APRIL 2025

The Land of Clubs - From 29-year-long waiting lists to $400K initiation fees, the allure of exclusive memberships lies in belonging to a world few can access. Now EdTechX is bringing that same elite experience to the world of education and training, but perhaps with a slightly easier door to open.

A global snapshot of the EdTech, HealthTech & Impact Investing markets.

Notable M&A & Fundraising activities across EdTech & HealthTech industries

Global trends across the tech-led impact ecosystem. In this issue:

Education Industry Analysis – Q1 2025

Healthcare Industry Analysis - Q1 2025

The Land of Clubs

By Charles McIntyre, CEO at IBIS Capital

There is something highly seductive about exclusive membership of a club, whether it is being allowed to join the treehouse gang at school or perhaps when you are a little older, a night out with the stars at Annabel’s in London’s Berkeley Square. That membership feeling is not just about benefits, but it is also about finding your tribe, somewhere where you feel you’re in good company.

London is home to more private member clubs that any other city, catering to the rich and famous as well as to politicians and spies. There is something for everyone. The claim to the oldest club sits with White’s which began life as a hot chocolate stop back in the 17th century and now boasts King Charles III (who held his stag night there before marrying Diana) and Prince William amongst its members.

Well, the exciting news is that EdTechX has also launched its own membership club. A dedicated club to the movers and shakers within the world of education and training. What’s more is that it is a little easier to join than having to wait the 29 years for membership at the Marylebone Cricket Club, home to the famous cricket ground known as Lords. A little cheaper than the $400k initiation fee for the Yellowstone Club at Big Sky, Montana, where you also have to buy a house within the grounds, which in case you’re interested, luckily includes its own private ski mountain. A little less restrictive than the Oxford and Cambridge club, where you will need to go and get a degree from either institution before applying.

EdTechX membership brings you the luxury of being amongst those making a difference; not forgetting there are a few perks along the way. Perhaps not a weekend of powder snow, but the pleasure of sumptuous dinners amongst kindred spirits, VIP access to lounges and networking within the world of EdTechX and insightful intelligence to what lies round the corner. What’s not to like…now’s the time to come join your friends and peers, and help shape the future.

Find out more on the EdTechX Membership page here.

💰 US tariffs trigger global economic disruption and new concerns for international educators

A new global trade war is taking shape, and it is likely to contribute to new international student mobility patterns. This could cause intraregional mobility in Asia and Europe to intensify, and the US stands to lose some of the competitive edge it gained in 2024. (ICEF Monitor)

🤖 After decades studying Spanish, a chatbot language tutor is helping me lift my game

Sceptical at first, I turned to AI to help me speak Spanish more fluently. Is it time to say adios to my human teacher? (The Guardian)

🌎 New guideline stresses on AI-based education

China aims to promote artificial intelligence in aiding the country's education reform, highlighting the cultivation of students' critical thinking, problem-solving abilities and practical skills, while accelerating digital transformation across the sector, according to a newly released guideline.

(China Daily)

👩🏽💻 HealthTech is the UK’s hidden gem – the government can’t ignore it

A targeted focus on HealthTech has the potential to boost the UK’s global competitiveness, writes Russ Shaw, founder of Tech London Advocates and Global Tech Advocates. (Digital Health)

📃 AI as a medical device – What are the regulatory considerations?

Artificial intelligence (AI) is currently revolutionising the healthcare industry, by introducing innovative solutions in diagnostics, treatment, and patient care. However, the rapid integration of AI into medical devices presents significant regulatory challenges.

(Health Tech World)

🤖 From robots to real-time data: What’s next for digital surgery?

Developments in digital surgery have arisen not only from a technology readiness, but also a psychological willingness to embrace new devices that help save, extend, or improve patient lives. The change has not been an overnight phenomenon – but it has certainly become more deeply embedded in the past few years. (Health Tech World)

💰 Europe’s healthtech and AI startups raise $13.9B in Q1 as global investors return

Healthtech dominated the investment landscape with $4.3 billion in funding, up 65 per cent YoY, and it came out on top for its fourth consecutive quarter. (Tech.eu)

👨🏫 Why Edtech's Billion-Pound Problem Can't Be Solved Without Educators

EdTech companies are rushing to integrate AI into their platforms, often without considering whether it truly enhances learning. (AI Business)

📈 How investors should respond to Trump’s tariffs

Plans to tax imports into the US have shaken up markets. But what happens next, and how can investors protect themselves? (Investors' Chronicle)

Education

Source: Capital IQ / Tracxn

Health

Source: Capital IQ / Tracxn

Education

Source: Capital IQ / Tracxn

Health

.png)

Source: Capital IQ / Tracxn

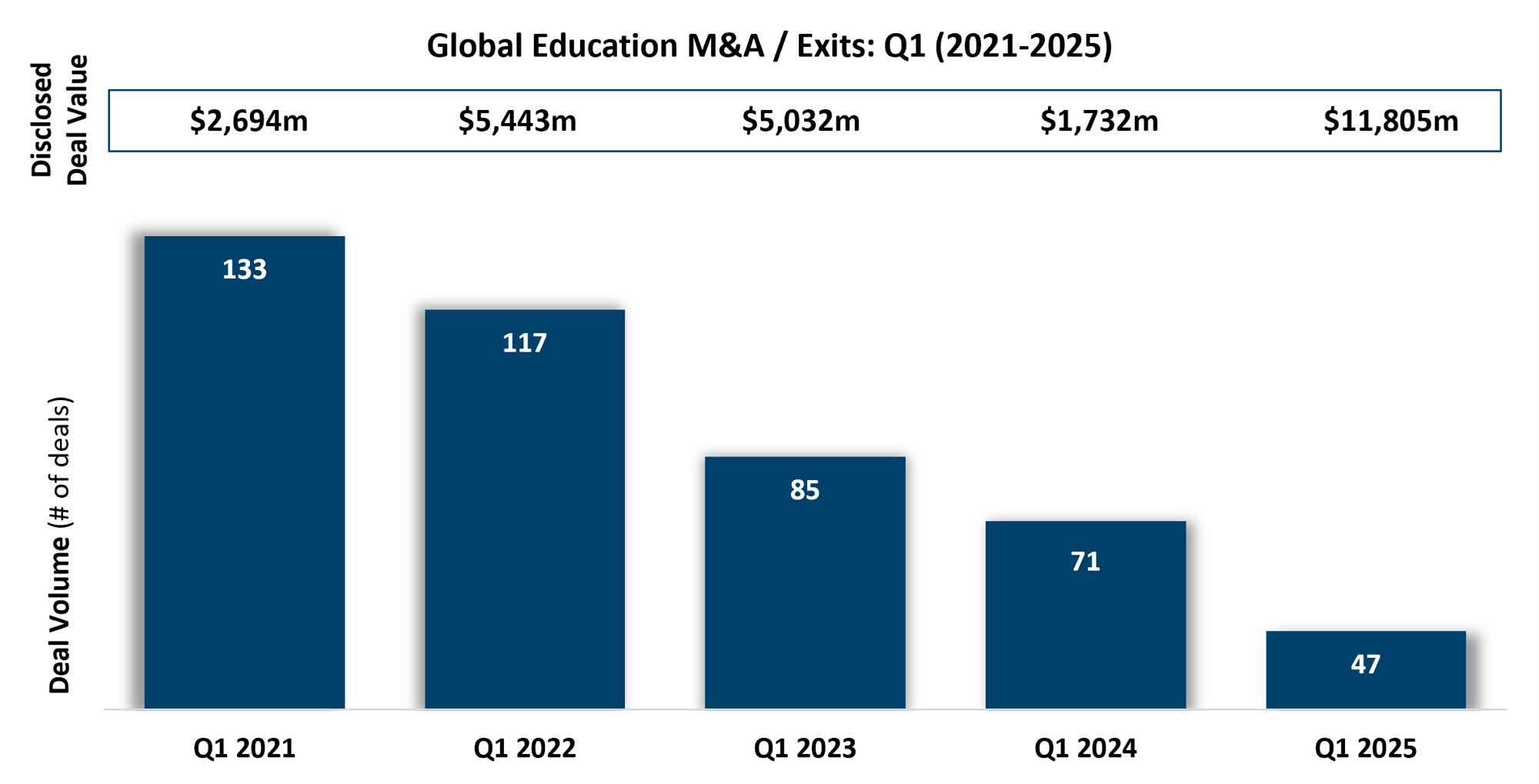

M&A deal volume in Q1 2025 declined by 34%, with 47 transactions recorded compared to Q1 2024. Despite the slowdown in the number of deals, overall deal value rose by 582% to $11,805 million, up from $1,732 million in Q1 2024, driven by high profile transactions, such as the $4,231 million acquisition of Paycor HCM Inc by Paychex Inc, and the $5,945 million sale of Personal & Information AG to HG Capital.

Notable Q1 2025 deals include:

- Markel Ventures (Markel Group Inc), the U.S.-based investment arm of Markel Corporation focused on non-insurance businesses, acquired Educational Partners International, a U.S.-based provider of online professional development courses for teachers and school administrators.

- Wonder, the US based food delivery startup completed the $90 million acquisition of Tastemade, a U.S.-based content provider offering cooking-related learning solutions.

- US based augmented reality provider Ascend Learning, acquired digital health education platform Clover Learning. The acquisition supports Ascend Learning’s mission to provide accessible, high-quality learning solutions for the healthcare workforce, particularly in response to rising demand and staffing shortages in imaging services.

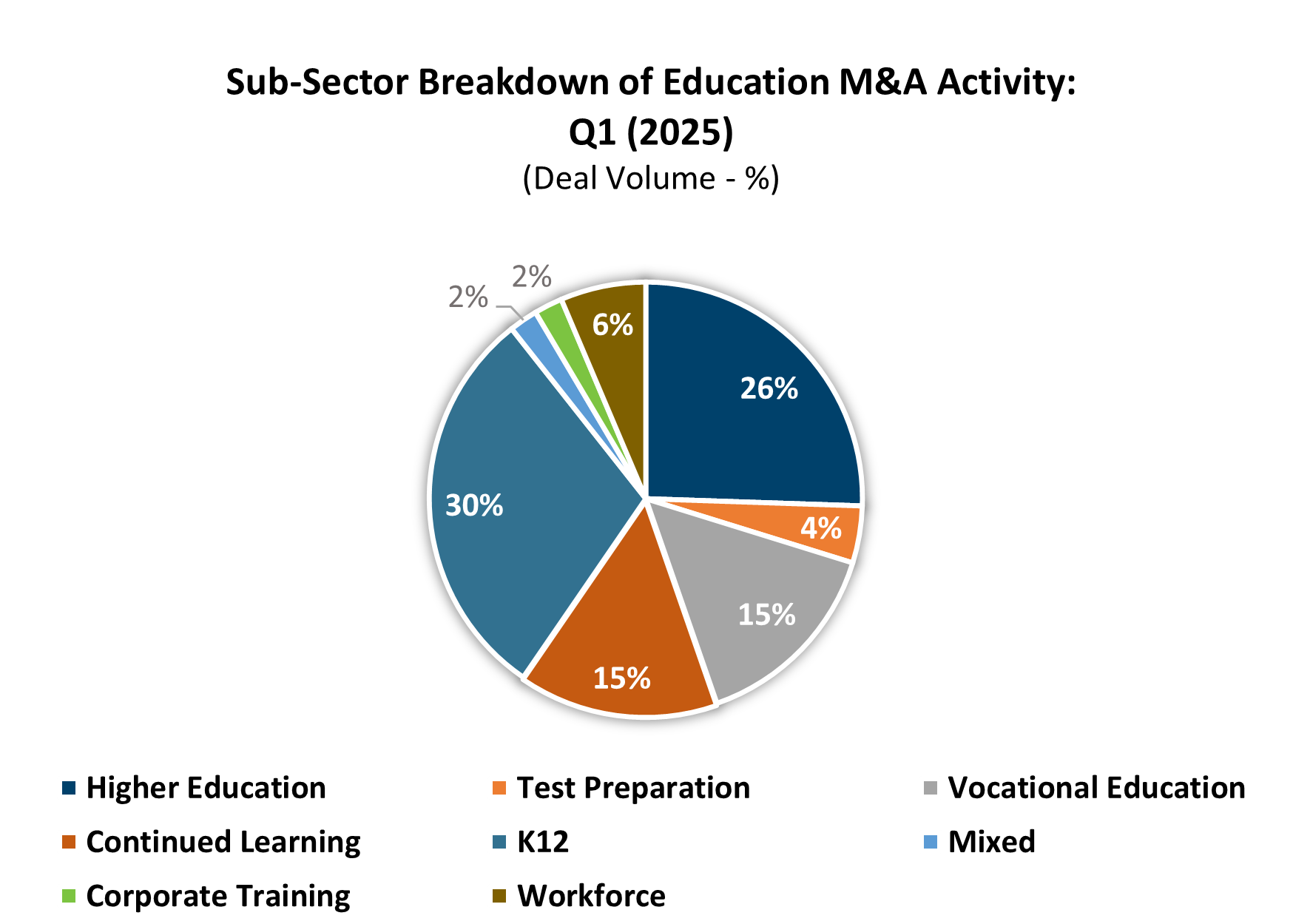

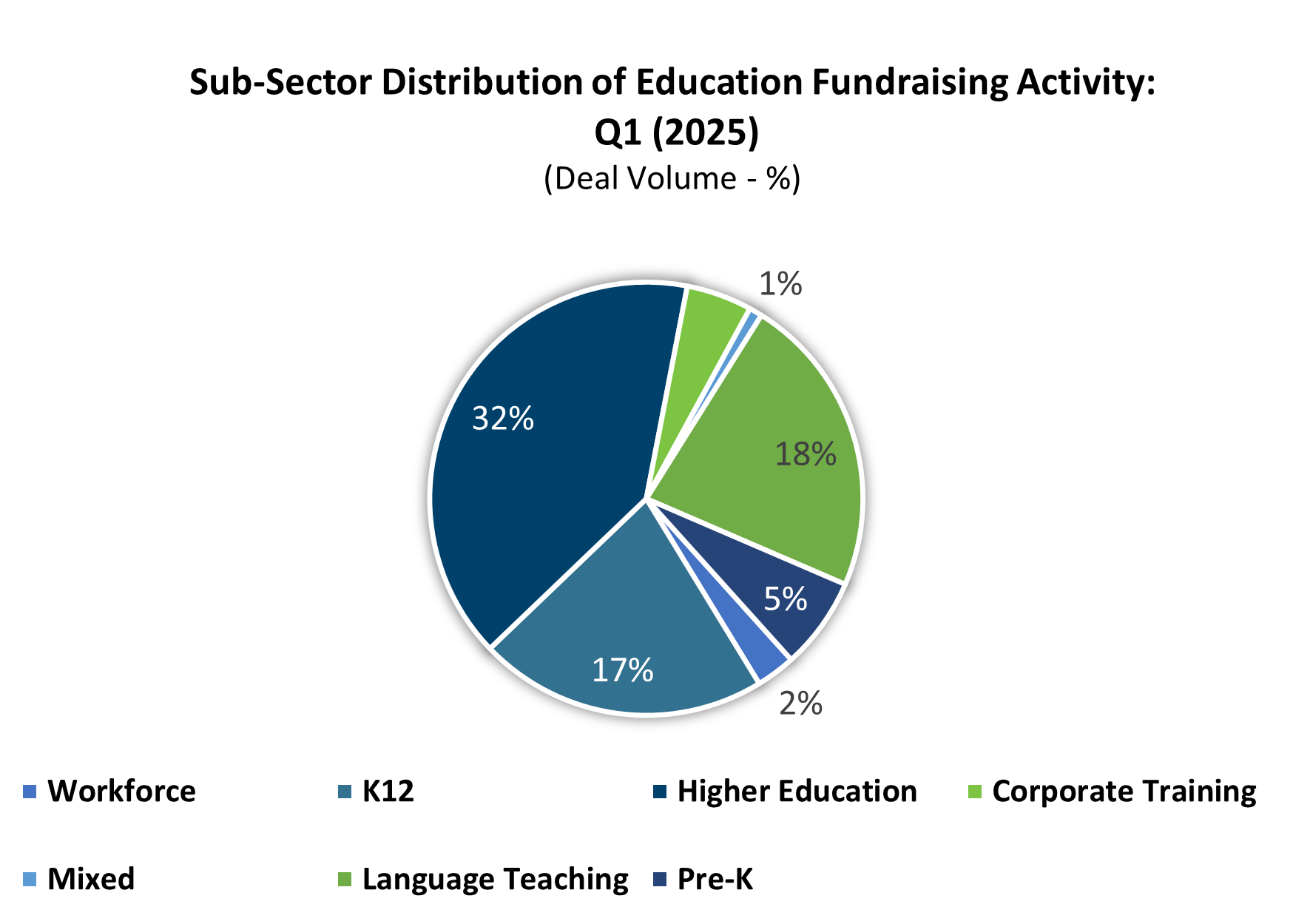

Strong investor appetite was evident in the K–12 sector, which accounted for the highest share of deals at 30%, followed closely by Higher Education at 26%. Data suggests a growing trend toward integrating new technologies in the classroom, with a focus on enhancing the student experience through extended reality and gamified content to boost engagement. Examples include the acquisition of UK-based AR/VR educational content developer InceptionXR by Relias, a provider of digital education, training, HR, and compliance solutions. The acquisition aims to support an immersive blended learning approach, with Relias noting that VR has significantly improved the adoption of best practices. Additionally, the acquisition of Earth Cubs, a UK-based online gamified platform focused on environmental education by CosmoBlue Media, is a great example of how gamified content can be used to blend and enhance the learning experience for students at home and in schools.

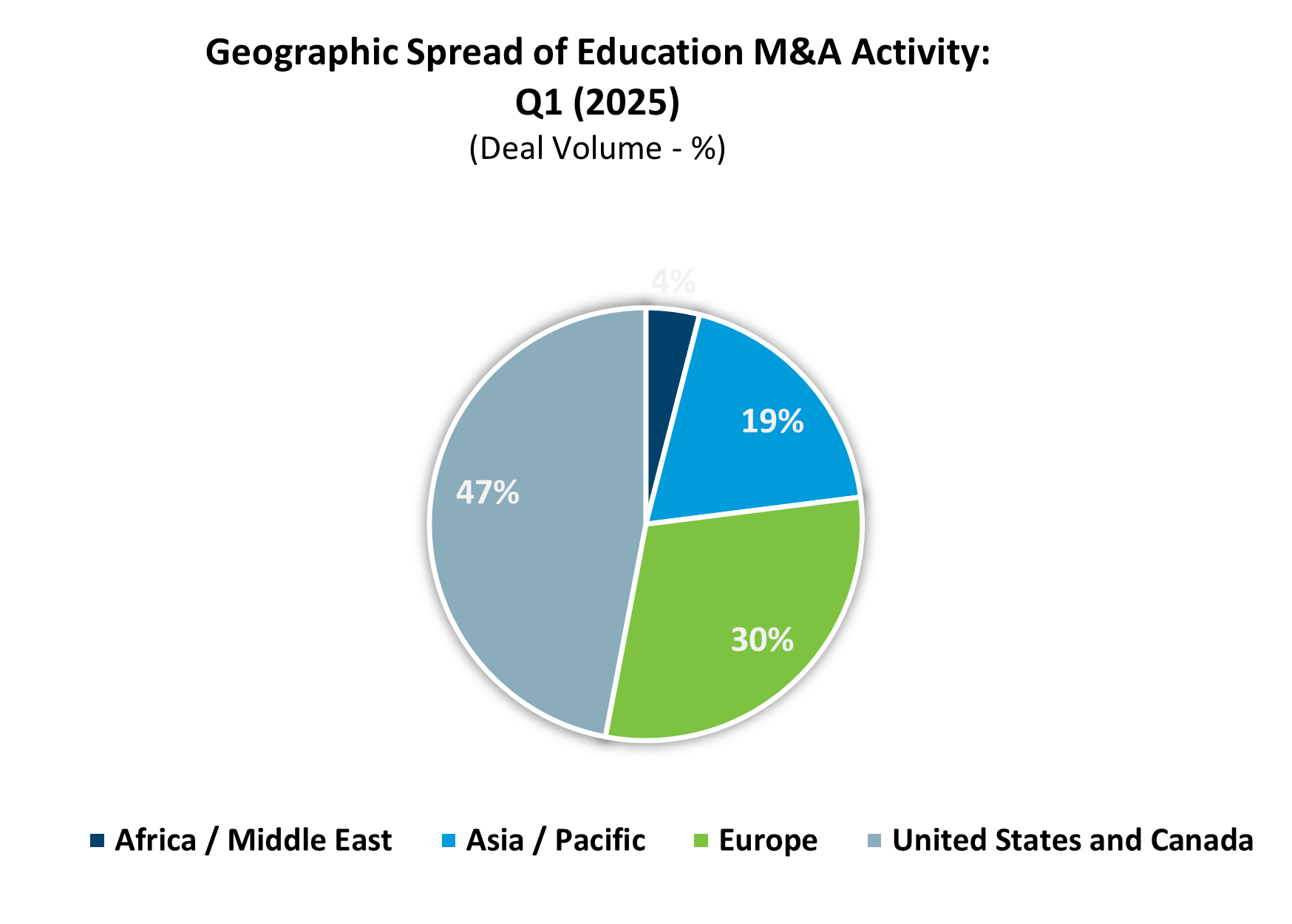

Geographically, United States and Canada took the lead, accounting for 47% of deals, followed by Europe with 30%. The Asia-Pacific region contributed to 19% of deal volumes, a dip from 26% in Q4 2025.

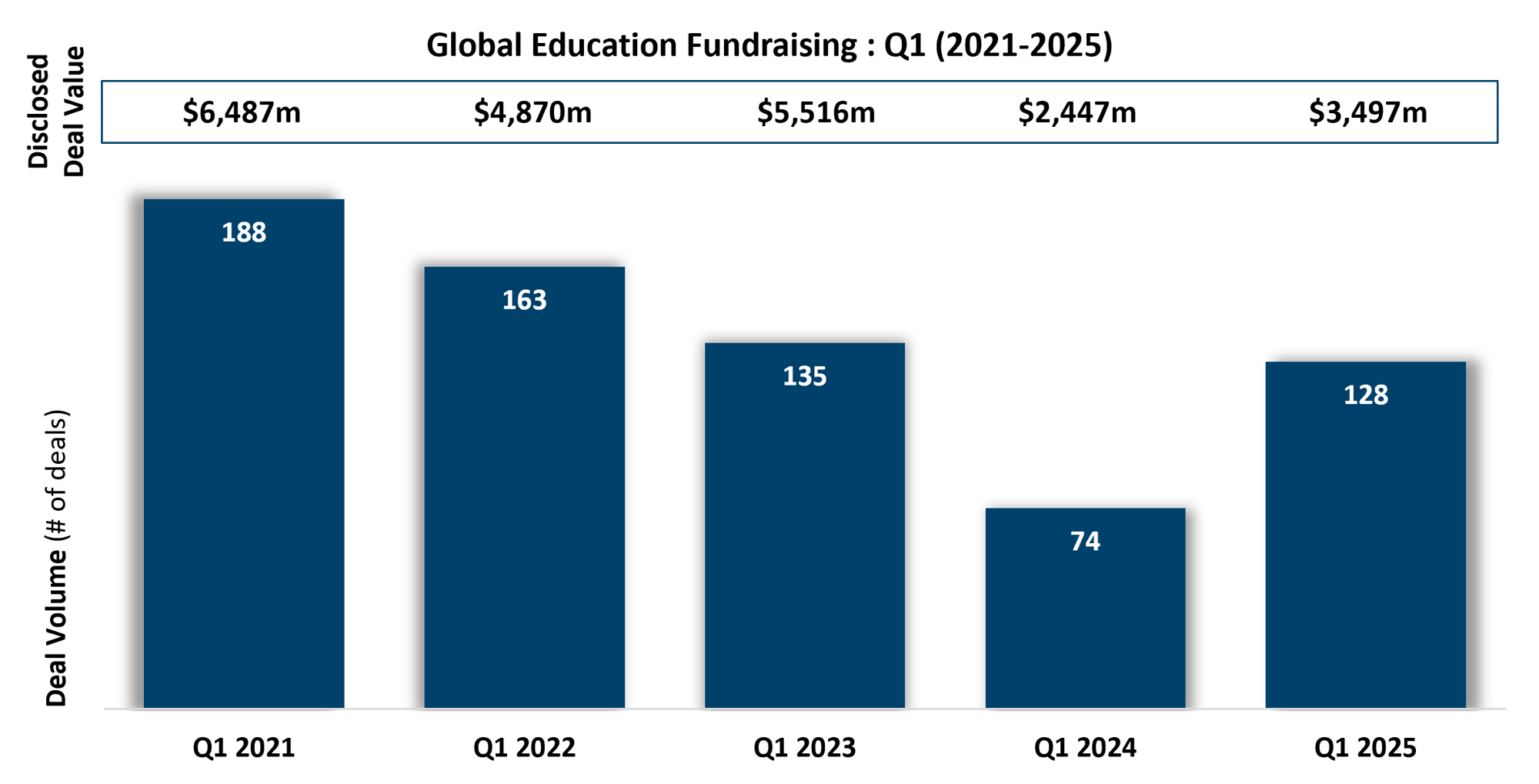

Similar to the trends outlined in our Q4 2024 report, Q1 2025 marked a rebound in deal activity, with 128 transactions recorded. This is particularly notable given that Q1 deal volumes had shown a consistent annual decline since Q1 2021. In this quarter, both deal volumes and values increased by 73% and 43%, respectively, signalling renewed market momentum.

High profile fundraises include the $259 million series C raise by Amboss, the German based provider of education resources for medical exams. Other notable transactions included:

- Loxo, a U.S.-based recruitment platform, secured a $115 million private placement, led by Tritium Partners. The funding will likely support Loxo’s continued product development and market expansion.

- Ula, a Saudi Arabia-based digital training platform, completed a $28 million private placement led by Foursan Group. The raise is expected to support regional growth and the expansion of Ula’s training offerings across key verticals.

- Excelsoft, the Indian-based SaaS provider focused on education and testing solutions also filed a shelf registration, with its planned IPO valued at $80 million. This suggests growing investor appetite for scalable education technology platforms in emerging markets and the rising demand for EdTech services in the region.

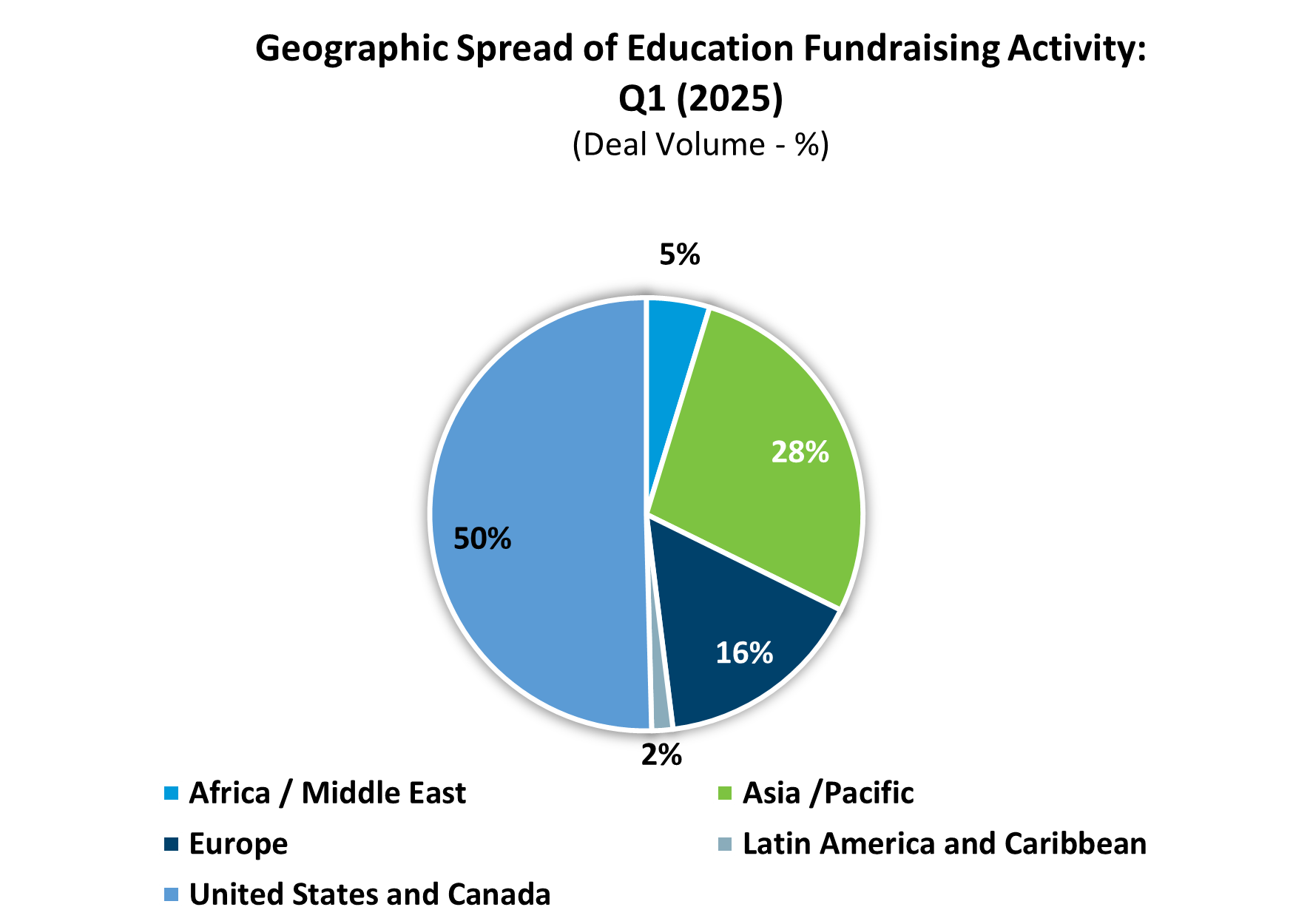

As with M&A activity, fundraising deals were dominated by the United States and Canada, which accounted for 50% of total deals. Similar to Q4 2024, the APAC region remained relatively active, contributing 31% of total fundraising volume. In contrast, Europe experienced a further quarterly decline, with its share falling from 24% in Q4 2024 to 16%.

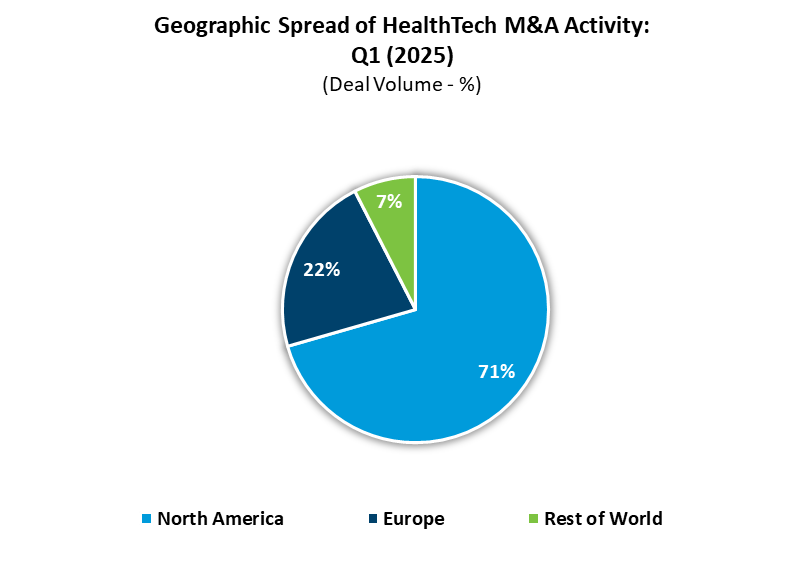

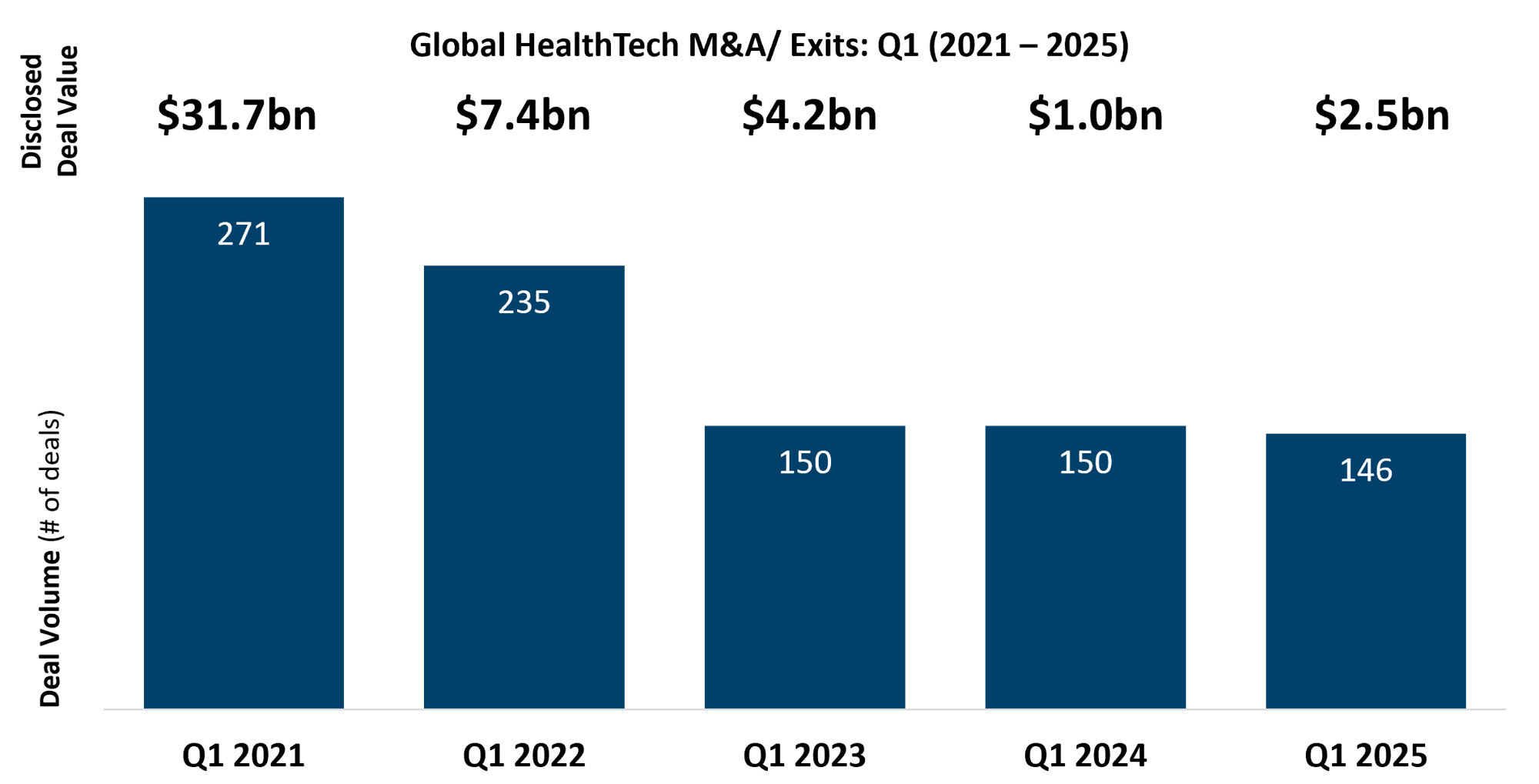

Q1 2025 Global HealthTech M&A has seen significant growth in value versus 2024 despite flat deal volumes, reflecting an increase in average deal size. Investment more than doubled from $1.0bn to $2.5bn even as volumes declined slightly from 150 to 146, reflecting a shift in volume towards North America, with typically larger deals for more mature companies.

Q1 2025’s value growth marks a welcome rebound in a vertical that has seen consistent decline in activity since 2021, although 2025 remains below 2023’s $4.2bn of investment across 150 investments.

Q1 M&A activity suggests Investor interest remains centred on healthcare software, with particular focus on administrative tech solutions and virtual healthcare delivery platforms. With public market valuations still reeling versus their 2021 peak, several publicly traded HealthTech companies (e.g. Accolade, Sharecare, Augmedix) were taken private, in a trend that looks set to continue through 2025. Recent transactions in the space include:

- $1.65bn sale of CentralReach, a US-based provider of SaaS solutions for Applied Behaviour Analysis therapy with individuals with autism spectrum disorder, to Roper Technologies, a US-based vertical software and technology aggregator which looks to acquire market-leading businesses in defensible niches generating stable, growing cashflows

- $621m acquisition of Accolade, a US-based consumer health platform providing delivery, navigation and advocacy services, by Transcarent, a US-based employee health benefits provider. The acquisition will provide Transcarent with a consumer-focussed user experience and a large audience, with over 20 million platform members

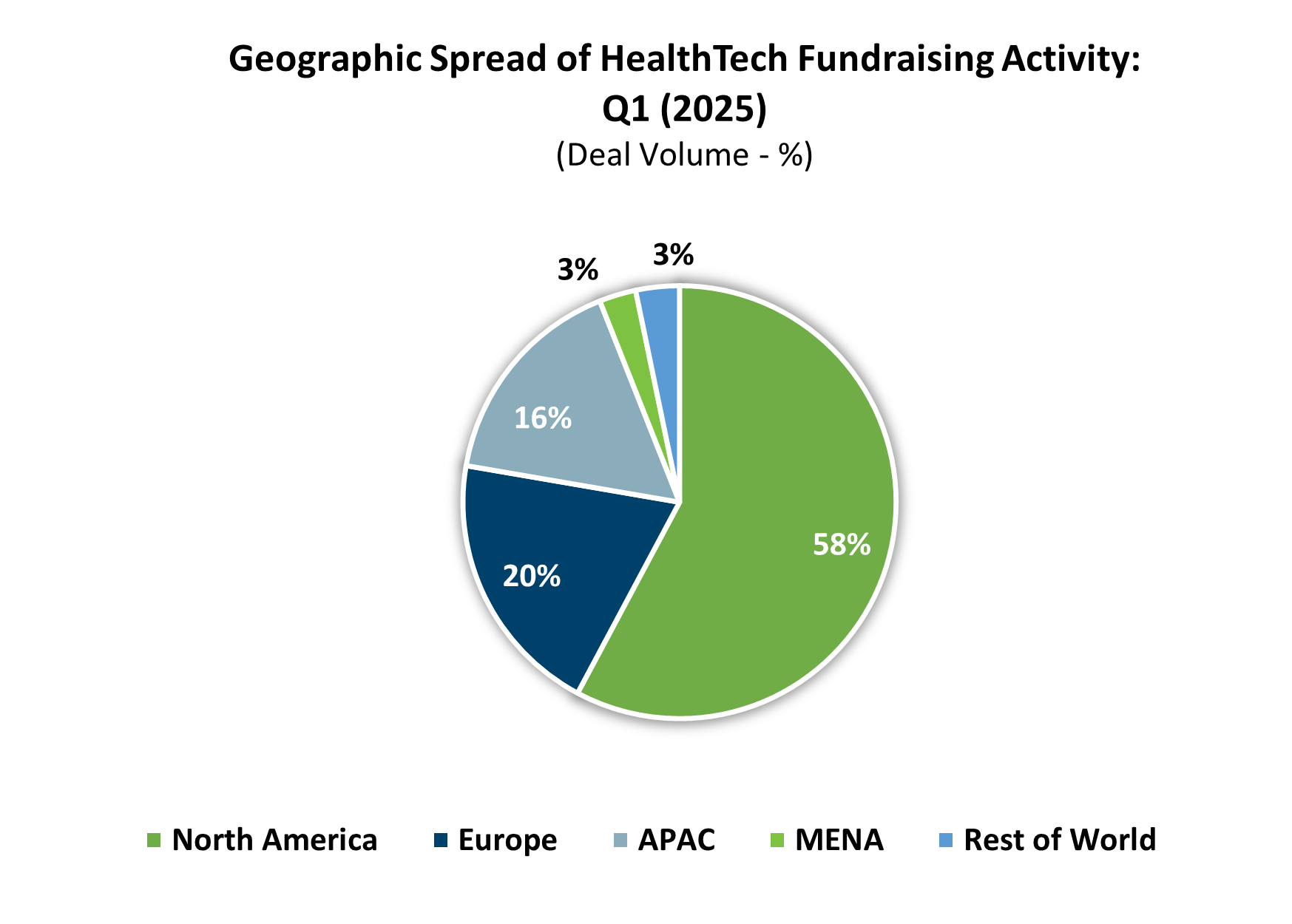

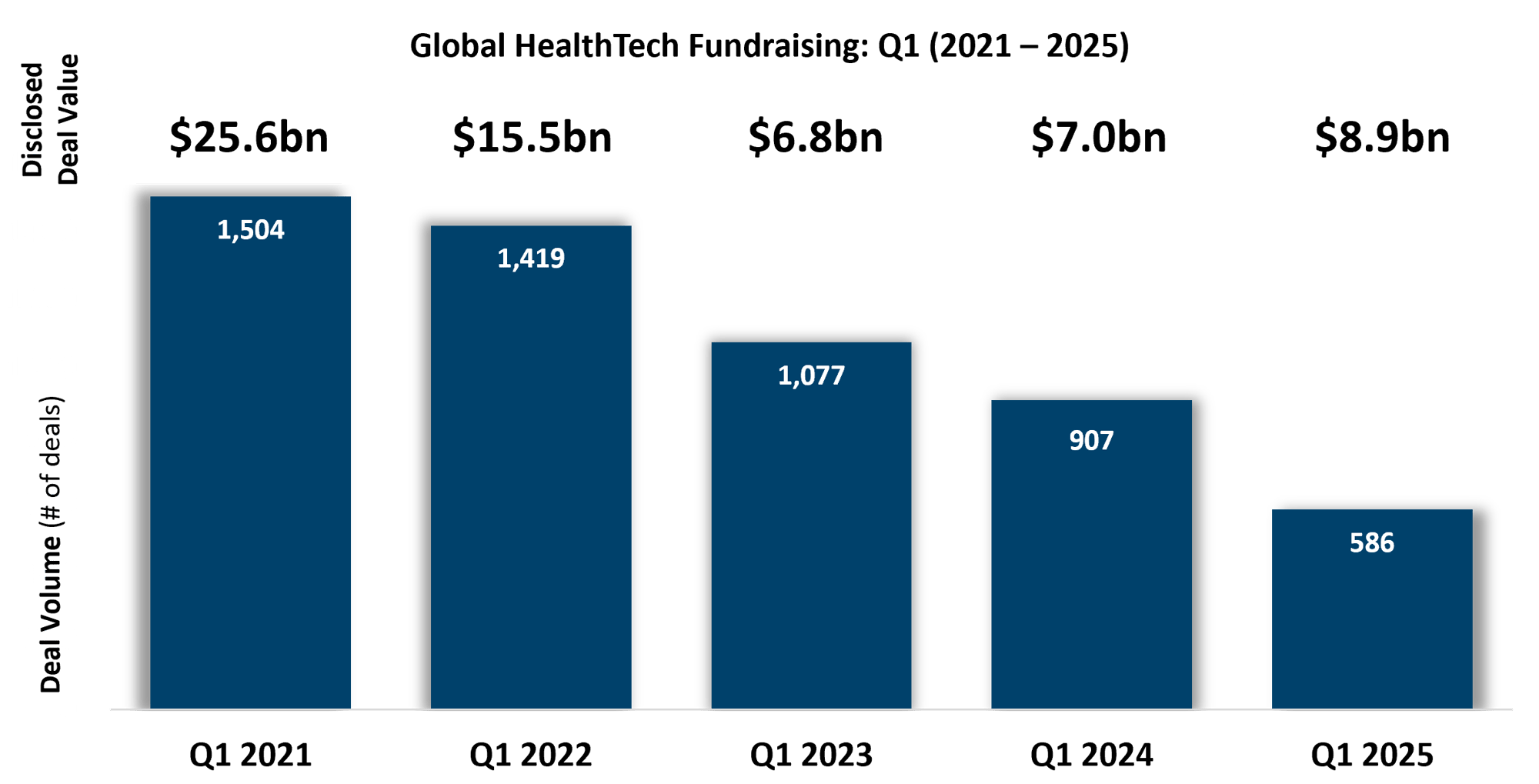

Fundraising activity in Q1 2025 saw an even more decisive shift towards fewer, higher-value rounds, with a 36% decline in fundraises to 586, a stark contrast to the 25% jump in value from $7.0bn to $8.9bn, the highest since 2022. Investor interest in the fundraising space reflects trends observed in the M&A market, with continued focus on administrative solutions and employee health, although with several significant rounds in consumer health and drug discovery. Most striking, however, was the considerable uptick in size and volume of deals with AI-driven theses, across drug discovery and patient-facing interactions. Notable fundraises include:

- $250m Series D raise by Abridge, a generative AI platform for clinical conversations, with investment from Elad Gil, IVP, Lightspeed Ventures and CVS. The new funding will be channelled into further development of AI capabilities and commercial growth

- $260m Series B raise by Neko Health, a preventative health company co-founded by Spotify’s Daniel Ek, led by Lightspeed Ventures. The raise will fuel the expansion of Neko’s full body scanning technology into Europe and the US

- $600m Series D raise by Isomorphic Labs, an AI-driven drug discovery company spun out of Google’s DeepMind business. The funding round was led by Thrive Capital, and will accelerate the development of Isomorphic’s AI drug design engine

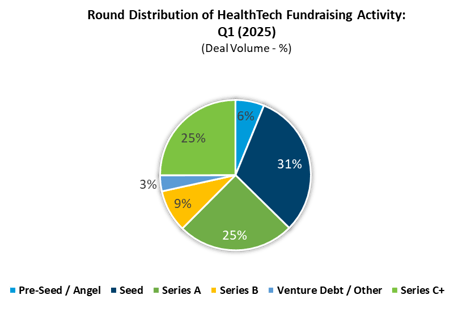

AI-driven research and drug discovery companies, such as Isomorphic Labs, Lila Sciences and XtalPi, garnered significant investor interest, with high upfront investments required to fund accelerated R&D into AI-enhanced drug discovery, development and trials. This emergence of research-intensive companies contributed to an overall shift to larger, later fundraising: Pre-Seed and Seed rounds saw their share of transaction volume decline from 55% to 37%, while Series C and above climbed from 13% to 25%.

North America increased its share of fundraise volume (58% vs 50% in 2024) and remained the single largest fundraising market, driving 64% of value. A similar picture played out across M&A, where 71% of transactions took place in North America (vs 56% in 2024) driving the large majority of deal value. However, Europe saw a significant rebound in fundraising from $930m to $2bn, reflecting 20% of Q1 funds raised (vs 13% in Q1 2024). APAC drove the lion’s share of remaining deal activity globally across M&A and fundraising, with notable transactions including HarrisonAI’s $112m Series C, Insilico’s $110m Series E and Deepwise’s $69m raise from Legend Partners – all centred on AI’s potential to revolutionise drug discovery, clinical imaging and diagnostic workflows.