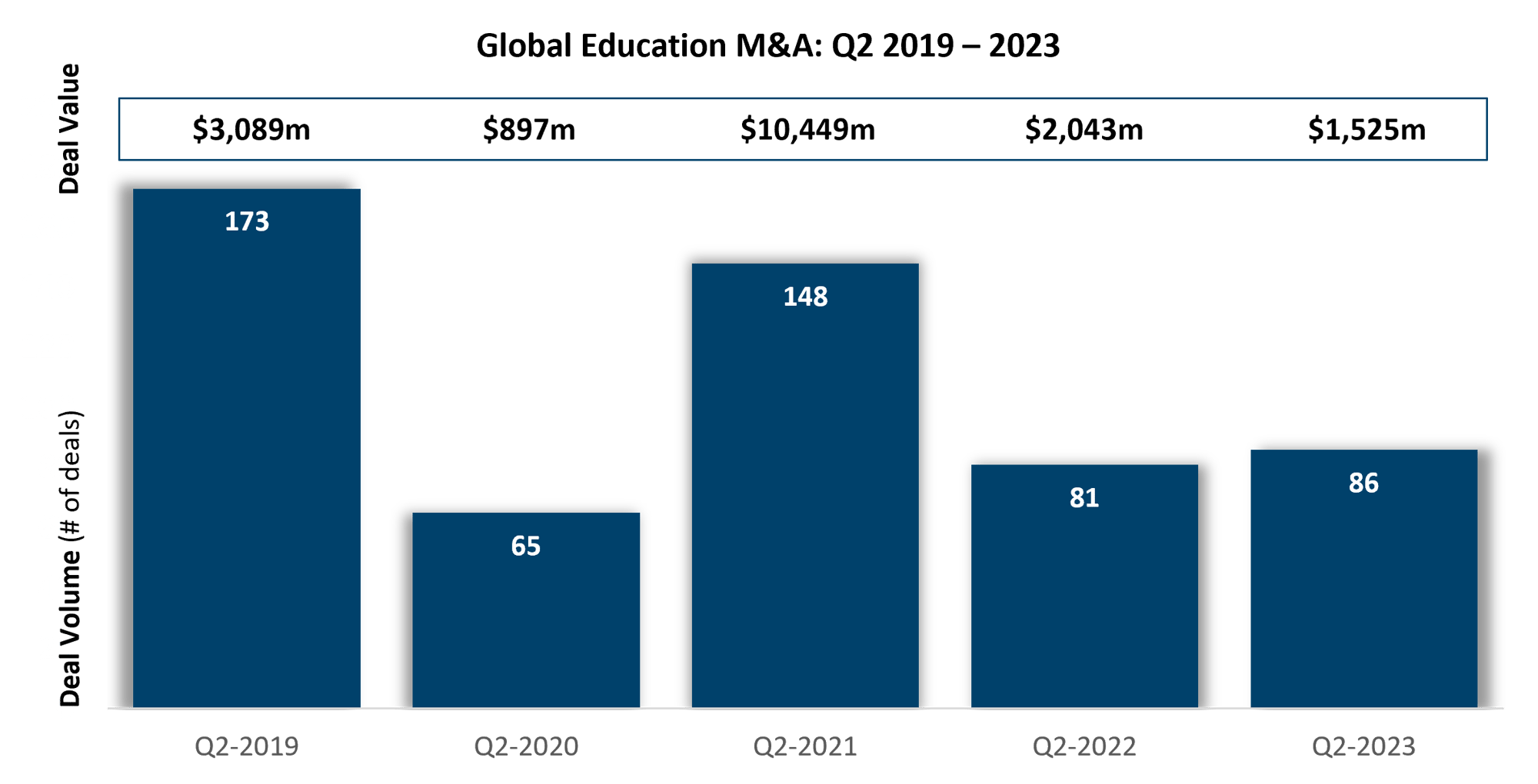

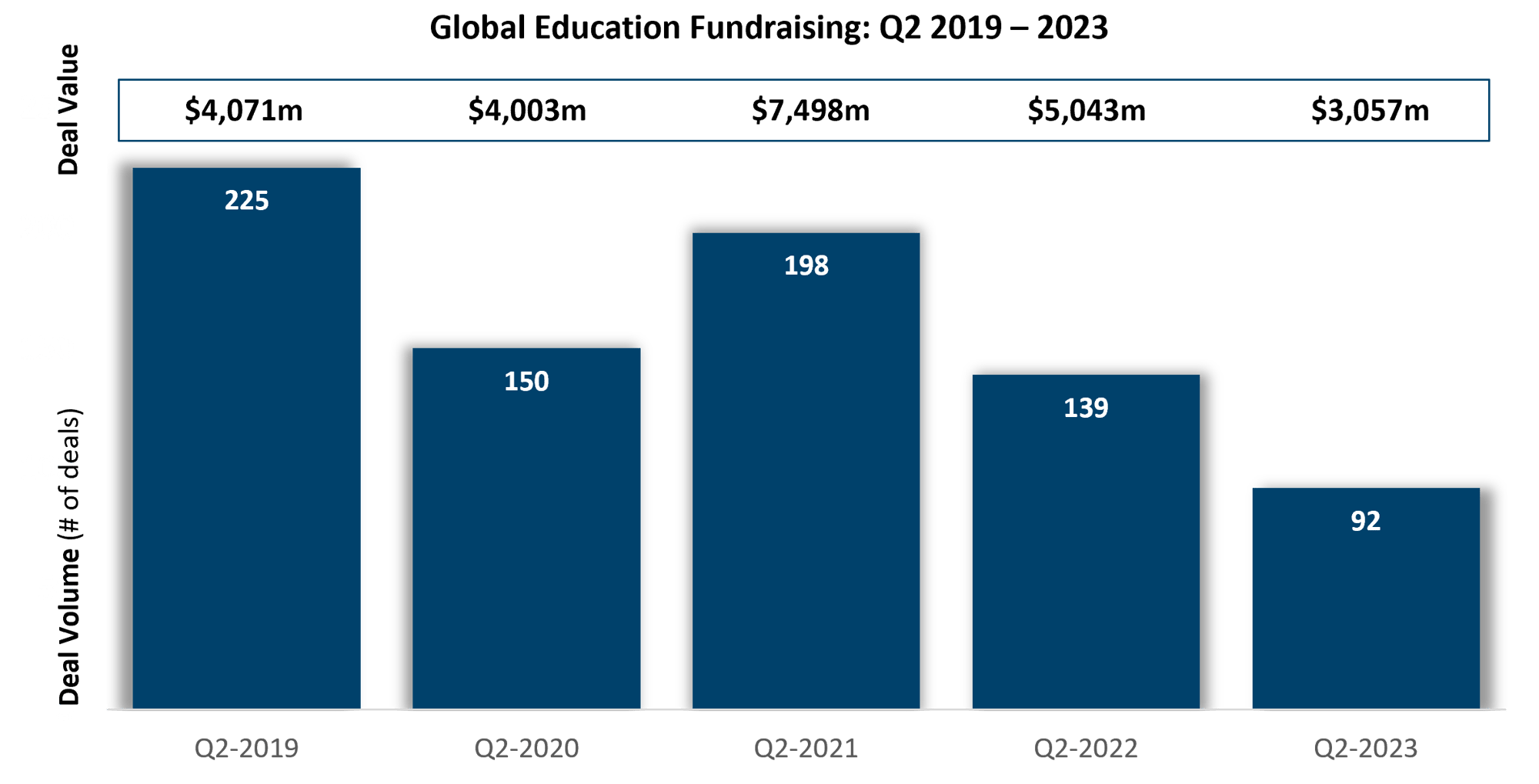

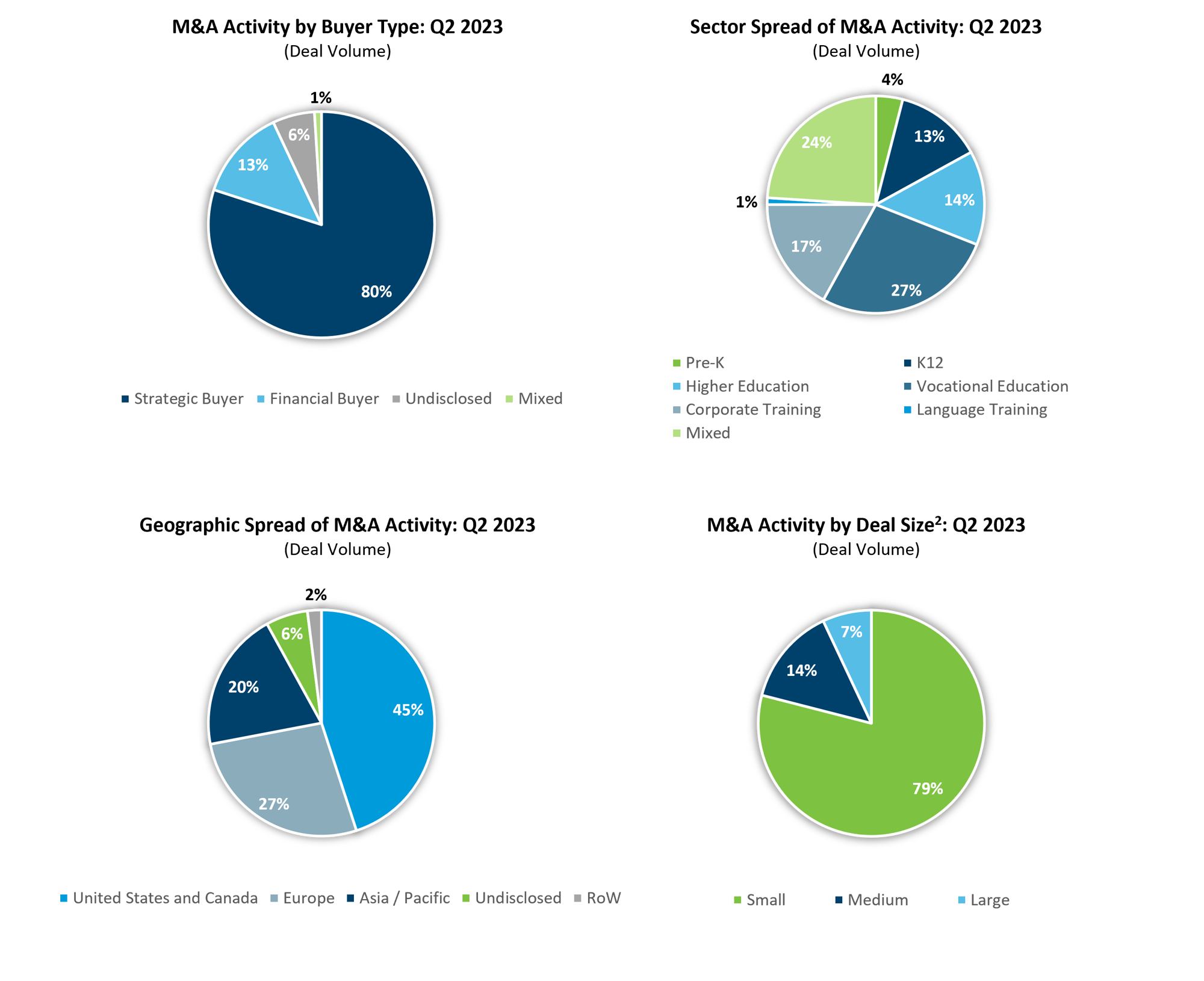

In Q2-2023, the EdTech industry witnessed a marginal increase in M&A activity compared to Q2-2022. Contrary to this small volume increase was the total value of deals during this period declining by 25%. This trend was primarily driven by a decline (-22%) in larger deals and an increase (+20%) in smaller deals relative to Q2-2022. Moving forward, the industry may experience a contraction in both M&A activity and fundraising, owing to the potential convergence of an AI "hype" crash and the downfall of prominent EdTech brands 3. Such a scenario could lead to a loss of confidence in educational innovation and technology among venture funders and the global community. The true opportunity during the resulting "back to basics" phase lies in creating a collaborative effort between companies and platforms that yield both financial and impact returns. This entails leveraging advanced technology where appropriate and prioritising support for schools, universities, and learners3.

A particularly noteworthy transaction in the EdTech sector during Q2-2023 was the acquisition of IMG Academy, a preparatory boarding school and sports training destination, for $1.2bn by BPEA EQT and Nord Anglia Education. The aforementioned transaction drove the majority of the overall deal value in the quarter, with the US-based company looking to support its international expansion and broaden its educational offering. From a sector perspective, deal activity in the education industry showed a fairly even distribution of interest across all subsectors. While nearly a quarter of deals targeted companies operating in mixed sectors, a high proportion (27%) of transactions occurred within the vocational education space. Notably, Recruiter.com Group, Inc. (NASDAQ:RCRT), a company focused on recruitment training, acquired the fintech assets of GoLogiq, Inc. (OTC:GOLQ), a provider of fintech and mobile solutions for consumer data analytics, for $88m.

- April-23: Cengage Group, a US-based EdTech company providing secondary and higher education, raised $500m in a PE round from Apollo Funds

- May-23: BYJU’s, an India-based EdTech company developing personalised learning programs for K12 students, raised $250m in debt financing led by Davidson Kempner

- May-23: EQuest Education Group, a Vietnam-based education firm, raised $120m in debt from an undisclosed creditor and equity funding from existing investor KKR

Looking ahead, it is anticipated that funding in the sector will likely mirror the post-pandemic trend of companies prioritising the enhancement of digital capabilities and the development of resilient learning environments for all students. Q2 of 2023 displayed indications of a potential stabilisation in funding within the sector, suggesting a potential shift towards a more diversified approach to future investments in education3.

Notes

1. Includes deals announced but not yet closed

2. Relates only to deals with disclosed transaction amounts. Small deals are considered to be <$50m; Medium deals are considered to be ≥$50m and <$150m; Large deals are considered to be ≥$150m

3. HolonIQ

M&A/Exits2 & Fundraising Activity3

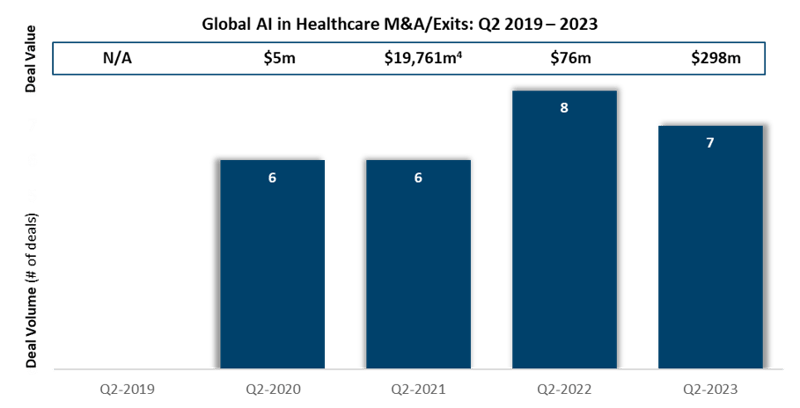

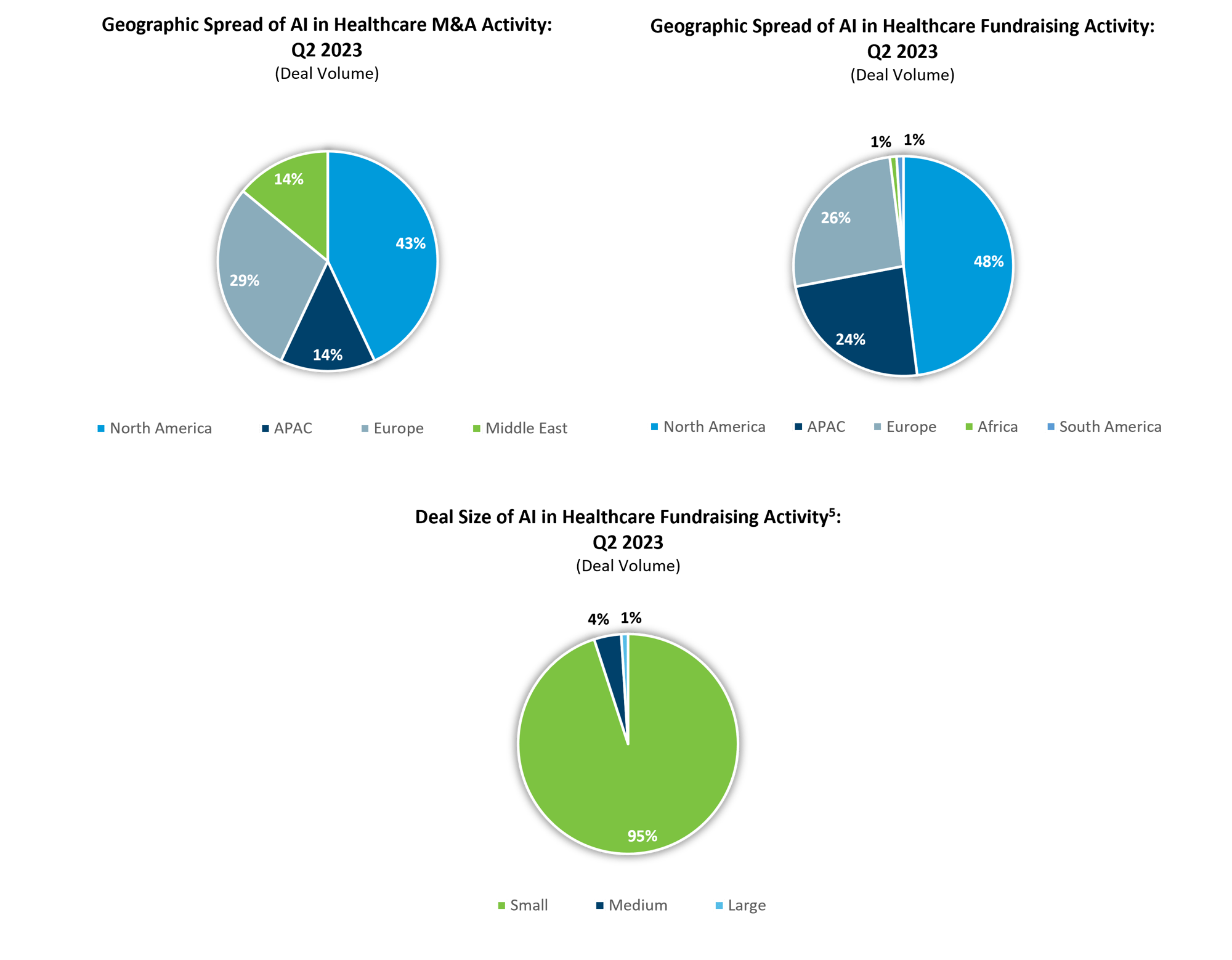

Artificial Intelligence (AI) has emerged as a key focus for investors in recent months, attracting considerable attention and yielding impressive results for companies that have embraced the technology. In the broader tech market, prominent players in Nvidia, Microsoft, and Google have capitalised on their investments in AI, reaping substantial benefits during Q2-2023, as evidenced by notable increases in their stock prices. This surge in investor interest underscores the growing recognition of AI's potential to revolutionise various industries and drive significant value for businesses that seize its opportunities. Within the healthcare sector, AI has shown great potential for its ability to assist in the way patients are diagnosed, treated, and monitored.

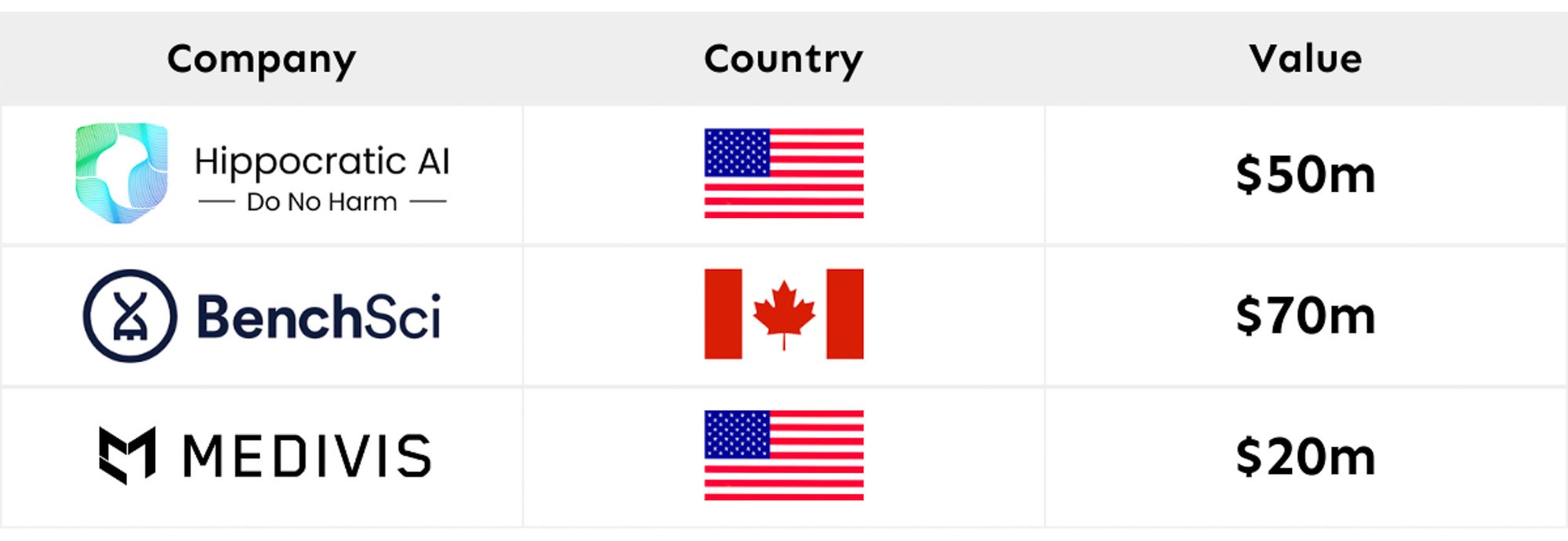

Although AI-related ventures have seen significant investment, the broader funding landscape has seen a recent decline. For instance, the month of April witnessed a substantial downturn in global funding, decreasing by 56% from the $47.8bn recorded in April-20216. Global fees for completed M&A dropped by 35% in the first half of the year to $12.8bn, reaching the lowest level since 20147. Additionally, global M&A activity experienced a 38% decline to $1.3tn, marking the lowest deal volume since the onset of the COVID-19 pandemic in 2020. Factors such as higher interest rates, stricter antitrust enforcement, and geopolitical tensions have contributed to the market downturn8. The general healthcare industry was not immune to the decline in dealmaking, having seen a fall in fundraising volumes of 63% quarter on quarter since 20223. Despite this fall, the AI subsector was somewhat insulated, having only seen a 27% decline in fundraising transactions by volume over the same period. Significant fundraising within AI healthcare landscape included a Series F raise of $215.0m by HeartFlow, a US-based company specialising in non-invasive coronary artery detection solutions through deep learning, and a $70.0m Series D raise by BenchSci, a company specialising in AI solutions for preclinical life sciences research and development.

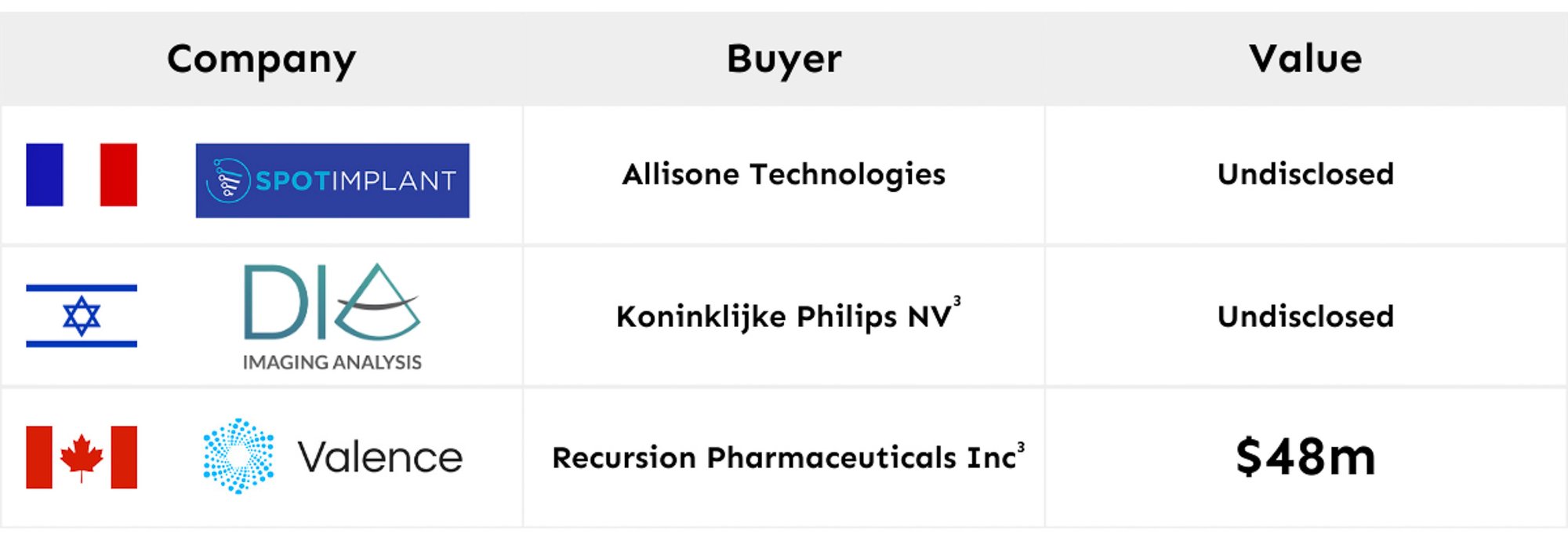

AI in healthcare M&A activity in Q2-2023 recorded the second highest average deal value in the past 5 years, with each transaction averaging $42.6m. A particularly noteworthy transaction in the sector was the collaboration of XtalPi Inc. (XtalPi), a pharmaceutical technology company powered by AI and robotics to improve the success rate of drug discovery and development, with Eli Lilly and Company (Lilly) in a deal worth up to $250m. Lilly will utilise the AI-technology pioneered by XtalPi to identify potential drug candidates that Lilly will then move through the clinical and commercial development processes. The acquisition of Valence, a developer of AI technologies to design differentiated small molecules with improved properties and function, for $47.5m by Recursion Pharmaceuticals also contributed 16% worth of total deal value to the quarter. Future funding in the sector may prioritise AI technology's potential to drastically enhance health savings for consumers, potentially resulting in a $150bn reduction in annual healthcare costs in the US by 20269.

Notes

1. Includes deals announced but not yet closed2. Exits: An exit occurs when an investor sells part or all of their ownership

3. HealthTech Alpha

4. Total value includes Microsoft acquisition of Nuance for $19.7bn

5. Small deals are considered to be <$50m; Medium deals are considered to be ≥$50m and <$150m; Large deals are considered to be ≥$150m

6. Crunchbase

7. Refinitiv, 2023

8. Financial Times, 2023

9. NCBI.NIH, 2020