JANUARY 2024

.jpg?width=2000&height=753&name=Hello%20Dragon%20(1).jpg)

Here Be Dragons - IBIS Capital CEO, Charles McIntyre envisions a cautious recovery in 2024 following a two-year slump amid the worst funding market in 5 years.

A global snapshot of the EdTech, HealthTech & Impact Investing markets.

Notable M&A & Fundraising activities across EdTech & HealthTech industries

Global trends across the tech-led impact ecosystem. In this issue:

Education Industry Analysis – Q4 2023

Healthcare Industry Analysis - Q4 2023

Here Be Dragons?

By Charles McIntyre, CEO at IBIS Capital

Worst funding market in 5 years, whether that be for public market IPOs or private equity. We limped to the end of 2023 after a 2 year slowdown, with depressed valuations and companies having to tighten their belts across the board. Grisly reading for pretty much anyone, except for perhaps followers of Nostradamus.

So, what do the runes tell us about the year ahead; is there room for any optimism? Well inflation is on the way down and interest rate cuts are in the offing. However, even if these are signs of a soft landing, there will be an economic lag and we can’t expect to immediately bounce back to those halcyon days of easy money and heady valuations. For the economic flywheel to turn smoothly, there still needs quite a lot of sorting out in the engine room.

What we are short of is a dose of optimism to lure investors back into the market. This optimism requires some bellwethers to point to better weather ahead. Stock markets did rally at the end of last year, with the TMT sector for example recovering most of the losses incurred in 2022. Increased public market valuations provide a trickle down of valuation expectations for private companies, so we might hope for improving appetite from investors more generally. However, we need to be careful as most of the US year-end rally was driven by a surge of retail investors entering the market to provide liquidity. We have yet to see the institutional investors reach into their pockets in any big way and we also need to note there has been limited volatility in the equity markets; the lowest in the last three years. But that might all change.

In 2024, more than half the people on the planet will go to the polls; it is the biggest election year in history. We also have continuing geopolitical risk with two major wars shifting tectonic plates of world order and slowing global GDP. Not unsurprisingly against this backdrop, investor sentiment has been to focus on companies with profit and shy away from top line growth. The premium valuations for software companies at the end of last year went to those with highest percentage of cash flow generation.

So, as we say goodbye to the Chinese year of the rabbit and hello to the year of the dragon, we have to ask ourselves what we might expect in the year ahead. An increase in smaller funding rounds, as companies that have been holding off are obliged to take on capital, albeit at lower valuations. Continued reluctance by private equity to sell portfolio companies, leading to an increasing liquidity bottleneck in the return of funds to underlying private equity investors. Where there is dry powder amongst the funds (and it is still mountainous), it will be directed at larger, profitable companies rather than aspirational high growth start-ups. Consolidation and corporate divestments will be on the 2024 news agenda, as companies look to find ways to improve margins, either by searching for combinations that generate savings or, for larger corporates, divesting of non-core assets to release cash.

In summary, don’t expect a year of fire breathing excitement but perhaps instead a more cautious year focused on trying to make sure the dragons stay in their lair while companies and investors tip toe around them looking to shore up profits and valuations.

💡 How To Break Into The U.S. EdTech Market? Think Small - When viewed from a distance, the United States educational market seems impossibly large. It may be called the United States, but the procurement process is hardly unified. What’s an international edtech company to do?

🏆 TIME Is Looking For the World’s Top Ed Tech Companies - For the first time, TIME will debut a ranking of the World’s Top EdTech Companies, in partnership with Statista, a leading international provider of market and consumer data and rankings. This new list will identify the most innovative, impactful, and growing companies in EdTech, which have established themselves as leaders in the EdTech industry.

🤖 Education and Artificial Intelligence: Navigating the Path to Transformation - In a world where technology is evolving at an unprecedented pace, education stands on the cusp of transformation. Imagine classrooms where teachers are empowered by cutting-edge technology and where students don't just learn from textbooks but co-create their educational journey. Artificial intelligence resides at the nexus of education and technology, where the opportunities seem limitless, though uncertain.

🔎 2024 predictions: Health tech suppliers on what’s in store - The year 2023 has once again been a significant one as the digital health world continues to develop and advance. We asked health tech suppliers what they think is in store in 2024.

🌟 The Digital Health 50: The most promising digital health companies of 2023 - The Digital Health 50 is CB Insights’ annual ranking of the 50 most promising digital health startups in the world. This year's winners are working on making healthcare AI safer, developing new drugs and therapies, bringing clinical trials to underserved populations, and more.

📈 Report: AI, value-based care are growing sectors in digital health but lack large-scale adoption - Rock Health's Digital Health at the Turn of 2024 report found retailers as providers and data interoperability are scaling innovations in the sector, with lasting trajectories.

💰 Which VCs invest the most often after top accelerators? - As accelerators become a stronger force in the venture ecosystem, other investors are relying on accelerators’ graduating classes to find their next deal. But which investors back the most startups coming out of Y Combinator (YC), Plug and Play, and other top accelerators?

👩🏫 Impact investors see opportunity in education - SDGs “are in peril” according to a status report published last year by the UN. Into this crisis step impact investors. Green and climate impact funds targeting private companies are pretty common. But impact funds dedicated to education are not.

🩺 Unlocking Healthcare Trends And Considerations For Investors - As the healthcare sector undergoes a seismic transformation, various trends are redefining the investment landscape—from the extraordinary growth of telehealth, to cutting-edge developments in biotechnology and precision medicine, and the staggering potential of the pharmaceutical market.

Education

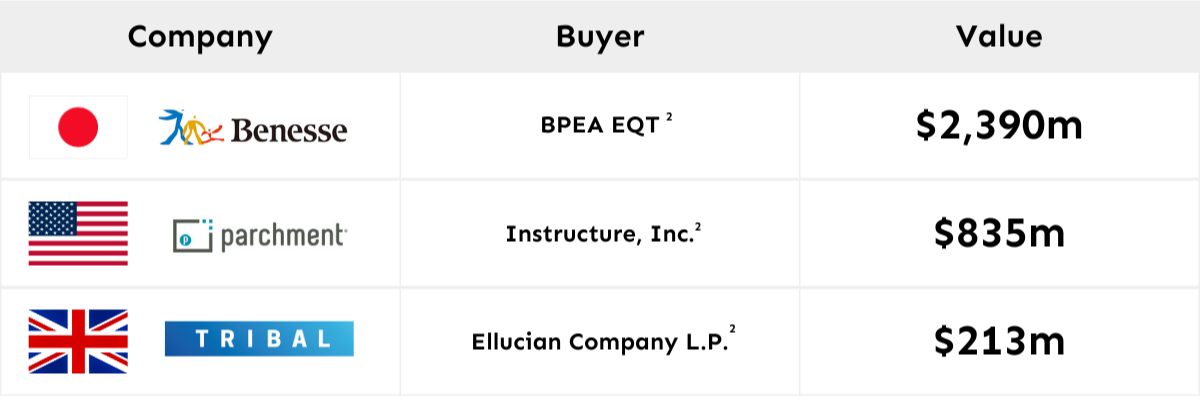

Source: Capital IQ | 2Deal announced but not yet closed

Health

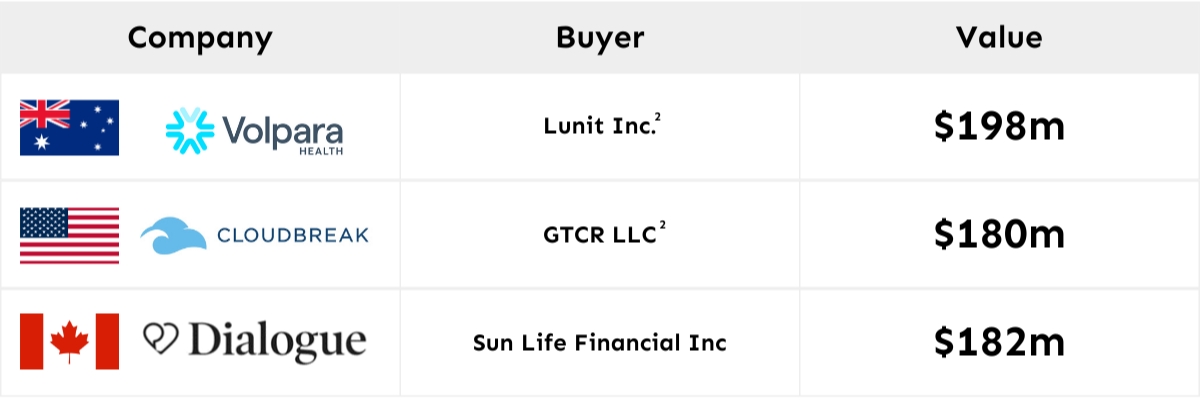

Source: HealthTech Alpha | 2Deal announced but not yet closed

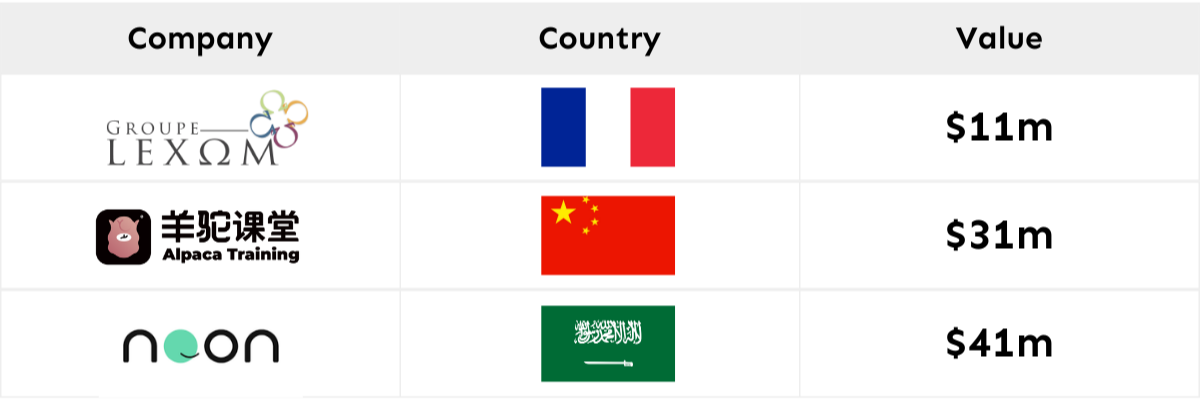

Education

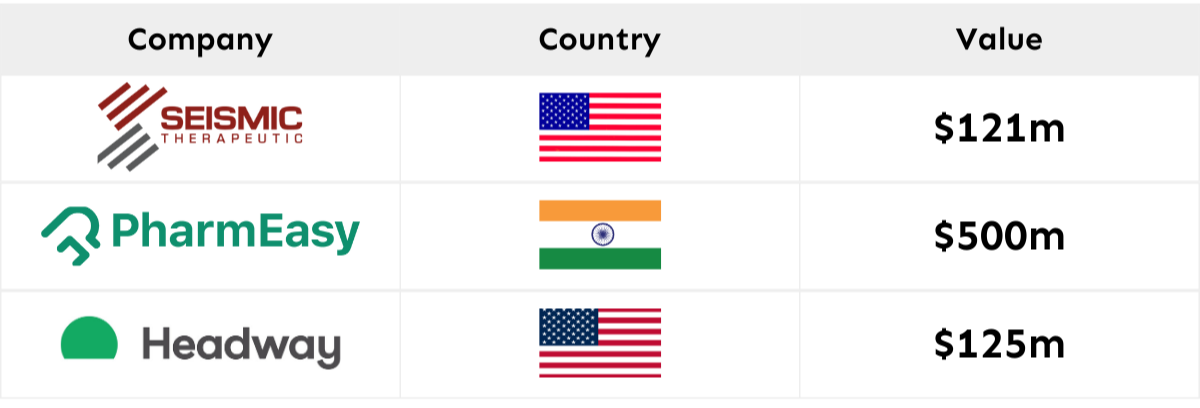

Health

In 2023, generative artificial intelligence (AI) emerged as an important development, weaving cautiously into educational technology, with its full potential still unfolding. The landscape is now ripe for innovative products and new market entrants in education, as international education experiences a resurgence. With the decline of the EdTech investment frenzy and valuations undergoing a correction, there has been a shift back to core educational values and tangible results. The focus is on enhancing the student experience, promoting well-being, fostering engagement, and improving retention1.

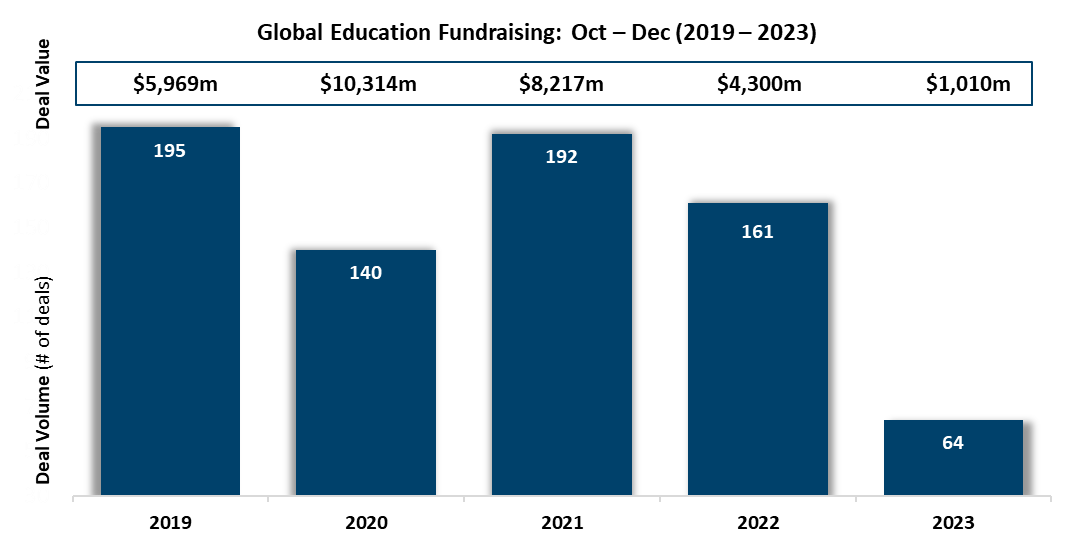

The inflow of capital into education ventures significantly slowed down in Q4-22, a trend that continued through 2023, culminating in a 76.5% decline in EdTech fundraising value in Q4-23 over the prior year. This follows the sizable 47.7% decline in the EdTech fundraising deal value in the preceding year. As highlighted in the January 2023 X Report, the fundraising surge, largely attributed to the impact of COVID-19, has now subsided and is evident in the fact that the value of disclosed fundraising has subsequently declined by 90.2% in Q4-23 from 2020 levels2.

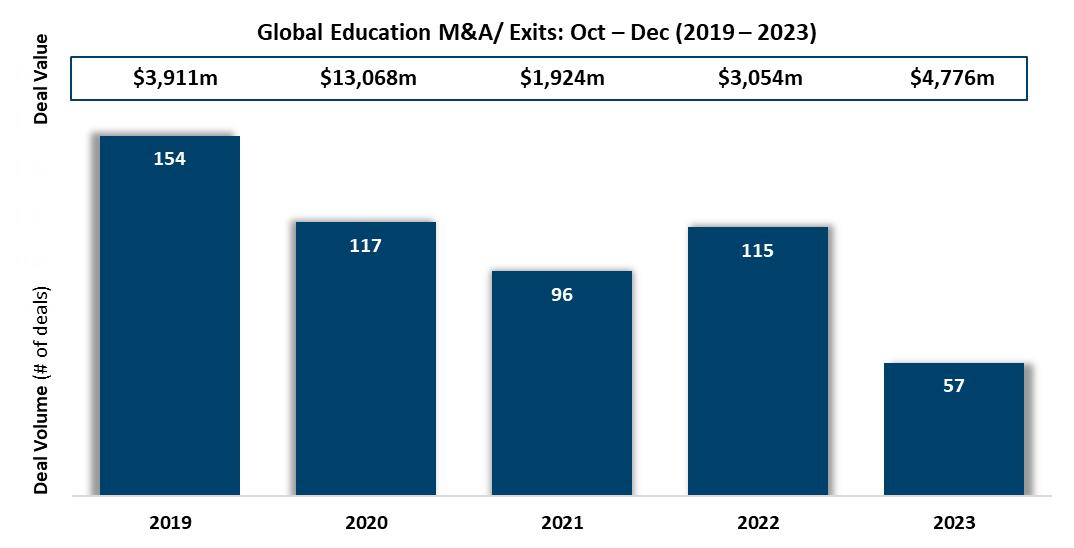

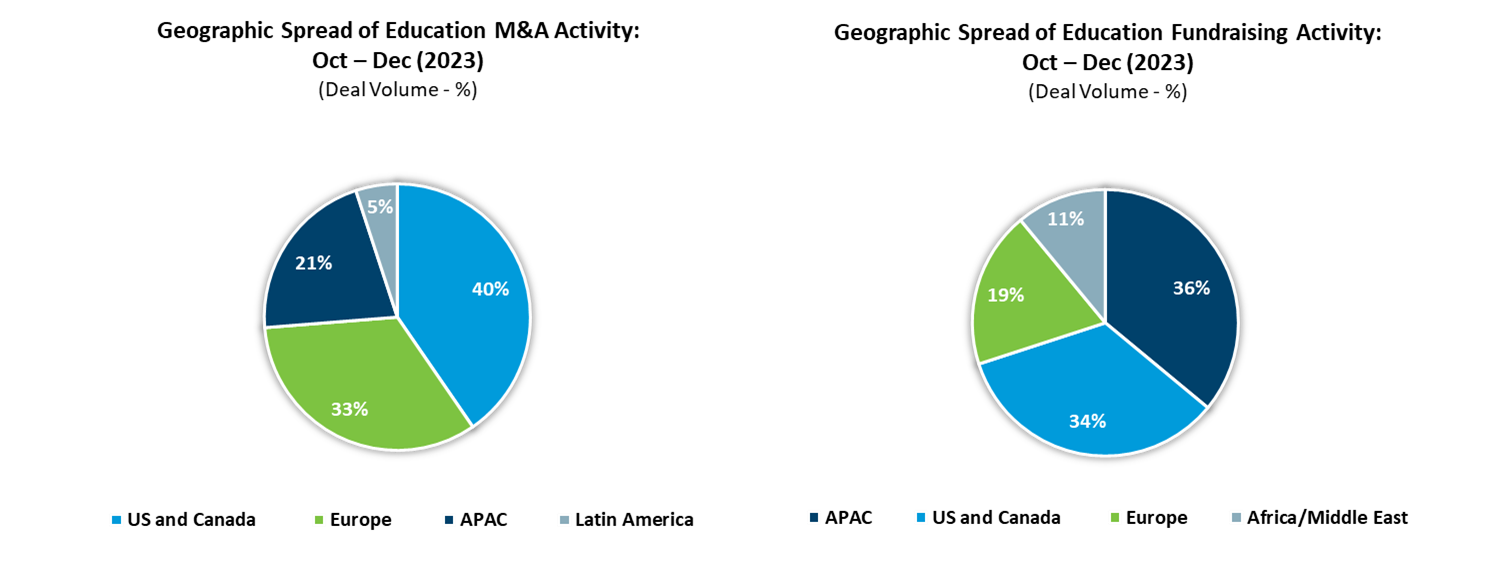

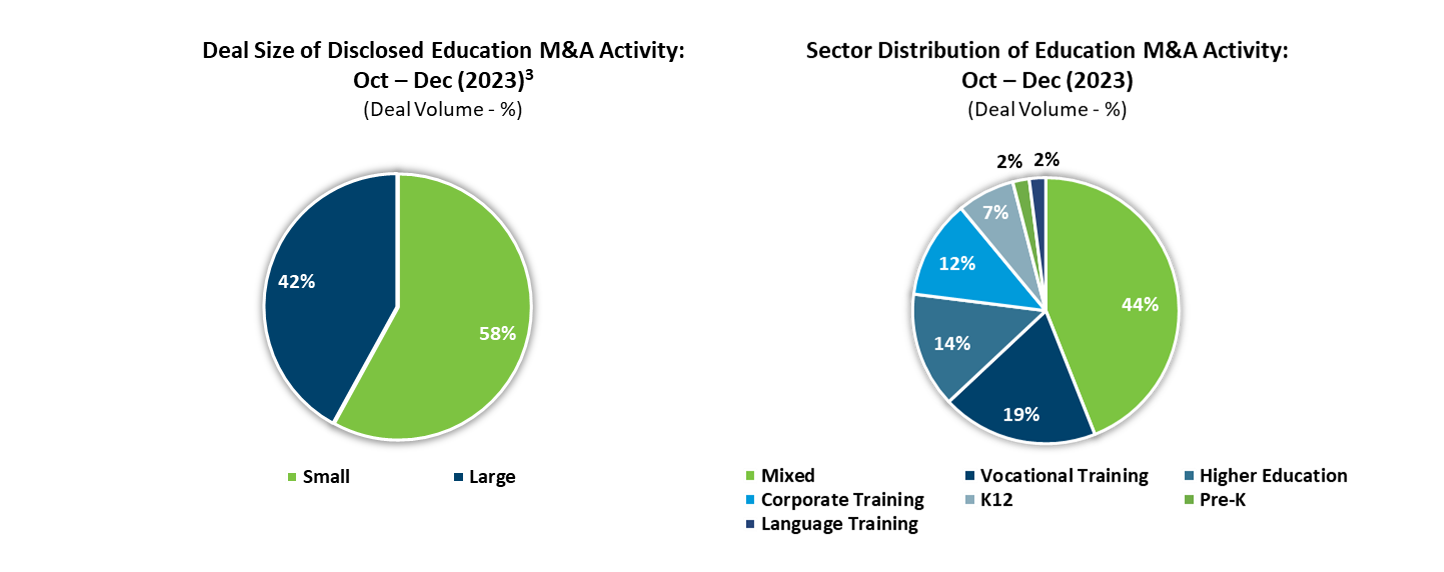

While the funding landscape has seen a downturn, the overall value of M&A deals in Q4-23 has increased by 56.4% compared to Q4-22. However, the number of deals conducted witnessed a substantial reduction, with a 50.4% fall in the volume of transactions during the same timeframe. Most of this deal volume (43.9%) spans businesses involved across multiple education verticals with vocational education, higher education, and corporate training being other significant areas of investment2.

Notable transactions in the fundraising and M&A space for this quarter include a $40.8m Series B fundraise led by Raed Ventures into Noon, a social learning platform, an $11.0m investment led by iXO Private Equity into Lexom and an M&A deal involving Benesse Holdings, a provider of educational services, and BPEA EQT, a private equity investor, concluded with a transaction value of $2.4bn2.

The US and Canada dominated the M&A market in Q4-23, comprising 40.4% of all deals by volume, while the APAC region comprised the lion’s share of the fundraising volume at 35.9% for the quarter2. Other significant funding dynamics include India's Byju’s, previously cited as the largest EdTech company in the world, facing governance and cash flow obstacles that have led to notable investors reducing their holding values by 86.0% less than peak valuation3. Moreover, the repercussions of stringent Chinese regulations persisted throughout 2023, placing pressure on the education sector in the region1.

Relates only to deals with disclosed transaction amounts. Small deals are considered to be <$50m; Medium deals are considered to be ≥$50m and <$150m; Large deals are considered to be ≥$150m

Despite the investment pullback, the long-term outlook for EdTech remained positive, with expectations of continued growth driven by technological innovation and a growing emphasis on digital learning solutions across the globe4. In the broader global economic context, uncertainty surrounds the timing of central bank interest rate policies, coupled with a cautiously optimistic growth outlook for 2024. Investment into EdTech may have slowed down this year, however, the overall outlook for the EdTech sector and technology as a major driver of global growth in education remains strong, with forecasters projecting continued growth in the sector through the rest of this decade4.

Notes

1. HolonIQ

2. Capital IQ

3. Reuters

4. Technavio

Graphics - M&A/ Exits & Fundraising Activity

Source: Capital IQ

Includes deals announced but not yet closed

The start of 2023 saw a cautious stance in the global economy, influenced by multiple substantial challenges, including constrained economic expansion, fluctuating conditions in public markets, and elevated inflation levels. The investment landscape remained strained, with a reduction in deal frequency, investment pace, and valuations. Investors became more scrutinous, prioritising strong unit economics and profitability paths, with many companies, especially later-stage ones, revising growth projections and cutting costs to avoid difficult valuation discussions1. Despite these difficulties, the year witnessed a stabilisation in economic conditions, with public markets showing early improvements and finishing 2023 on a high. Annual global inflation growth declined to 6.4%, compared to 8.9% at the end of 20222, and investment pullbacks stabilised1.

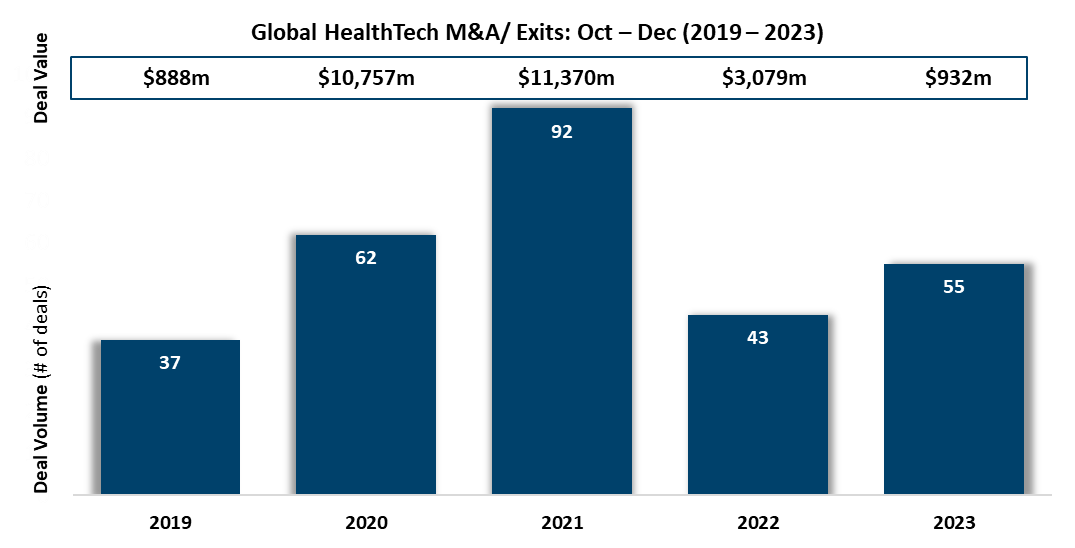

While the 2023 financial year was positive for the global financial markets, HealthTech sector funding demonstrated a mixed performance. In Q4-23, the merger and acquisition (M&A) market showed signs of revival, recording a 27.9% year-on-year increase in deal count3. This marks a significant rise in transaction volume compared to the same quarter of 2022, however, the disclosed monetary value associated with these transactions did not match the increased volume, remaining 69.7% lower than Q4-22 and 91.8% lower than the peak values seen in the final quarter of 20213.

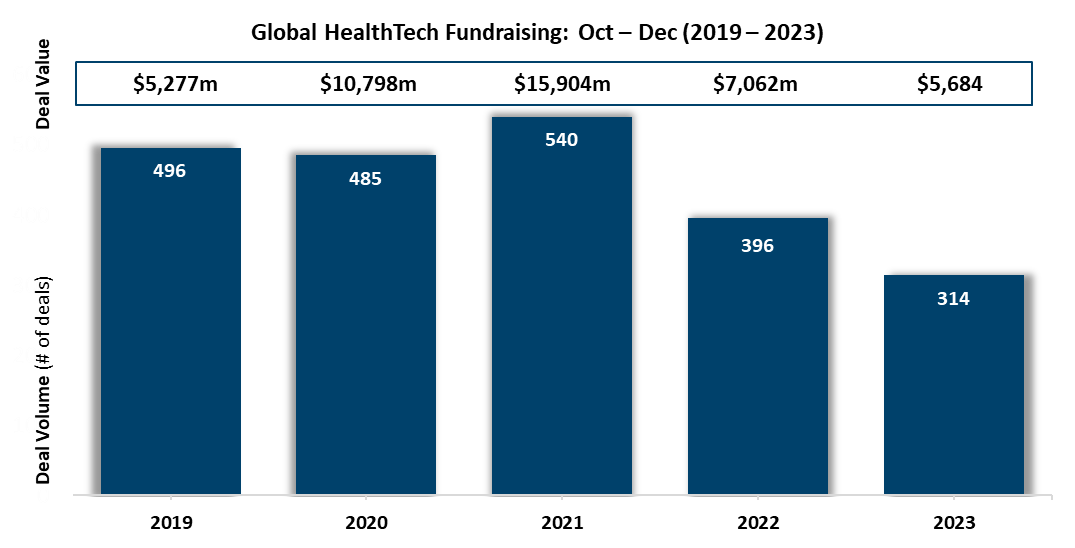

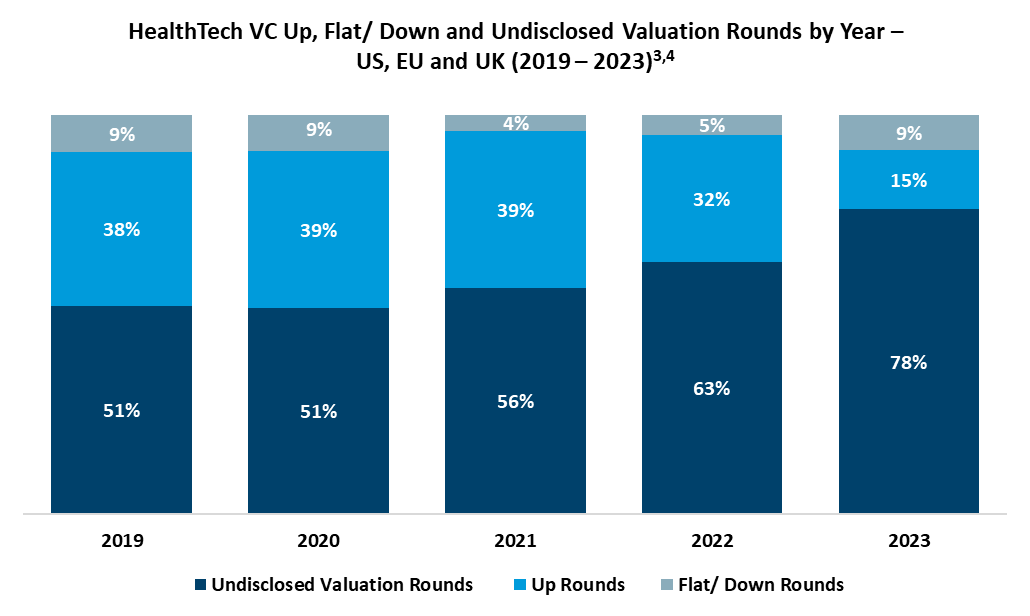

In line with this declining M&A trend, fundraising marked the second consecutive fourth-quarter decline, being down by 20.7% and 19.5% in terms of volume and value of transactions respectively, when compared to Q4-223. The fundraising landscape for HealthTech shows a cautious trend, with 9.0% of the recent funding rounds closing at or below past valuations. Additionally, another trend is the lack of transparency in valuation disclosures, with a significant 78.0% of deals not reporting valuation figures in 20231. This lack of disclosure suggests the possibility of more flat or down rounds than recorded1.

Source: SVB Future of HealthTech 2023. Totals may differ due to rounding.

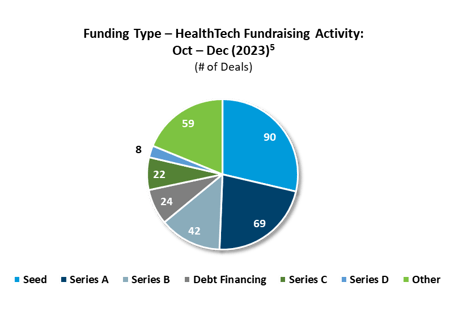

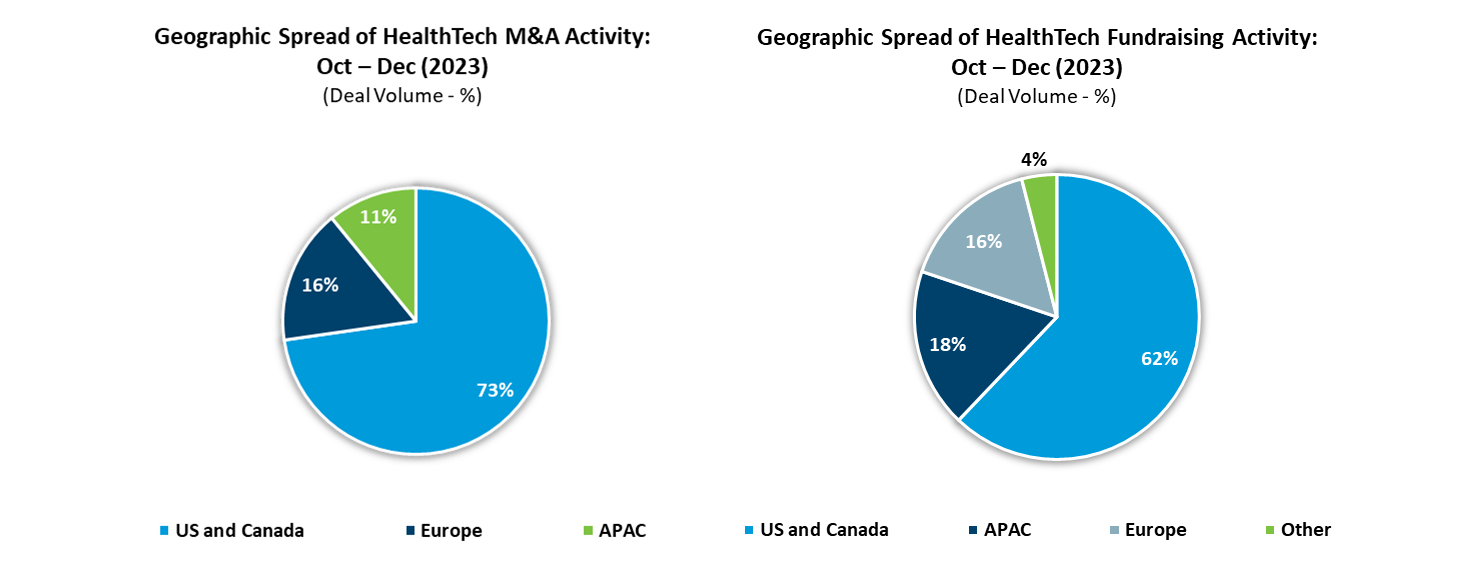

Notable transactions in the fundraising space for Q4-23 include a $175.0m Series E fundraise led by Space Between into Devoted Health, a Medicare Insurtech company. Additional large transactions include a $125.0m Series C investment led by Spark Capital into the mental healthcare app Headway and a $121.0m Series B raise led by Bessemer Venture Partners into Seismic Therapeutic, a biotechnology company developing machine-learning technology for immunology drug development3. The US and Canada maintained their dominance in both M&A and fundraising transactions, constituting 72.7% and 62.4% of total transactions, respectively. Funding rounds were distributed across various stages, with Seed and Series A raises being the most prevalent3.

Other funding round categories include additional Series E-H rounds, Strategic funding, Grants, Pre-Seed, Angel, Bridge and Secondaries funding.

In the private HealthTech sector, funding dynamics have displayed a complex pattern, with mixed results observed in recent quarters. Nonetheless, the recent market correction has played a pivotal role in recalibrating HealthTech company valuations, aligning them more closely with realistic growth prospects and profitability benchmarks1. This adjustment is poised to underpin a more sustainable and functional market ecosystem and is likely to foster a healthier investment climate. Looking ahead to 2024, there is a tangible optimism that the HealthTech market will diverge from the previous downtrends in fundraising and M&A. Instead, it is anticipated to embrace a trajectory of robust growth, fuelled by strategic investments and an increased emphasis on innovation in areas such as value-based care solutions and platform-enabled ecosystem models4,5.

Notes

1. SVB: Future of HealthTech 2023

2. IMF

3. HealthTech Alpha

4. Mckinsey

5. Deloitte

Graphics - M&A/ Exits & Fundraising Activity

Source: HealthTech Alpha

Includes deals announced but not yet closed

.png)